SafeMoon’s knee-jerk reaction could be nothing

- SafeMoon price action performed a sharp knee-jerk bullish reaction on Friday.

- SFM price could be bouncing off the low of $0.000342750 and start to fade back to that level.

- Expect to see confirmation of what is to come next week.

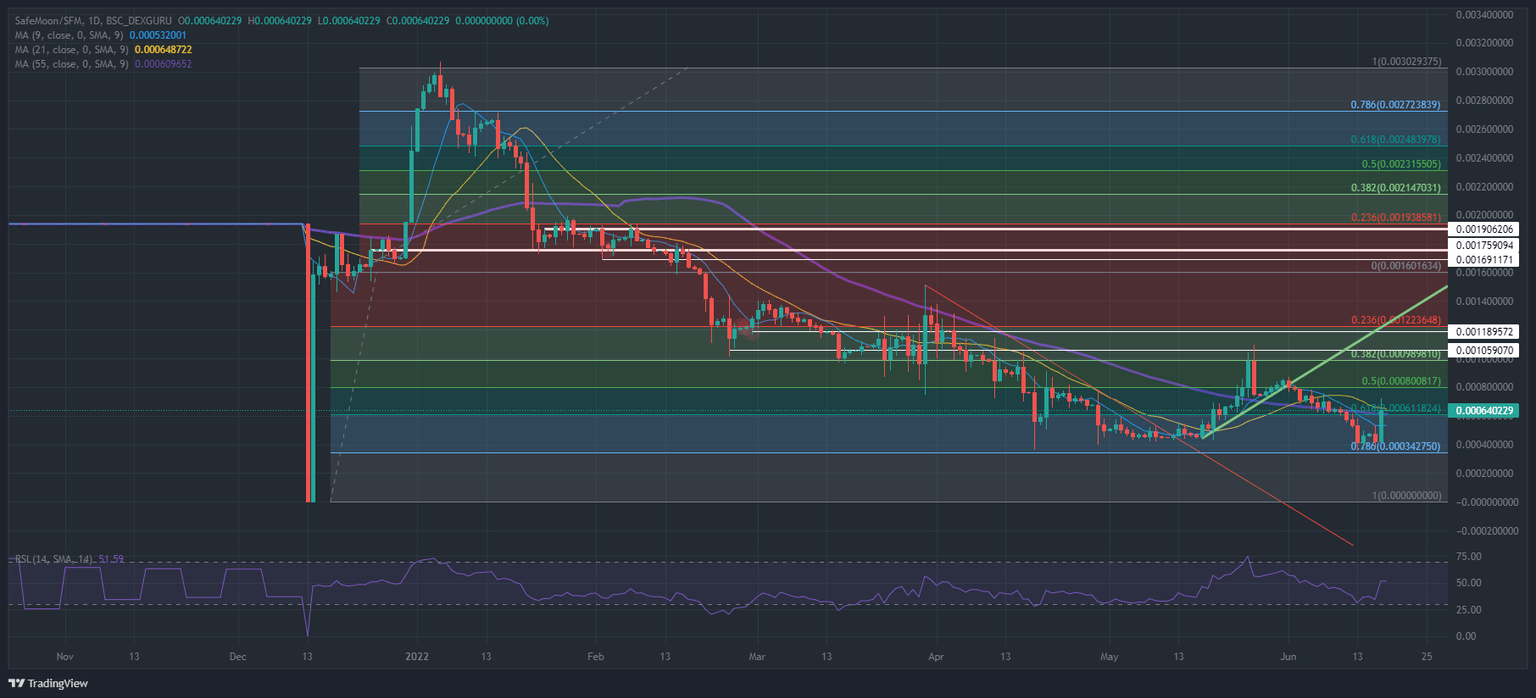

SafeMoon (SFM) price performed a squeeze to the upside on Friday in what turned out to be a knee-jerk reaction that followed after price action bounced off the 78.6% Fibonacci level. That fell together with the Relative Strength Index (RSI), which bounced off the oversold barrier and went higher. The risk is that the tops come down, and price action gets squeezed towards the downside and drills down on it to break lower next week.

SFM price at risk of a false break

SafeMoon price has shot out a few bears in its knee-jerk reaction on Friday that shot through all the moving averages. The risk going into and over the weekend is that the lows start to get lower, and the price drops further to that base level. As pressure will start to mount again on that base level at $0.000342750 or the 78.6% Fibonacci level, it means issues for next week.

SFM price is opening below the 21-day Simple Moving Average (SMA) at $0.00648722, which is not a healthy sign to build on, as price action will drop back to lower levels as the peaks over the weekend will not be able to top out the one from Friday. Little by little price will drop back to the baseline at $0.00342750 and break below it towards lower levels with the risk that price action completely evaporates and SFM price because worthless. That could happen when a perfect storm opens on Monday trading with dollar strength, global markets at risk-off and cryptocurrencies bleeding across the board.

SFM/USD daily chart

Should there be a continuation of the trend on the back of some dollar weakness or because over the weekend, no actual risk events can unfold, SFM price could have room to catch up higher. Then the 50% Fibonacci would come into play, and price action could climb higher towards $0.000800817. If $0.001000000 can be reached is rather doubtful, though, as the current tail risks that are keeping a drag on price action will not go away overnight.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.