Experts predict Shiba Inu will rally by 85% toward $0.000013

- Shiba Inu's Coinbase listing find relief as the exchange announces SHIB order books are live.

- The memecoin continues to trade nearly 81% below its all-time high from four months ago.

- Analysts expect a breakout, SHIB is likely to resume an uptrend to $0.00000850.

Shiba Inu struggles to climb higher; traders expect the token to rally following the Coinbase announcement.

Shiba Inu set to make a comeback from the flash crash

Following the meltdown in May 2021, the overall cryptocurrency market began its recovery and the altcoin rally extended to Shiba Inu. From July to mid-August, SHIB rallied over 50%, however, since then, the token has posted consistent losses for holders.

The world’s second-largest exchange, Coinbase, announced SHIB’s listing, and the resurgence in the token’s price can be considered the “Coinbase Effect,” as the enthusiasm of Shiba Inu holders and traders was short-lived.

Coinbase Pro announced earlier today that it has started accepting orders in SHIB-USD and SHIB-USDT.

Our SHIB-USD and SHIB-USDT order books are now in full-trading mode. Limit, market and stop orders are all now available.

— Coinbase Pro (@CoinbasePro) September 10, 2021

The crash on September 7 had led to nearly a 30% drop in SHIB’s price within a single day.

The Coinbase listing announcement acted as a catalyst for the token’s recovery on the following day. A boost in price accompanied SHIB’s debut on the exchange, and analysts expect the altcoin to make a comeback to $0.000013.

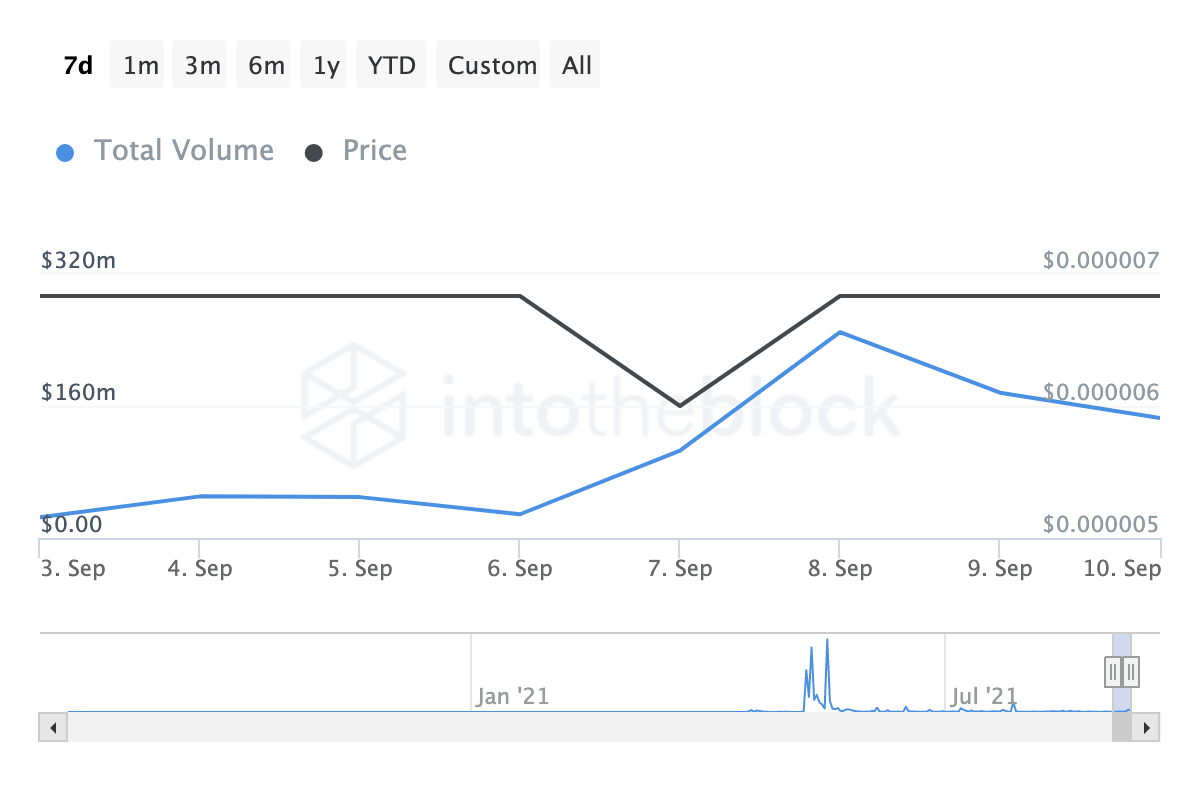

On-chain indicators for SHIB suggest a bullish trend reversal in the token. The number of large transactions worth $100,000 or higher has increased over the past week.

Based on data from blockchain intelligence platform, IntoTheBlock, a total of $830.89 million in large value transactions were processed on the SHIB network. The indicator measures the aggregated daily volume of transactions greater than $100,000, reflecting large wallet investor activity.

Large transactions volume in USD (SHIB)

Analysts expect a push to the upside, setting the next price target at $0.00000850. FXStreet analysts predict that SHIB is vying for a 30% ascent once it crosses the key support level.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.