How trade SafeMoon price for a quick profit?

- SafeMoon price consolidates, suggesting an infight between bulls and bears for control.

- Investors can expect the recovery rally to continue until the altcoin reaches $0.000876.

- A daily candlestick close below the range low at $0.000356 will invalidate the bullish thesis.

SafeMoon price gets ready for a quick run-up amid a bearish challenge. As a result, SAFEMOON has been consolidating below a crucial resistance barrier. Investors can expect the altcoin to resume its run-up soon.

SafeMoon price to overcome hurdles

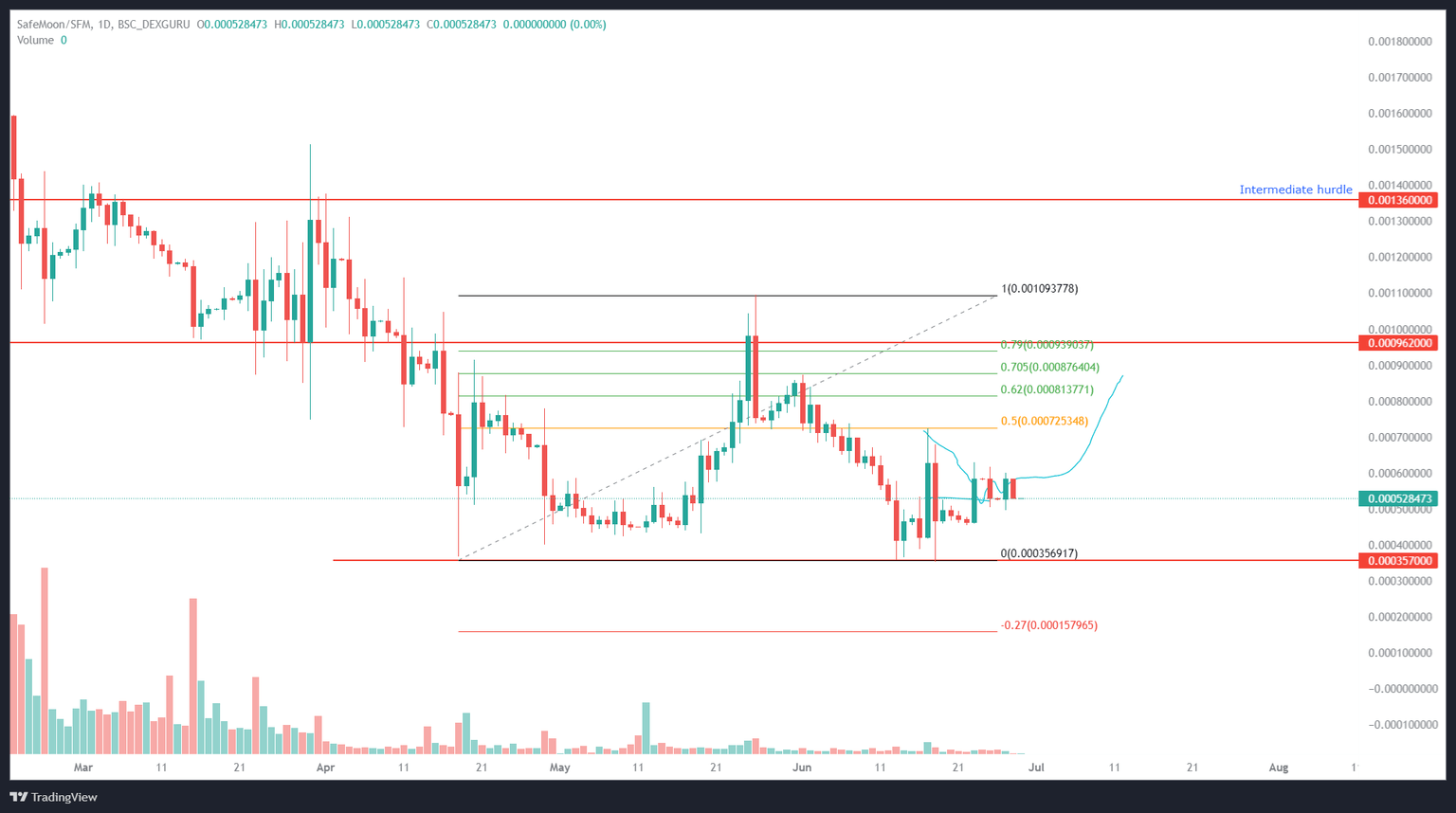

SafeMoon price has tagged the range low at $0.000356 twice after a 200% upswing between April and May 2022. After a full retracement to the range low, buyers seem to have made a comeback, resulting in a recovery rally.

As SafeMoon price reverts to the mean, investors can expect the first major hurdle to be the 50% retracement level at $0.000725. However, the bears seem to be giving bulls a fight for their money, resulting in a coil below the range’s midpoint.

A breakout from this setup could push SafeMoon price to the 70.5% retracement level at $0.000876. This move would constitute a 65% gain and is likely where the upside is capped for SAFEMOON in the short term.

However, if Bitcoin recovers to $30,000 or higher, then the chances of SAFEMOON revisiting the range high at $0.00109 are high.

SAFEMOON/USDT 1-day chart

While things are looking up for SafeMoon price, a daily candlestick close below the range low at $0.000356 will create a lower low. This development will skew the odds in the bears’ favor and invalidate the bullish thesis.

In such a situation, SafeMoon price could slide lower to the immediate support level at $0.000157.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.