Here’s how Ethereum could recover its losses since Shapella with massive deposits

- Ethereum tokens that are out of circulation hit a new all-time high of 18.87 million, following the Shapella upgrade.

- Spike in volume of Ether out of circulation signals the likelihood of recovery in ETH and a reduction in selling pressure on the altcoin.

- Experts believe Ethereum price could hit the bullish target of $1,925 once it begins its recovery.

Ethereum tokens being pulled out of circulation have hit a new all-time high based on data from crypto intelligence tracker Nansen. Following the Shapella upgrade, Ethereum locked out of circulation hit 18.87 million ETH.

Also read: Meme coin traders hunt for the next PEPE, ape into low market cap projects for gains

Ethereum locked out of circulation hits record since Shapella

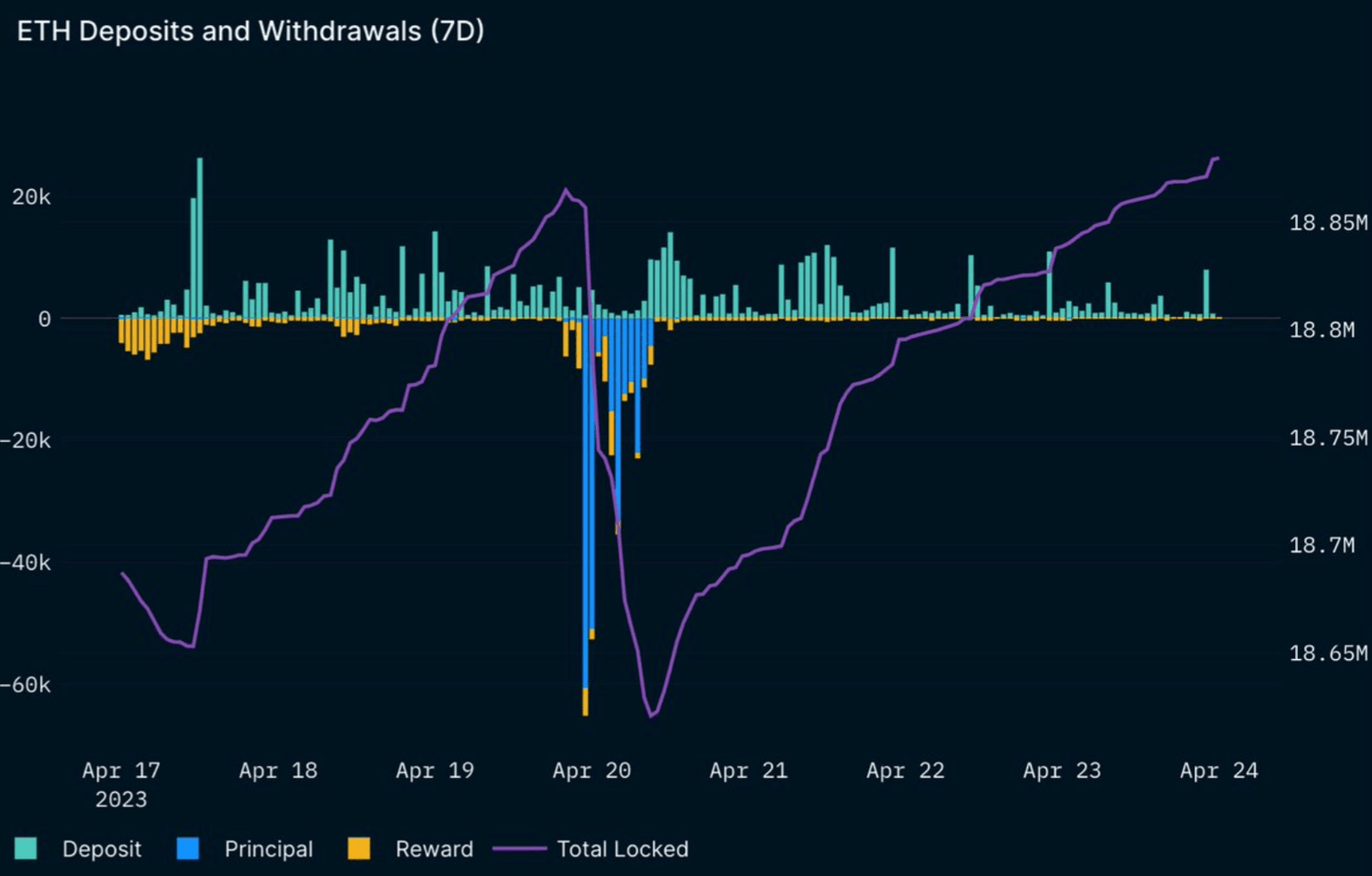

Ethereum recently wiped out all its gains since the Shapella upgrade. Based on data from crypto intelligence tracker Nansen, total ETH locked out of circulation, which includes staked ETH, the altcoins deposited to the contract but not validated yet and the rewards on the contract have together exceeded 18.87 million, a new all-time high.

Ethereum deposits and withdrawals

This is a key metric since Ether that is pulled out of circulation reduces the selling pressure on the altcoin. It indicates decline in exchange wallet reserves and supports a bullish thesis for the asset.

Will Ethereum recover its losses?

A spike in ETH locked out of circulation fuels the thesis for Ethereum price recovery. Experts believe the altcoin is primed to recover its gains. Interestingly, ETH price has nosedived below $1,850, reducing the percentage of holders profitable at the current price level. This is likely to discourage traders that are sitting on unrealized losses, from shedding their ETH holdings.

As seen in the price chart below, Ethereum is currently in a short-term uptrend that started in December 2022. The altcoin hit a peak at $2,138 before receding to critical support at $1,851. If buying pressure sustains and volume of ETH locked continues climbing higher, Ether is likely to recover and make a comeback above $1,925, a level that coincides with the 10-day Exponential Moving Average (EMA).

ETH/USDT 1D price chart

Ether price is steady above the 50-day and 200-day Exponential Moving Averages at $1,829 and $1,654 respectively. Bullish targets for Ether are resistance at $1,925, and $2,023, followed by the April 2023 peak of $2,138. A decline below the 50 and 200-day EMAs could invalidate the bullish thesis for Ethereum.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.