Fan tokens rise with 262% rally in OG coin: Lawyers argue Hong Kong’s trading circles are driving the “pump”

- Fan tokens of football clubs like Barcelona and Manchester have made a comeback with 262% weekly gains in OG coin.

- Lawyer Liu Yang told Chinese journalist Wu Shuo that Hong Kong-based trading circles are likely driving the price rally in fan tokens.

- Similar traders were involved in the release of OKLink’s stablecoin USDK and Tornado Cash’s TORN price rally.

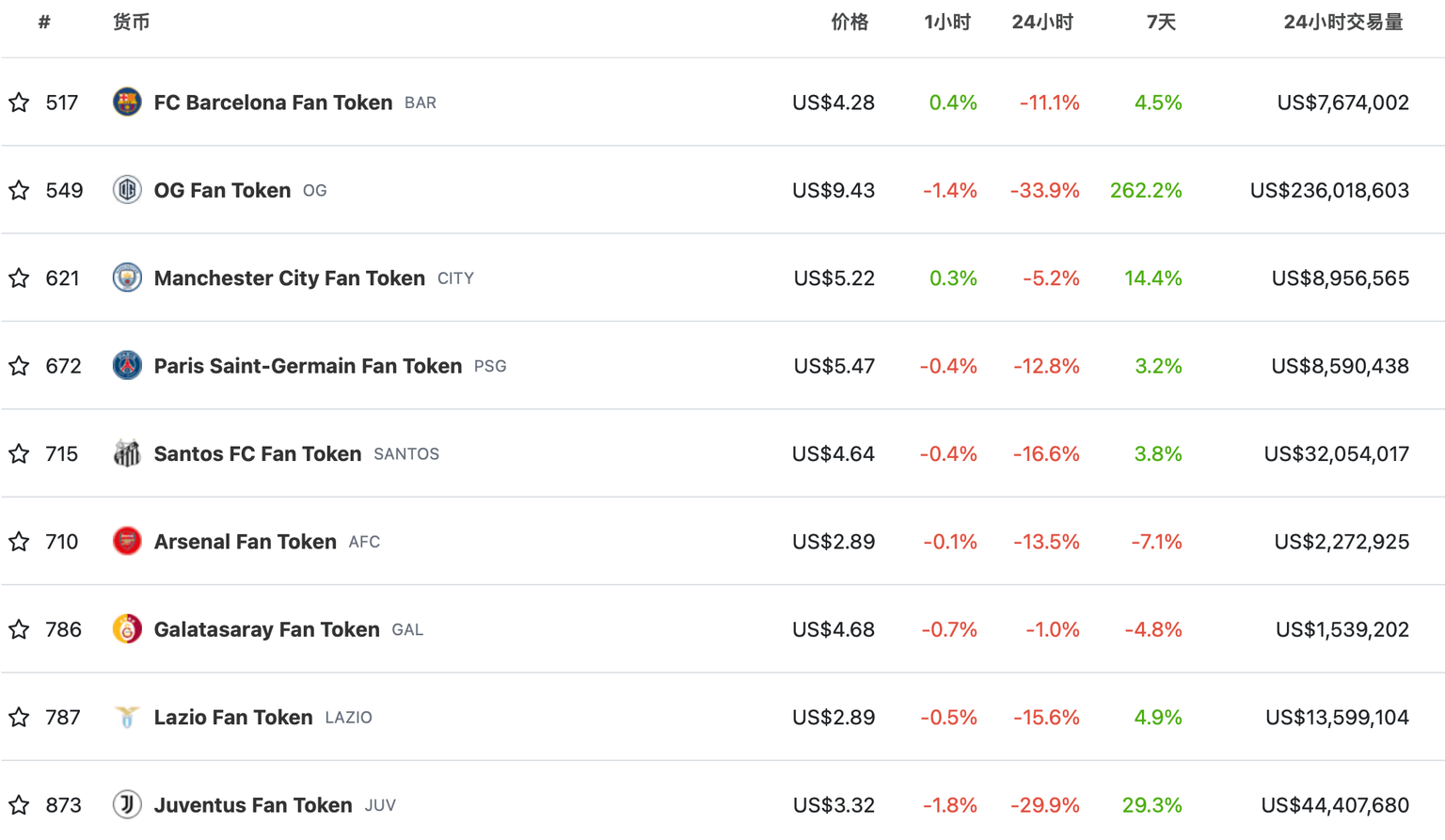

Fan tokens or digital assets that offer exclusive benefits to fans of football clubs have yielded double-digit gains to holders over the past week. OG Fan token (OG) offered 262% gains to holders over the past week alongside Manchester City Fan Token (CITY), FC Barcelona Fan Token (BAR) and Juventus Fan Token (JUV).

Lawyers believe the price rally in fan tokens can be attributed to trading circles based in Hong Kong and these gains are likely to be unsustainable in the long-term.

Also read: Ethereum Shapella upgrade is less than two days away, here's where ETH price is headed

Fan tokens yield double-digit gains for holders led by OG coin

Wu Shuo, a Chinese journalist reported on the massive price rally in OG Fan Token that yielded 262% gains for holders over the past week. The rally in OG triggered a large-scale interest spike in fan tokens of Football clubs, such as CITY, BAR, and JUV among others.

Fan Tokens

The total market valuation of these tokens increased by 16.2% over the past week, based on CoinGecko data.

What is driving the price rally in fan tokens?

Lawyer Liu Yang told journalist Wu Shuo that the rally may be related to the behavior of trading circles. Yang noted that the people involved in the trading circle are related to the platform OKLink that was engaged in releasing the stablecoin USDK of the platform.

吴说获悉,近期粉丝币 OG 的上涨引发粉丝类 Token 的大面积普涨,Coingecko 数据显示,此类 Token 总市值近 7 天上涨 16.2%。刘扬律师分析认为,可能与盘圈行为有关,起盘的人搭建了平台,并且发布了平台的稳定币 USDK,类似操盘手还操作过 TORN PEOPLE 等。用户需谨防风险。

— 吴说区块链 (@wublockchain12) April 10, 2023

Similar traders operated Tornado Cash’s TORN token and lawyers warned users to be aware of risks involved in short-lived price rallies. The gains in fan tokens are likely to be unsustainable with the involvement of a small group of traders that fuel rallies in different tokens.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.