Dogecoin price eyes a quick 8% move as meme coin fever grips investors

- Dogecoin price looks ready to overcome the consolidation taking place between the $0.0927 to $0.1060 range.

- A bounce from the four-hour demand zone has kickstarted the uptrend and DOGE extend 8.80% from the current levels.

- A four-hour candlestick close that flips the demand zone’s lower limit at $0.0901 into a resistance level will invalidate the bullish thesis.

Dogecoin (DOGE) price trades at $0.0977, but is poised to move higher as many investors are attracted to the gains of meme coins. Currently, Bonk Inu (BONK), a Solana-based meme coin, is the hype as the dog-themed crypto has rallied 183% in under 30 hours. As a result of the massive gains noted in BONK, DOGE could kickstart a quick uptrend.

Read More: Dogecoin price crashes 7% hours after Elon Musk reacts to DOGE founder mocking the bears

Dogecoin price likely to bounce

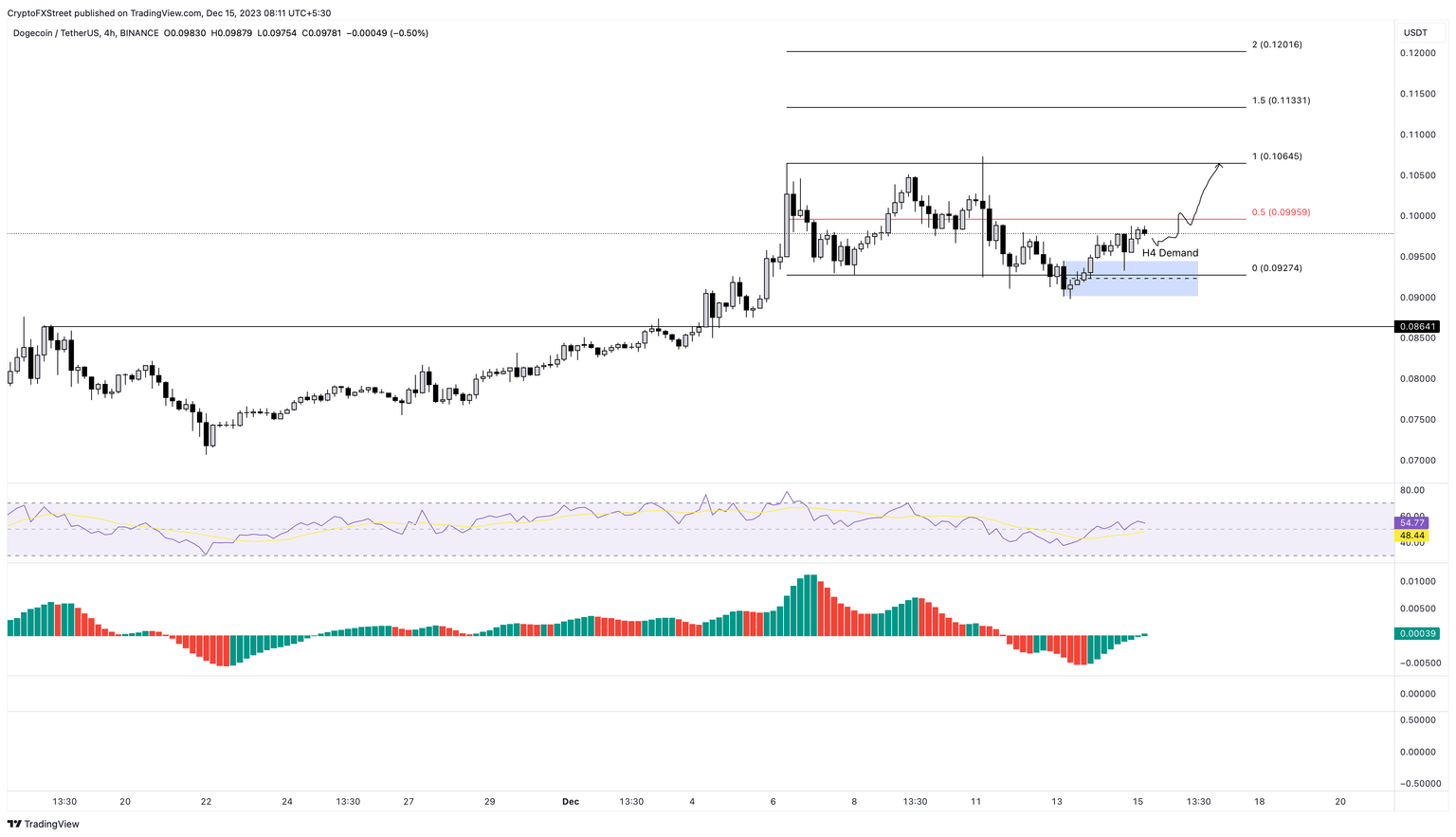

Dogecoin price created the $0.0927 to $0.1060 range after registering 48% gains between November 22 and December 3. After a brief deviation below the range on December 13, DOGE recovered successfully and created the four-hour demand zone that extends from $0.0901 to $0.0944.

A bounce off this level is a great entry point for intraday traders looking for a retest of the range high at $0.1060. This move would constitute an 8.80% gain. Supporting this outlook is the four-hour Relative Strength Index (RSI), which has reset at the mean level of 50, indicating that there is a chance for a bullish comeback. The Awesome Oscillator has also flipped above the zero mean level, indicating that the bullish momentum is on the rise.

With the momentum indicators painting a bullish outlook for Dogecoin price, investors need to anticipate a potential move that breaks out of the consolidation. As more investors book profit from BONK’s impressive rallies, a portion of these profits is likely to rotate to other meme coins like Dogecoin, Shiba and Floki Inu.

Therefore, DOGE is likely to overcome the $0.1060 hurdle and tag the $0.1130 level, constituting a 16% move. In a highly bullish case, the meme coin could also retest the $0.1200 barrier and register a 23% gain.

Read More: Tokens tied to Dogecoin-funded DOGE-1 satellite jump ahead of SpaceX launch

DOGE/USDT 4-hour chart

While the rangebound outlook for Dogecoin price seems logical, investors need to pay attention to Bitcoin’s ongoing struggle around the $45,000 region. A sudden spike in selling pressure for BTC could negatively impact altcoins’ gains.

In such a case, a four-hour candlestick close that flips the demand zone’s lower limit at $0.0901 into a resistance level will invalidate the bullish thesis for DOGE. This move could knock Dogecoin price down by 4% to retest the next key support level at $0.0865.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.