Injective Price Forecast: Nearing a breakout towards $55

- Injective price edges closer to a breakout as it trades around $43.

- The short-term target for INJ bulls would be $51, but $55 could be reached soon.

- A twelve-hour candlestick close below $34.15 would invalidate the bullish thesis.

Injective (INJ) price has been consolidating for more than two months and is now showing signs of breakout. Patience could see investors realize double-digit gains in the coming days.

Also read: Injective price could retest $50 as INJ bulls try to overcome critical resistance level

Injective price ready to move higher

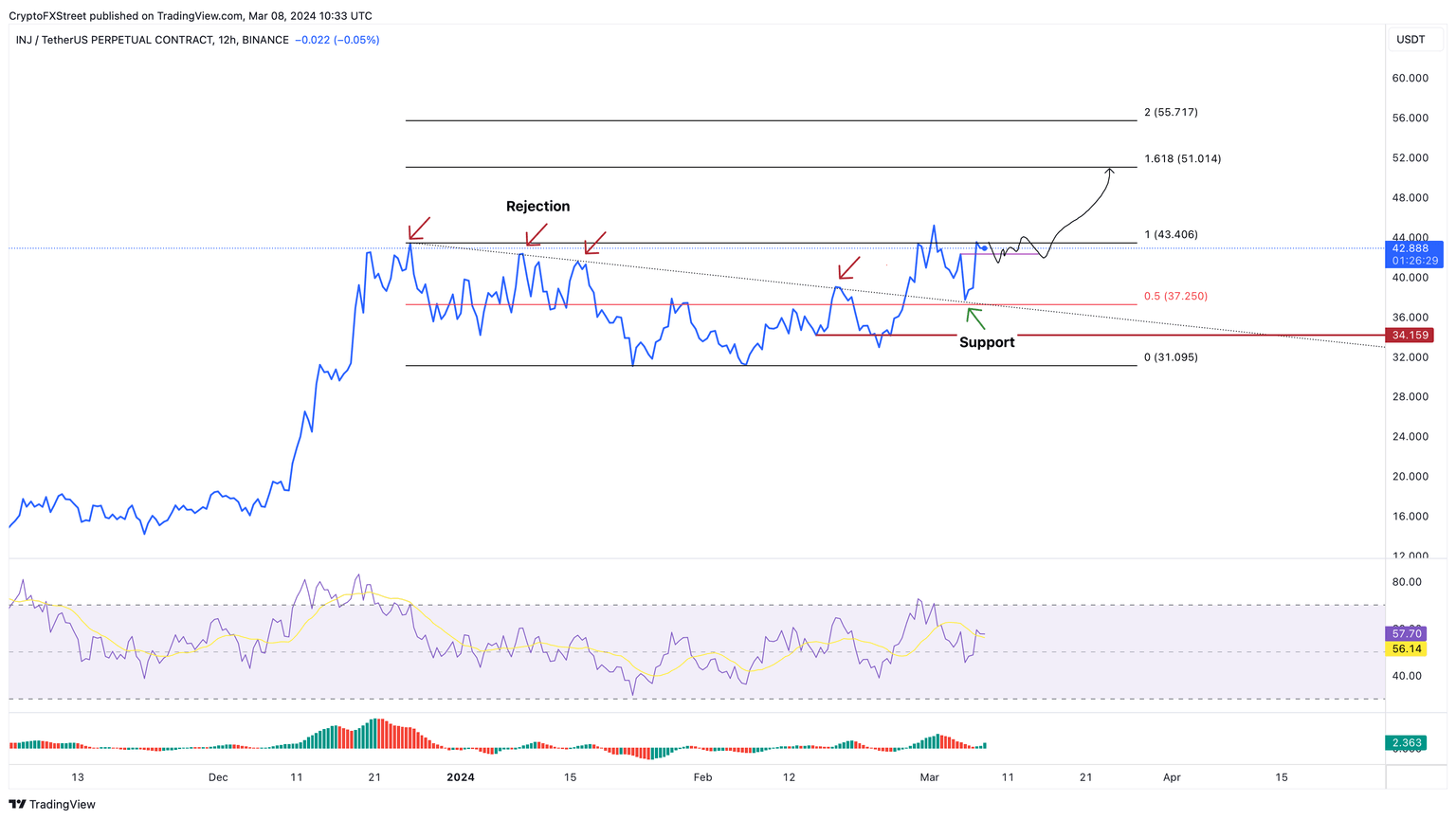

After more than two months of consolidation, the Injective price is close to breaching the $31.09 to $43.40 range. INJ has produced three distinctive lower highs inside this range. Joining these swing points using a trend line shows that the altcoin faced a lot of selling pressure.

But the recent spike from buyers has pushed the Injective price to breach this declining resistance trend line level on February 27, resulting in a 13% rally. Interestingly, the liquidation event on March 5 knocked INJ down to retest this declining resistance level, confirming a successful flip into a support floor.

Now, Injective price is hovering just below the range high of $43.40, attempting to overcome it. As Bitcoin slips into consolidation, altcoins are likely to break out. In such a case, INJ could trigger a breakout, which could result in a quick 17% rally to $51. Considering the said target is close to the $50 whole number, INJ would naturally gravitate towards this level, making this a high probability level for bulls.

If the buying pressure continues to pour in, the Injective price could shoot up to $55, representing a 28% gain.

Read more: Injective introduces 'ERC-404' port to capitalize on the hype around the experimental token standard

INJ/USDT 12-hour chart

On the other hand, if Injective price produces a twelve-hour candlestick close below $34.15, it would produce a lower low and invalidate the bullish thesis. Such a development could see INJ revisit the range low at $31.09, or a decline of 9%.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.