Floki Inu Price Forecast: FLOKI to pull off a 10% recovery bounce soon

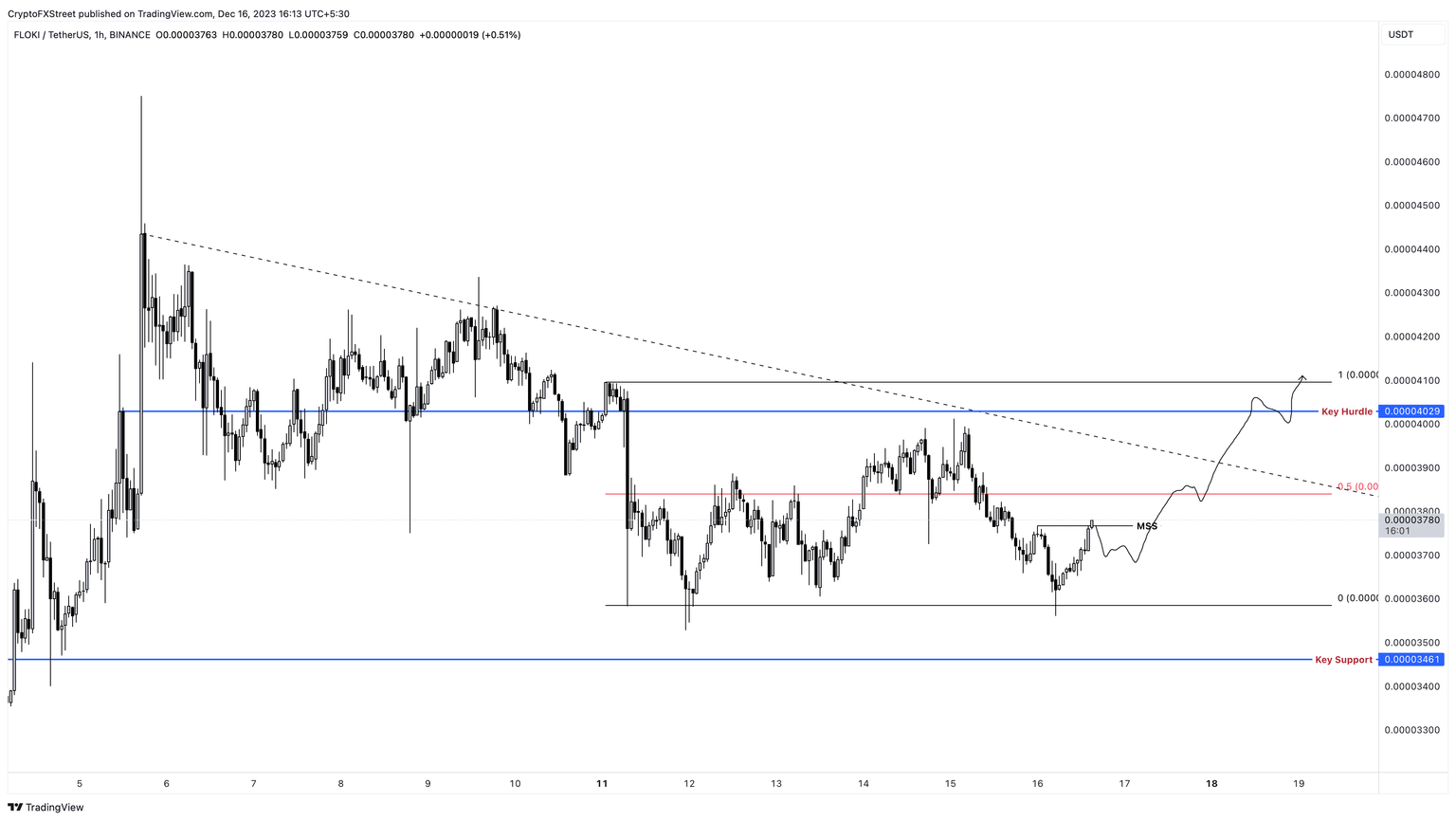

- Floki Inu price is consolidating between the $0.0000358 to $0.0000409 levels.

- A sweep of the range low is likely to be followed by a recovery rally that leads to a 10% bounce.

- A decisive flip of the $0.0000358 level into a resistance barrier will invalidate the bullish thesis for FLOKI.

Floki Inu (FLOKI) price, on the one-hour time frame, has signaled that it wants to go higher by producing a shift in the market structure. If buyers don’t step off the gas, this move is likely going to yield handsome returns for FLOKI holders.

Also read: Dogecoin price eyes a quick 8% move as meme coin fever grips investors

Floki Inu price likely to climb higher

Floki Inu price created a range, extending from $0.0000358 to $0.0000409 on December 11. This consolidation is still in play as FLOKI swept the range low on December 16 and recovered above it. The subsequent push to the upside has created a higher high, indicating a market structure shift, favoring the bulls.

Going forward, Floki Inu price needs to overcome the range’s midpoint at $0.0000384 to tag the rang high at $0.0000409. But this move is unlikely going to be a straightforward one. Instead, a minor pullback could occur to $0.0000365, where interested investors could open a long position. The retest of the range high at $0.0000409 would constitute a 10% gain.

The Relative Strength Index (RSI) and the Awesome Oscillator (AO) momentum indicators are both favoring buyers and shows an uptick in bullish momentum, which supports the main thesis.

Also read: Shiba Inu Price Prediction: Will BONK profit rotation kickstart SHIB’s 25% rally?

FLOKI/USDT 1-hour chart

On the other hand, if Floki Inu price breaks below the range low of $0.0000384, it would create a lower low and invalidate the bullish thesis.

In such a case, Floki Inu price could crash by 3.4% and retest the $0.0000346 support level.

Read more: FLOKI staking TVL explodes, hits $54.4 million within a week

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.