Here's why Bitcoin and the crypto market rallied after Fed Chair's speech

- Bitcoin surged above 5% in the past 24 hours after Fed Chair signaled that a rate cut is imminent.

- Cryptocurrency prices often perform better during lower interest rates environment.

- The general crypto market rallied, with several cryptocurrencies in key categories posting sizable gains.

- The rising stablecoin market cap indicates stronger buying pressure.

Bitcoin (BTC) has gained nearly 5% alongside a rally across the crypto market in the past 24 hours following indications of interest rate cut from Federal Reserve (Fed) Chair Jerome Powell's keynote on Friday morning.

Bitcoin's love for low interest rate

In his speech, Powell noted that the labor market has cooled and "conditions are now less tight than those that prevailed before the pandemic." Hence, "the time has come for policy to adjust," he said.

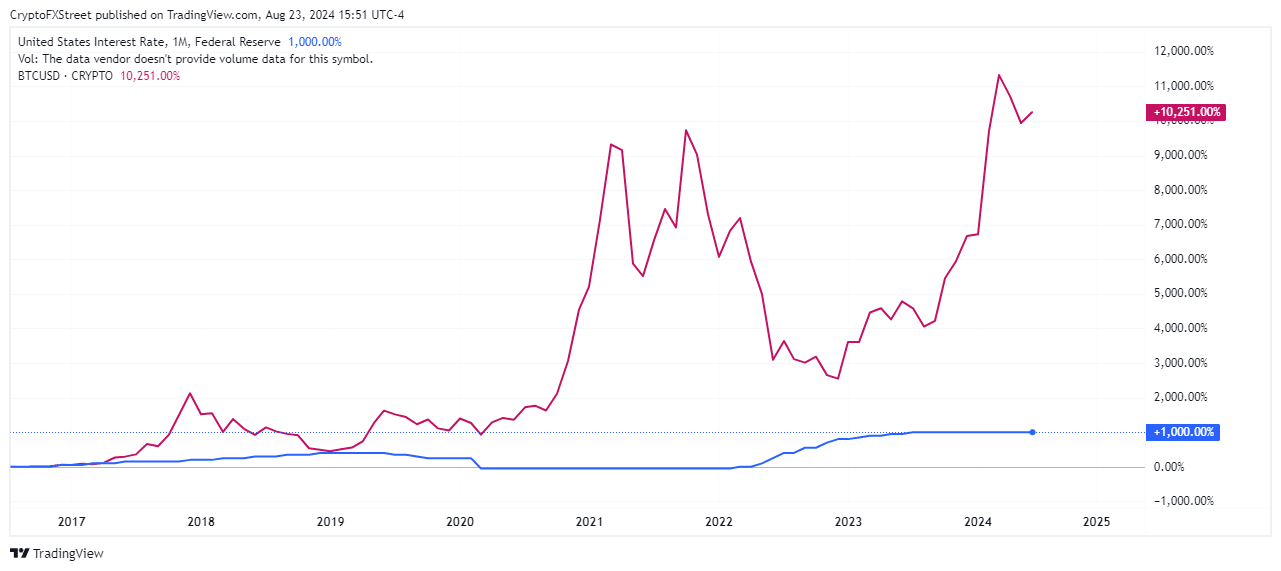

Bitcoin and the crypto market have historically posted higher prices when interest rates are low. This is evidenced by the crypto market bull run and ICO boom in 2017 when rates hovered around 0.75% - 1% and 1% - 1.25%. However, the market began seeing a correction when the Fed began hiking rates in 2018.

BTCUSD/USINTR

The crypto bull cycle from 2020 to 2021 also paints a similar picture. After the Fed slashed rates to 0% - 0.25% following the pandemic, Bitcoin began staging a bull run, rising more than 1,000% within a year. However, the market started retracing in 2022 when the central bank began hiking rates again.

Bitcoin and crypto market rallies after Fed Chair confirmed interest rate cut

Shortly after Powell's speech on Friday, Bitcoin surged above $63,000 for the first time since August 2, when the market began a downturn.

The general crypto market soared alongside Bitcoin, with several tokens in the top 50 posting sizable gains. Ethereum (ETH) appears to be mirroring Bitcoin's price, also rising above 5% on the day.

In the Layer 1 altcoin space, Solana (SOL), Avalanche (AVAX), Near Protocol (NEAR), Aptos (APT) and SUI are showing strength with gains above 4%, 8%, 11%, 12% and 20%, respectively.

The Artificial Intelligence tokens category is led by Artificial Super Intelligence (ASI), Bittensor (TAO) and Render (RNDR), which jumped by 19%, 12%, and 23%, respectively. Meme coins also saw noticeable gains, led by Dogecoin (DOGE) and Shiba Inu (SHIB), each rising more than 7% in the past 24 hours.

The gains across these sectors saw the general crypto market capitalization rising by over 3% on Friday.

Crypto market capitalization

Meanwhile, with buyers dominating the market, short traders have suffered huge losses, sustaining over $91 million in liquidations on Friday.

The price rally across the crypto market may continue in the coming weeks when the Fed eventually cut rates. The thesis is supported by the rising stablecoin market capitalization. The stablecoin market capitalization reached a new record high of $165 billion during the week, as per CryptoQuant's data.

Stablecoin total market capitalization

Increasing stablecoin market cap often correlates with higher prices in Bitcoin and the wider crypto market as it signifies an inflow of new capital.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi