Fantom price eyes breakout from multi-month consolidation, FTM holders could triple investment

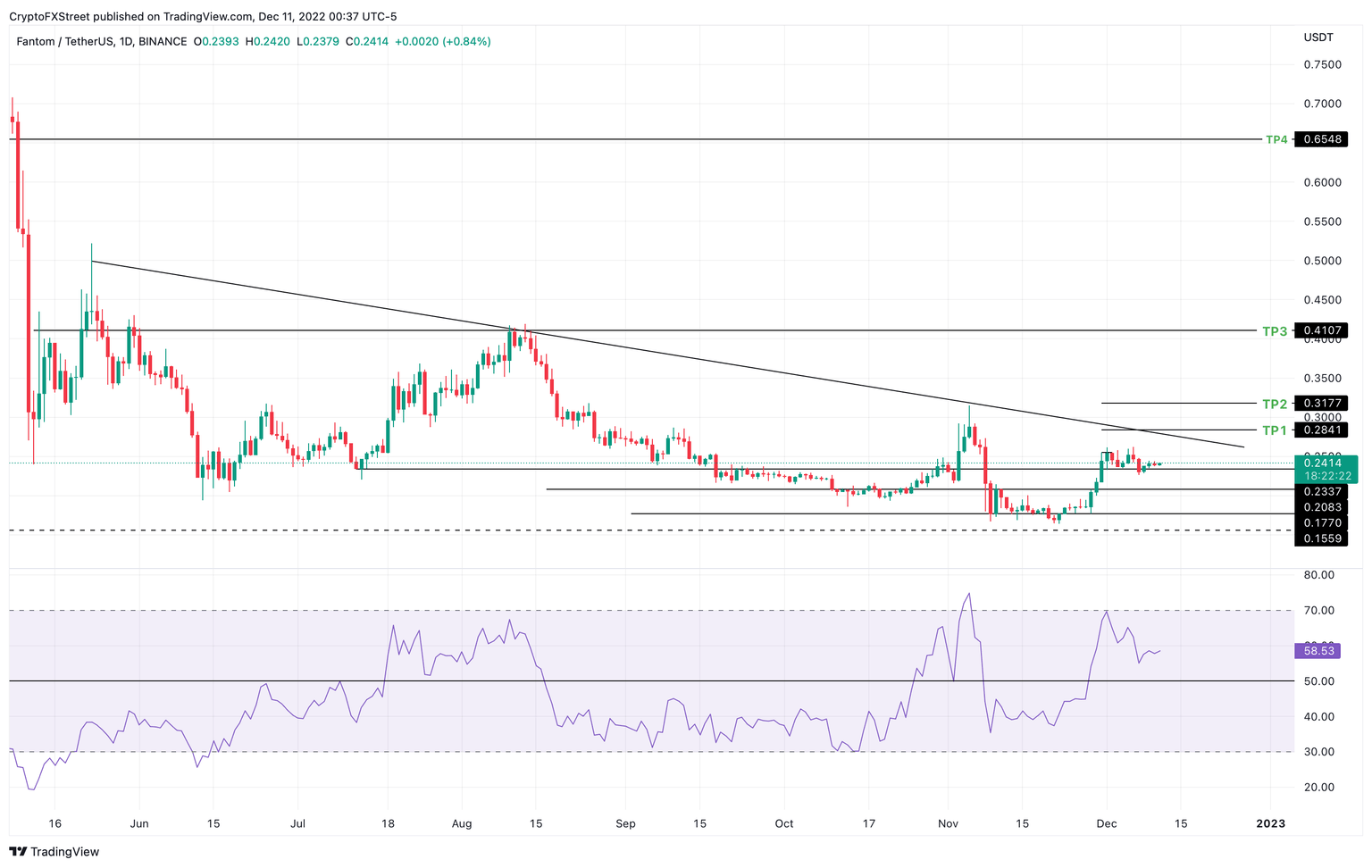

- Fantom price shows a consolidation below a trend line connecting the lower highs produced since May 23.

- A breakout from this setup could result in a minor move to $0.317, but depending on the momentum, FTM could even rally 170%.

- A daily candlestick close below $0.177 will invalidate the bullish thesis.

Fantom price clearly shows consolidation as it hovers above a support level but below a multi-month trend line. A decisive move above this declining resistance level will signal a breakout and trigger a massive run-up for FTM.

Fantom price remains undervalued

Fantom price has produced three distinctive lower lows since May 23, denoting persistent sellers. This could be due to the market conditions or just investors offloading their holdings in hopes of a better discount. Regardless, FTM has been stuck below this downtrend for roughly seven months.

The Relative Strength Index (RSI) shows that it has finally breached the midpoint at 50, indicating a resurgence of buyers. This move pushed Fantom price by 55% in just ten days, hinting that the buyers’ appetite is strong. A pullback in FTM to roughly retest the $0.208 support level will knock RSI down to retest the 50-level again. Such a development could reset the bullish momentum, allowing the buyers to make a comeback.

Therefore, the range between $0.233 and $0.208 is the best place to accumulate FTM at a discount before it kick-starts its rally.

As for the upside target, Fantom price needs to bounce from the zone mentioned above and break out from the declining trend line. A successful hold above the $0.295 or $0.300 level will be a confirmation that the uptrend is progressing smoothly.

In such a case, the short-term targets will be $0.317 and $0.410. Beyond this hurdle, Fantom price could target the $0.654 barrier.

If FTM retests the $0.654 level, it will denote a 170% upswing from $0.233. From $0.208, however, this move would constitute a 214% gain.

FTM/USDT 1-day chart

Regardless of the massively optimistic outlook from a technical standpoint, Fantom price must clear some significant hurdles. Even before that, FTM must hold above the $0.233 support level.

A failure to do so will knock the altcoin down to a $0.208 foothold, which could be another level to accumulate with higher rewards but relatively lower risk. The trouble for bulls will arrive if FTM produces a daily candlestick close below the $0.177 support level. This move will shake the belief among sidelined buyers and invalidate the bullish thesis.

This development could see Fantom price revisit the $0.150 level to recuperate.

This video shows how Bitcoin price moves could affect Fantom price

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.