Ethereum Shapella upgrade set to go live in 48 hours, what this means for ETH holders

- Ethereum network’s Shapella upgrade will transform the liquid staking landscape forever, making ETH the benchmark yield for crypto.

- Lowering of gas fees for developers and increase in popularity of liquid staking derivatives is expected to drive ETH adoption higher.

- Nearly 85% of Ethereum holders expect more ETH to be staked within the next three months, driving away fears of massive selling pressure on the altcoin.

Ethereum blockchain’s Shanghai upgrade is slated to occur on April 12. This marks the second-most significant milestone in Ethereum’s developmental journey post the Merge, the transition from Proof-of-Work.

Liquid staking derivatives have gained traction in the weeks leading up to the Merge.

Also read: Ethereum stakers are underwater with Shanghai hard fork drawing close

Ethereum Shapella upgrade run down

Ethereum Shapella upgrade, known as Shanghai, is a hard fork scheduled for April 12, 2023. The upgrade lines up a series of improvements in the Ethereum blockchain, including the proposed Ethereum Improvement Proposals (EIPs) Shanghai and Capella.

In addition to token withdrawals, the upgrade reduces gas fees for Ethereum network developers. The Shanghai upgrade has bundled five different EIPs, EIP 3651, 3855, 3860, 4895 and 6049.

These Ethereum Improvement Proposals address scalability issues, transaction fees and token withdrawal related developments on the blockchain. Capella upgrade tackles full and partial withdrawals for the network’s validators.

What Ethereum holders need to do?

Ethereum holders and users don’t need to take any additional steps if they use an exchange, digital or hardware wallet unless specified by wallet providers.

What happens if stakers or node operators do not participate in the upgrade?

Ethereum clients that fail to update to the latest versions will sync to pre-fork blockchain once the upgrade is complete. This implies that the operator will be stuck on an incompatible chain and unable to operate on the post-Shanghai blockchain network. Therefore it is essential that operators participate in the upgrade.

What ETH holder community expects

On Crypto Twitter, Ethereum believers, a group referred to as “ETH Maxis,” analysts and developers have presented different scenarios for ETH post the hard fork. Experts believe ETH token unlock could result in temporary selling pressure on the altcoin, however a large percentage of staked ETH may hit liquid staking projects or line up for staking elsewhere given the price of the altcoin, and holders being underwater at the time of unlock.

Another scenario stems from the front-running of the Shapella upgrade and Ethereum’s recent price rally to the 2023 high above $1,900. It is likely that the ETH upgrade is priced in and the token unlock turns out to be a non-event or has less of a bearish impact than anticipated previously by the community.

More Ethereum to be staked within the next three months: 83% ETH holders

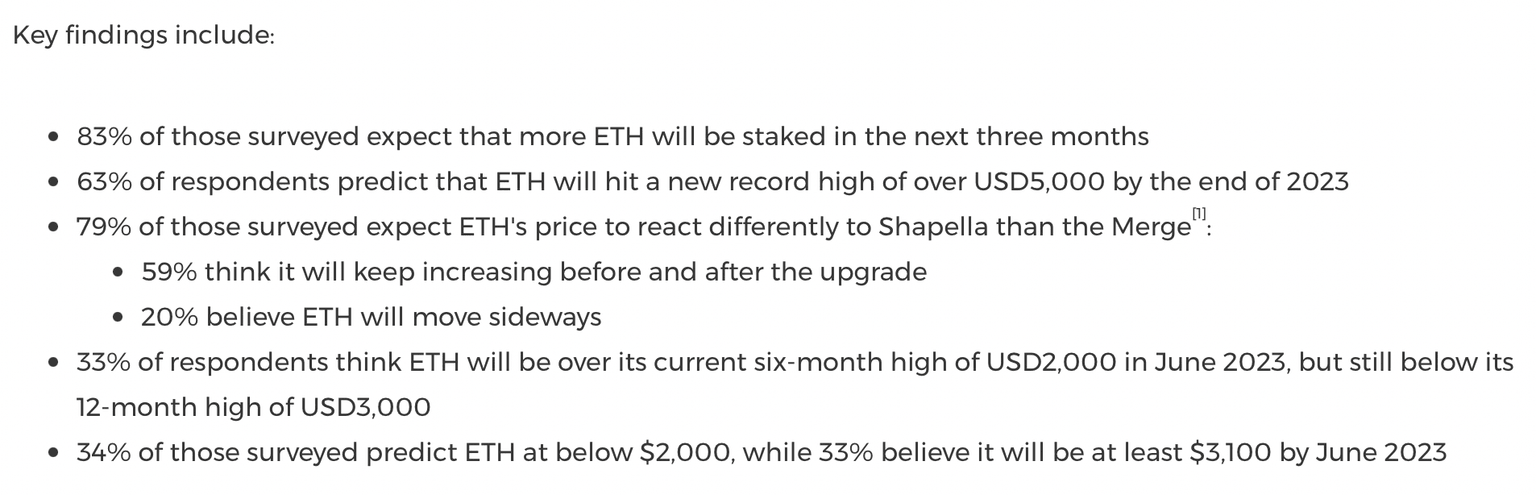

In a recent survey conducted by OKX exchange, 83% of ETH community members/ respondents expressed optimism about a spike in Ethereum staking within the next three months.

Following are the key findings of the survey:

Key findings of the OKX survey

While the token unlock is going live for the first time since the launch of the Beacon Chain contract in 2020, ETH holders are convinced that more tokens will be staked within the next three months, supporting a bullish thesis for the asset in the medium-term.

How Ethereum's upgrade could be a deciding moment for crypto traders

Crypto traders that suffered a setback in the tumultuous events in cryptocurrency markets could take ETH token unlock as the first opportunity to exit from digital assets. Holders with an appetite for risk could continue holding or staking their ETH in anticipation of rewards in the future. These two possibilities make it a deciding moment for crypto and it remains to be seen how ETH holders react post token unlock. There is a likelihood of glitches in the upgrade's implementations and ETH token unlock, this is another factor that could influence digital asset traders.

Experts criticize Ethereum for scalability issues

YavuzAyral, a crypto analyst and expert believes that focusing on Ethereum limits the innovation in the cryptocurrency industry. Several Layer 2 solutions are working on tackling Ethereum’s issues, despite that there is uncertainty in the ETH ecosystem.

Focusing this much on Ethereum limits innovation in the whole crypto space.

— Emir (@YavuzAyral) April 7, 2023

How many more L2s do we need to fix Ethereum’s issues? Do they fix a problem or bring more uncertainty for the future?

There are better blockchains out there for developers to build better products.

The expert criticizes developers for building more solutions to scale Ethereum and calls for innovation on other blockchains where scalability is not an issue.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.