Injective Price Prediction: INJ 3.0 upgrade reduces the token supply

- Injective price extends its gains on Tuesday after rallying more than 25% in the previous week.

- The recent announcement of INJ 3.0 focuses on significantly decreasing the token supply.

- On-chain data further boosts the bullish outlook as INJ’s Total Value Locked and Open Interest are rising.

Injective (INJ) price extends its gains for the seventh day in a row, trading above $26 on Tuesday after rallying more than 25% the previous week. The announcement of the INJ 3.0 upgrade on Sunday, which focuses on significantly decreasing the token supply, could further fuel the ongoing rally. Moreover, INJ’s on-chain metrics boost the bullish outlook as its Total Value Locked (TVL) and Open Interest (OI) are rising.

Injective 3.0 upgrade could boost INJ’s bullish outlook

Injective announced that its governance proposal to begin the next phase of INJ 3.0 passed on Sunday.

Injective 3.0 upgrade aims to dramatically decrease the supply of INJ, which will continue until Q1 2026, making INJ one of the deflationary digital assets. This supply shock is expected to increase the token’s value as demand increases.

The governance proposal to begin the next phase of $INJ 3.0 has passed with 99.99% of community members voting YES.

— Injective (@injective) January 5, 2025

The new chapter of INJ 3.0 is live now to dramatically reduce the token supply, enabling INJ to become one of the most deflationary assets over time. pic.twitter.com/YJNCQsIiD7

Injective price action looks promising

Injective price broke above the daily resistance at $23.46, closed above the 50-day Exponential Moving Average (EMA) around $24.41 on Sunday, and rallied 10% until Monday. At the time of writing on Tuesday, it trades in green around $26.19.

If the upward momentum continues, INJ could extend the rally to retest its next daily resistance level at $31.12, marking an additional 18% gain from current levels.

The Relative Strength Index (RSI) on the daily chart reads at 58, above its neutral level of 50, indicating bullish momentum. Moreover, the Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover on Friday, signaling a continuation of the uptrend.

INJ/USDT daily chart

Injective on-chain metric shows positive bias

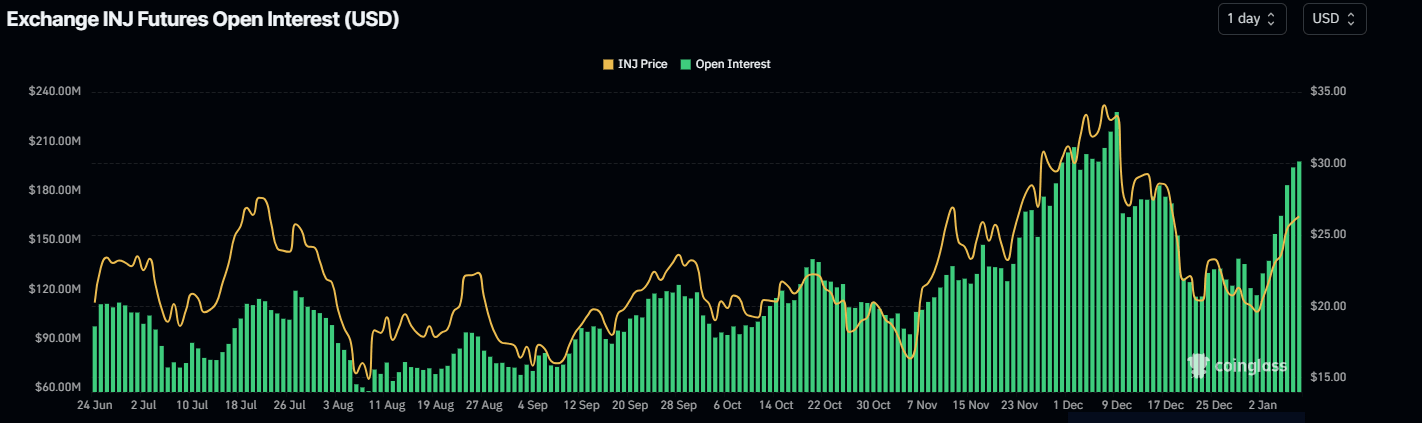

Looking at Injective’s Open Interest (OI) further boosts the bullish outlook. Coinglass’s data shows that the futures’ OI in INJ at exchanges rose from $116.42 million on January 1 to $197.74 million on Tuesday, the highest level since December 16. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the Injective price.

INJ Open Interest chart. Source: Coinglass

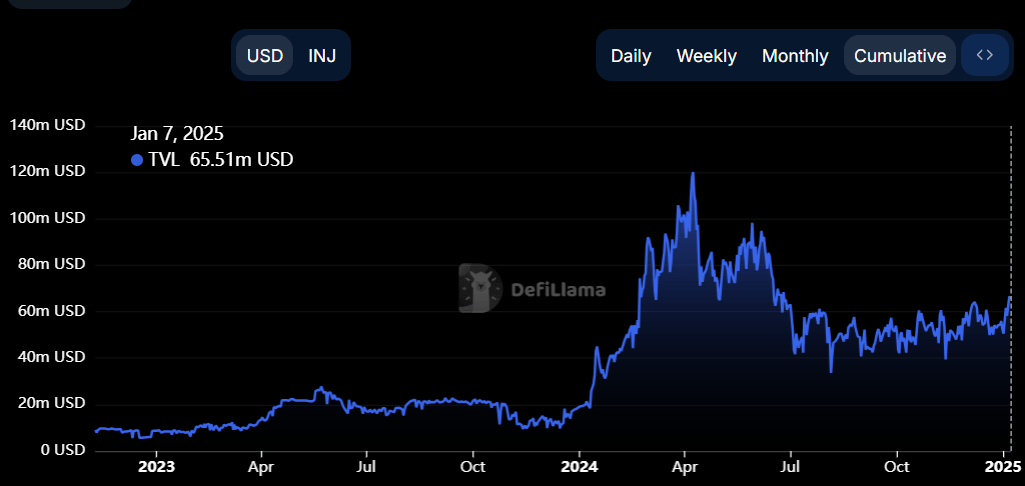

Additionally, data from crypto intelligence tracker DefiLlama shows that INJ’s TVL increased from $50.54 million on January 1 to $65.51 million on Monday, constantly rising since the end of December.

This 29.6% increase in TVL indicates growing activity and interest within the Injective ecosystem. It suggests that more users deposit or utilize assets within INJ-based protocols, adding credence to the bullish outlook.

Injective TVL chart. Source: DefiLlama

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.