How Dogecoin price will double despite recent fakeout

- Dogecoin price is on its way to relaunch after the initial breakout failed to maintain its momentum.

- Investors can expect a 40% ascent to $0.216 in the coming week.

- A weekly candlestick close below $0.11 will invalidate the bullish thesis for DOGE.

Dogecoin price has undone its gains from the last week but has not turned bearish yet. Market participants can still expect DOGE to start another rally to retest the target it failed to reach before.

Dogecoin price to relaunch its uptrend

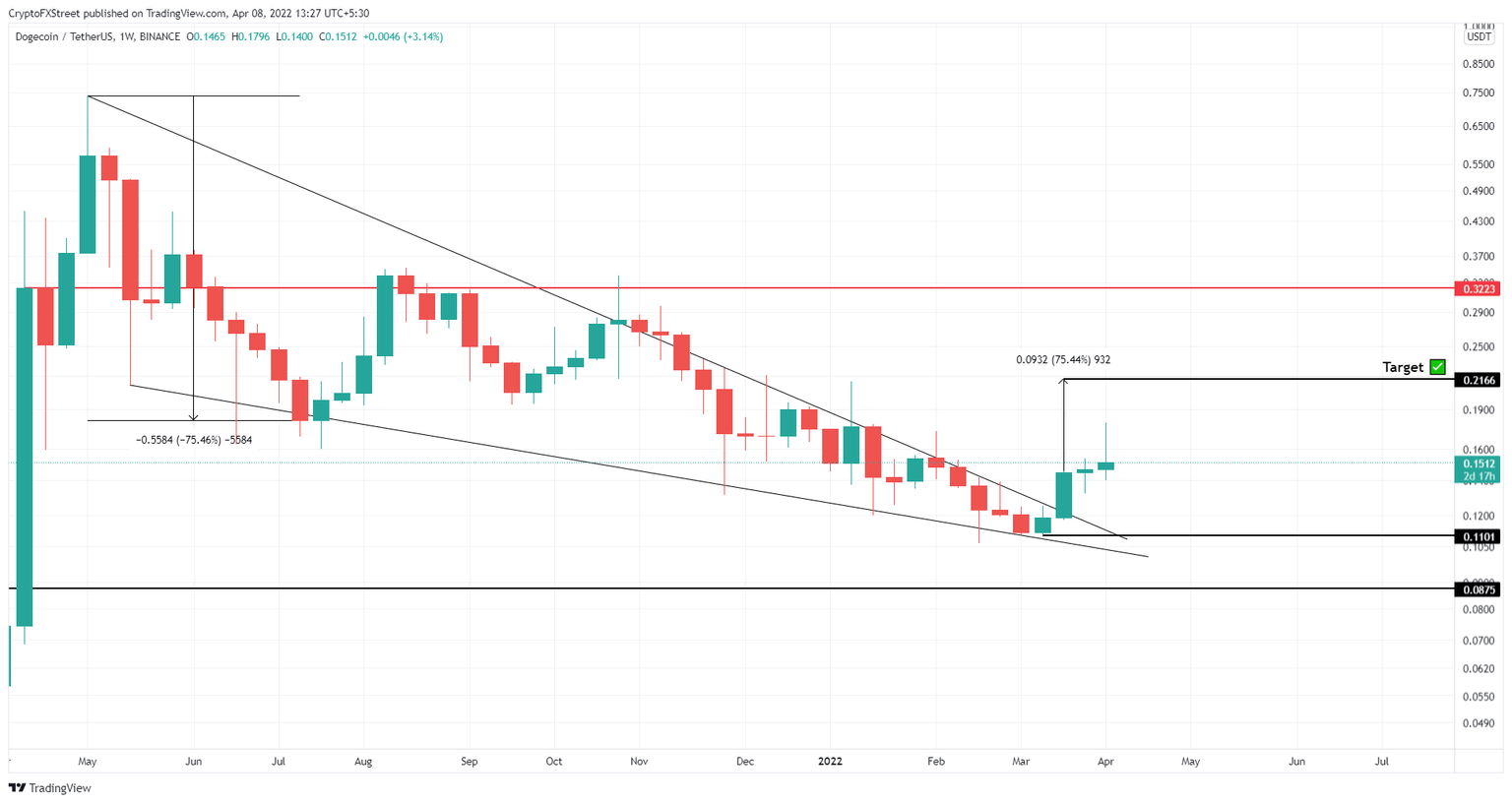

Dogecoin price action since May 3, 2021, has set up four lower highs and five lower lows, which when connected using trend lines results in a falling wedge formation. This technical formation forecasts a 75% ascent to $0.216, determined by adding the distance between the first swing high and low to the breakout point at $0.123.

On March 21, the Dogecoin price breached the falling wedge’s upper trend line at $0.123 and rallied 21%, but in the second week of April, it seems to be facing difficulties. Despite rallying 28%, intense profit-taking combined with a BTC flash crash has caused the gains to come undone.

As a result, DOGE is currently hovering around $0.151, which suggests that another 42% ascent is likely. Assuming DOGE manages to hit its targets, a local top is likely to form around the swing high.

If buying pressure continues to build up, however, Dogecoin's price could extend to the $0.322 resistance barrier, bringing the total gain to 113%.

DOGE/USDT 1-day chart

While the general outlook for DOGE is massively bullish from a swing trader’s perspective, a sudden crash for the big crypto could ruin the setup.

In such a case, a weekly candlestick close below $0.11 will invalidate the bullish thesis for the Dogecoin price. This development would open the path for DOGE to explore lower levels such as $0.087, where sidelined buyers or long-term investors might step in.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.