Here’s what Shiba Inu needs to do to prevent a brutal sell-off

- Shiba Inu price is edging closer to a descending triangle breakout without a proper directional bias.

- A breakdown of the $0.0000101 support floor could result in a 26% crash to the $0.0000074 barrier.

- Buyers need to defend the $0.0000101 foothold to prevent this sell-off.

Shiba Inu price has been consolidating between a declining trend line and a horizontal support level since May 12. As the trend lines converge, SHIB has less space to move, which will eventually resolve into a volatile move via a breakout.

While descending triangles have a higher probability of a bearish breakdown, a perfect combination of signals could trigger a bullish breakout.

Shiba Inu price awaits volatility

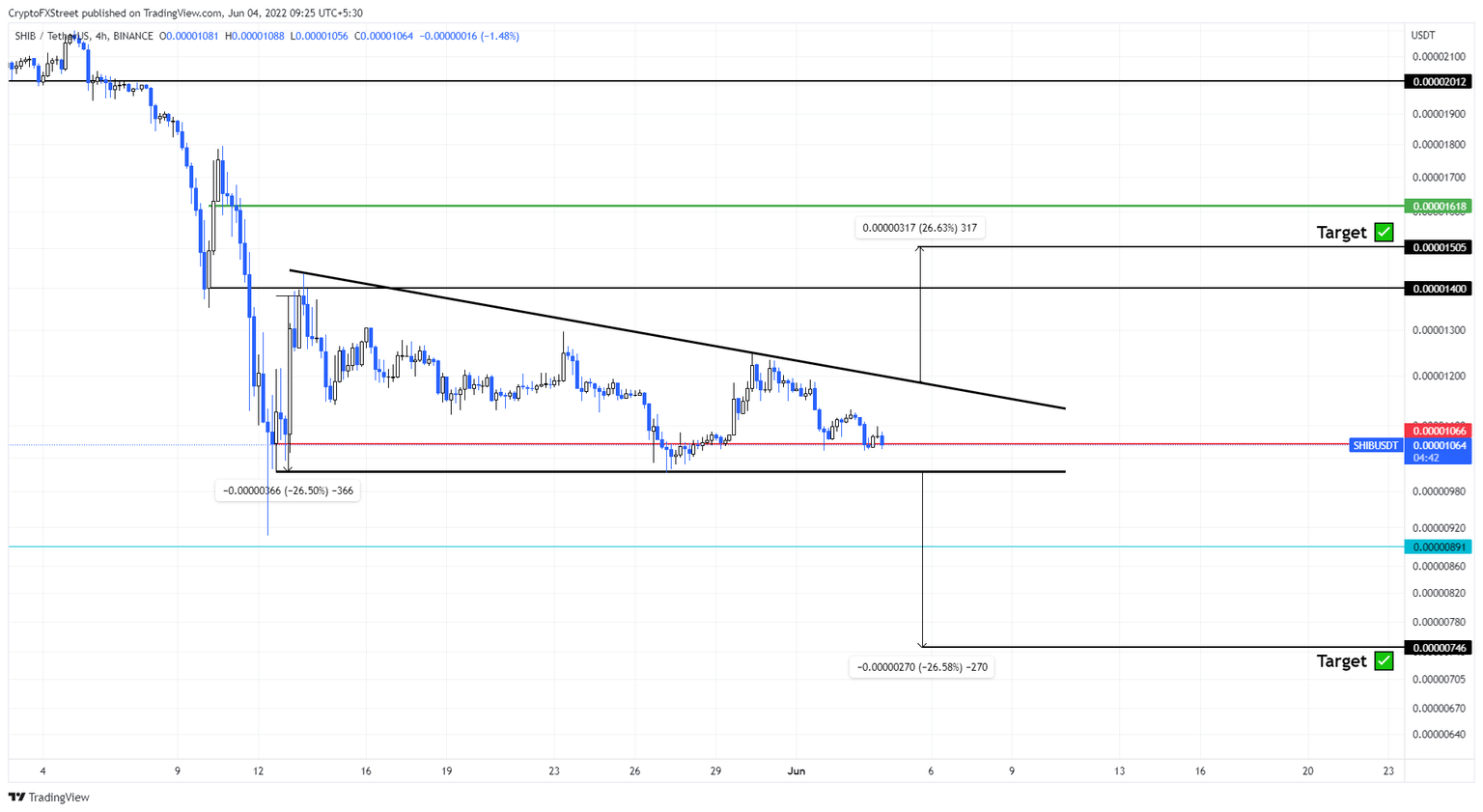

Shiba Inu price recovered quickly after the May 12 crash and set up two lower highs and two equal lows. When these swing points are connected using trend lines a descending triangle forms.

This technical formation forecasts a 26% move, obtained by measuring the distance between the first swing high and low to the breakout point. For a bullish breakout, SHIB needs to bounce off the triangle’s base at $0.0000101 and produce a decisive four-hour candlestick close above the hypotenuse at roughly $0.0000189.

For bears, things are much easier. If sellers overwhelm the bullish momentum and break below the $0.0000101 barrier, it will trigger a bearish breakout. In such a case, the theoretical target forecasts a 26% crash that puts Shiba Inu price at $0.0000074.

Therefore, the buyers need to defend the $0.0000101 barrier at all costs to prevent a bearish development. In this case, SHIB could rally higher and retest the forecasted target at $0.0000150.

SHIB/USDT 4-hour chart

While things are looking on the fence for Shiba Inu price, investors need to be patient with trading SHIB.

Depending on how the asset reacts to the $0.0000101 support floor, things will evolve. However, a breakdown of the said foothold will invalidate the bullish thesis and knock SHIB down to $0.0000074.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.