Here’s what happened when Bitcoin ETFs were rejected in 2017

- In March 2017, when U.S. regulators rejected the Winklevoss twin’s Bitcoin ETF, Bitcoin price plunged by nearly 20%.

- There is a long history of Bitcoin ETF applications getting rejected by the SEC.

- In the summer of 2018, on a single day, nine Bitcoin ETF applications were rejected.

- Proponents expect BTC prices to plummet significantly in response to any ETF rejection.

Bitcoin ETF rejection could trigger a BTC price drop, according to experts. Historically, ETF rejection has negatively impacted the asset’s price.

Bitcoin ETFs lined up for approval from the SEC

The U.S. Securities & Exchange Commission (SEC) has a history of rejecting ETF applications over the years. From the first Bitcoin ETF filed in July 2013 by Cameron and Tyler Winklevoss to Fidelity’s filing for approval of “Wise Origin Bitcoin Trust” in March 2021, there is a long list of applications and subsequent rejections.

The SEC has cited concerns over extreme volatility in BTC prices and the inherent risk for investors. Proponents remain hopeful that the new SEC chair Gary Gensler would be more accepting of cryptocurrency funds.

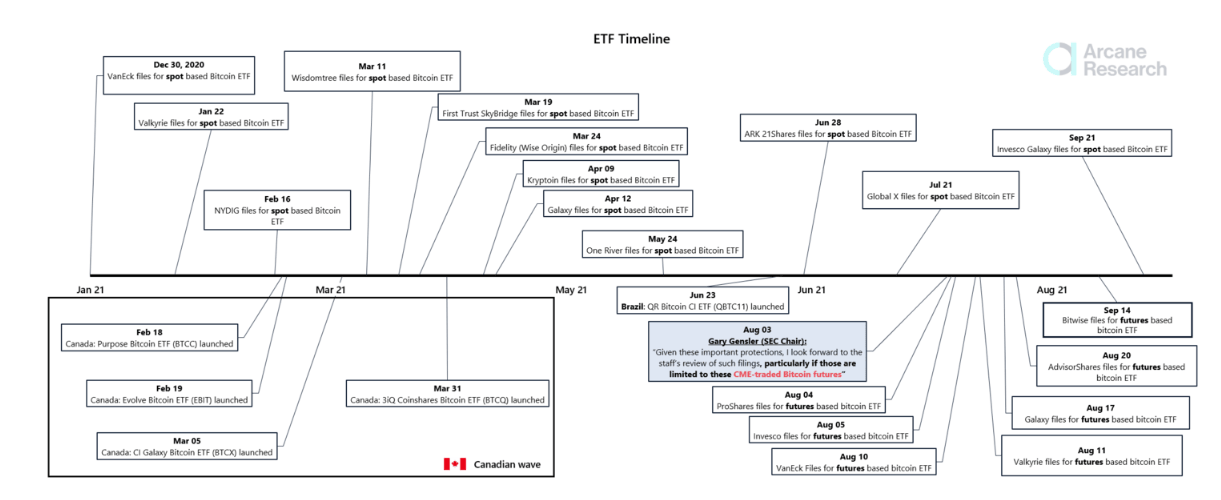

Arcane Research, a crypto data-driven analysis and research firm, shared the following timeline for Bitcoin ETFs in Q4 2021.

ETF timeline.

Currently, there is an air of optimism in the crypto community, awaiting ETF approval; however, experts have hinted that the wait maybe longer. Todd Rosenbluth, senior director of ETF and mutual fund research, is a source close to the development. Rosenbluth believes that there will be no ETF approval by the SEC this year.

Rosenbluth was quoted:

It’s a timing issue. Does it happen in 2021, or does it move to 2022, so all of these products that…could meet the goals actually are approved and can launch at the same time instead of getting a first-mover advantage? It’s possible – in fact, we think it’s likely – that we’re going to see a delay of a Bitcoin futures ETF until 2022 until the regulatory environment is more clear.

Pseudonymous cryptocurrency trader @RNR_0 tweeted:

Hey kid, have you ever seen the ETF rejection in 2017? I have lots of memories pic.twitter.com/pcUIYvTvYR

— Romano (@RNR_0) October 13, 2021

The rejection of the Winklevoss twins’ Bitcoin ETF triggered a BTC price drop of nearly 20%. Proponents and traders who were around for the 2017 ETF rejection are reminding crypto Twitter of the negative impact on Bitcoin price.

Ryan Selkis, the founder of Messari Crypto, commented on Grayscale’s Bitcoin ETF application, stating that the asset management giant has $35 billion in Bitcoin, and it must be converted into a Bitcoin ETF.

tl;dr on this is @BarrySilbert is @GaryGensler's daddy.

— Ryan Selkis (@twobitidiot) October 14, 2021

Grayscale has $35 billion in bitcoin AUM that must either be converted to an ETF, or SEC will allow $25 billion of investor $ to bleed to a private trust sponsor.

It's a big game of chicken. Advantage Barry. https://t.co/Xi3ur4982T

FXStreet analysts have evaluated BTC prices and predicted that Bitcoin is primed for hitting a new all-time high.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.