Grayscale Bitcoin Trust discount shrinks first time in a year as DCG and Gemini saga unravels

- Gemini exchange is working on recovering $900 million in customer assets from Digital Currency Group-owned Genesis, to no avail.

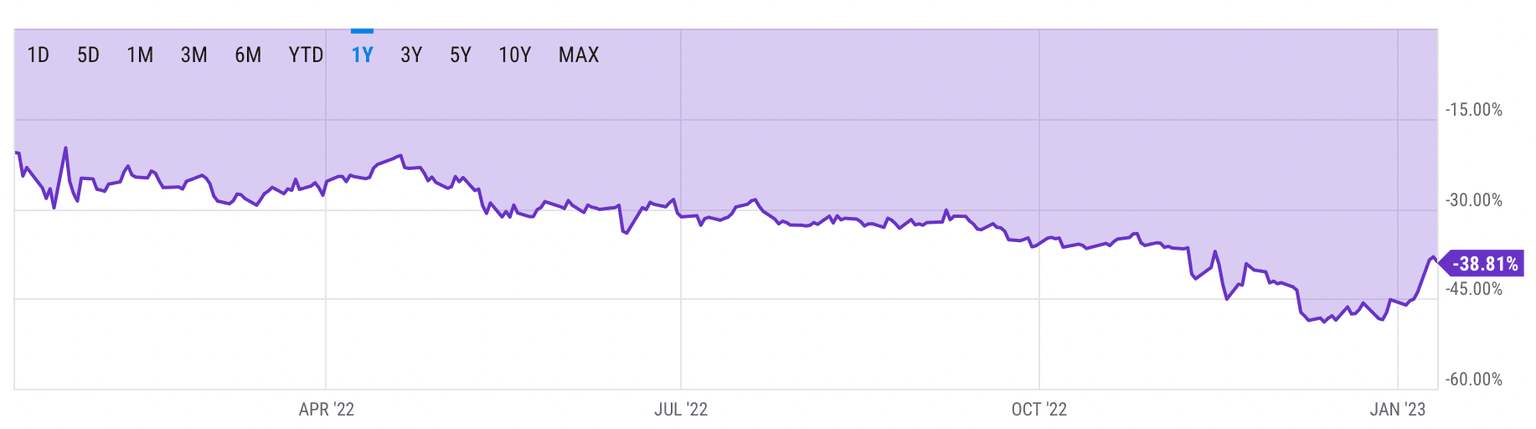

- The spat has weighed heavily on the Bitcoin market and the Grayscale Bitcoin Trust discount has reached 38.8%, shrinking for the first time in a year.

- The Digital Currency Group is likely to raise cash by selling their GBTC shares, increasing the pressure on the historically low GBTC discount.

Grayscale Bitcoin Trust (GBTC) shares could succumb to selling pressure from venture capital firm Digital Currency Group (DCG) unloading its GBTC shares. Crypto lender Genesis, owned by the DCG group owes $900 million to Gemini’s “Earn” product users and the two firms are embroiled in a long spat that weighs heavily on the market mood and leading crypto Bitcoin.

Also read: Here’s what Bitcoin price needs to break out of the bear market in 2023

Gemini battles DCG for $900 million in user funds, builds up fraud allegations

Crypto lender Genesis, owned by venture capital firm Digital Currency Group, announced the need for a $1 billion liquidity injection in the aftermath of the FTX and Alameda crisis in 2022. Crypto exchange Gemini, co-founded by Cameron and Tyler Winklevoss, is struggling to recover $900 million in user assets from Genesis. The exchange has accused the lender of fraud after several failed attempts to recover the funds used to generate yield for their “Earn” product’s customers.

The dispute between the two firms has been unresolved and grown larger, weighing heavily on Bitcoin and market participants in the ecosystem. Two key scenarios could play out, spelling different outcomes for Gemini’s “Earn” users and crypto lender Genesis.

The DCG group has nearly 10% of Grayscale Bitcoin Trust shares on its balance sheet. After nearly a year, GBTC discount shrinked 10% since December 2022. In December GBTC traded at a discount of 48% and it has recovered to 38.8% since then.

GBTC discount

While the above chart signals a recovery, GBTC could tackle rising selling pressure if DCG unloads its holdings. This is expected to influence Bitcoin price since GBTC is the preferred vehicle for many institutions to obtain regulated exposure to the risk asset. When GBTC swings from premium to a discount to Net Asset Value (NAV) it fuels speculative arbitrage in the market.

NAV is the net value of an investment fund's assets minus its liabilities, divided by the number of shares outstanding; GBTC shares trade at a premium or a discount to this value.

Therefore GBTC discount is a metric to keep eyes peeled on, when predicting the direction of Bitcoin’s price trend. In the event that DCG needs to raise cash or goes down the path of Chapter 11 bankruptcy, selling GBTC shares is a potential option.

DCG would offload its GBTC shares in a market that's already illiquid and increase pressure on the historically low discount. DCG holds approximately 67 million shares and the daily trade volume is less than 4 million shares a day. However, DCG cannot sell more than 1% of shares outstanding every quarter and this slows the venture capital firm’s sale to a 2.5 year timeline.

GBTC discount could continue shrinking consistently if DCG finds capital to stay afloat and avoids a bankruptcy filing.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.