Ethereum’s selling pressure plummets while ETH price enters new uptrend targeting $1,000

- Ethereum price has finally cracked the $700 resistance level and aims higher.

- It seems that Ethereum’s selling pressure is greatly declining in the past week.

Bitcoin has been the dominant leader for the most part of this recent rally. However, it seems that Ethereum bulls are finally awakened and have pushed the digital asset towards a high of $745, not seen since May 2018.

Ethereum price has the potential to hit $1,000

Despite Ethereum price skyrocketing in the past few days, the number of coins inside exchanges is still declining, which indicates it is going out to other platforms, decreasing the selling pressure.

ETH Inflow Chart

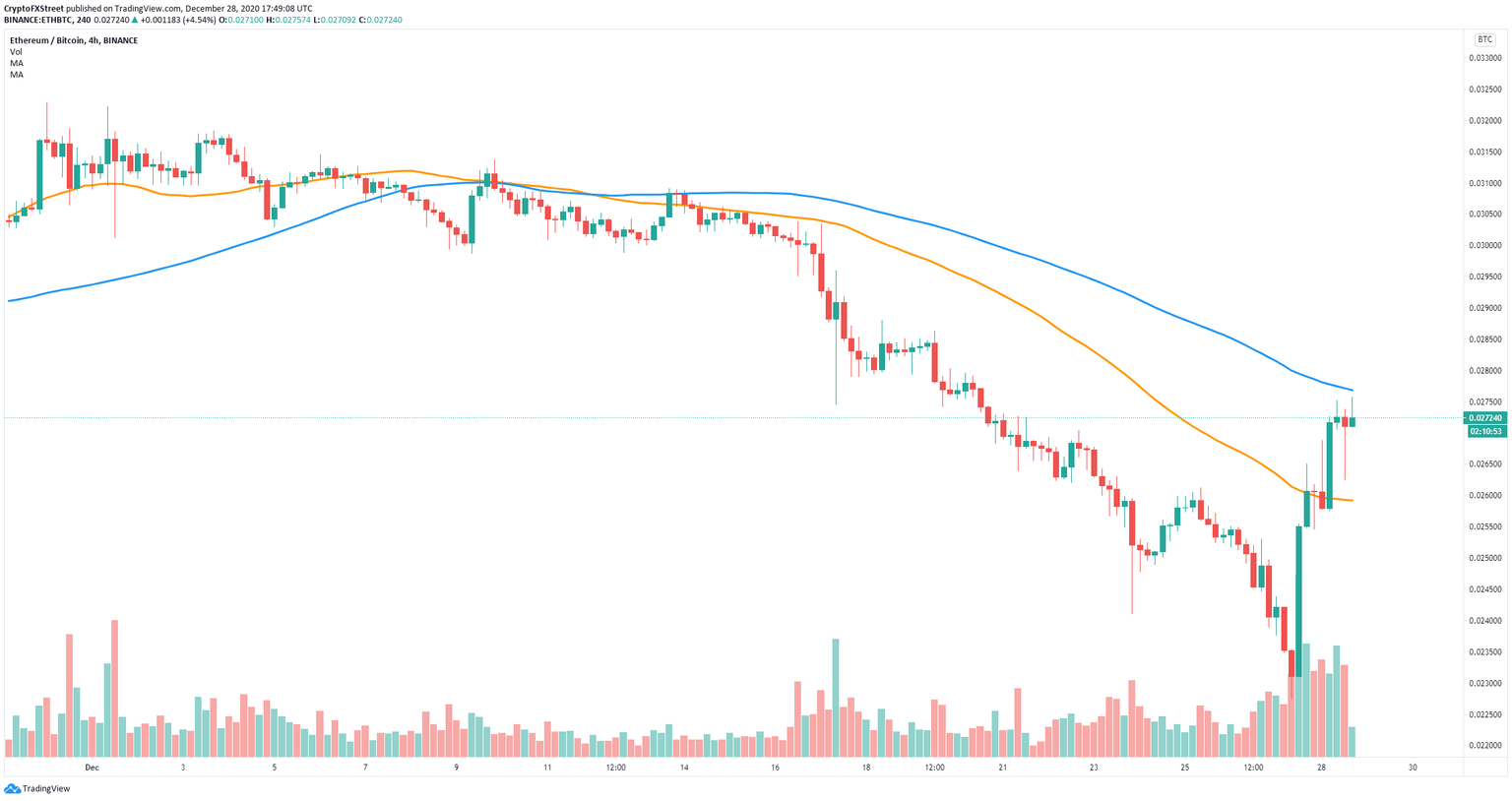

The Eth2 deposit contract holds more than 2.1 million ETH coins now, worth around $1.55 billion at the time of writing. On the ETH/BTC pair, Ethereum has finally managed to change the 4-hour downtrend into an uptrend.

ETH/BTC 4-hour chart

Bulls still need to push Ethereum price above the 100-SMA at 0.027 BTC before a full-blown rally towards 0.03 BTC. Besides low coin supply on exchanges, the miners’ balance also remains extremely low dropping from 1.13 million on October 16 to only around 987,000 currently.

ETH Supply Chart

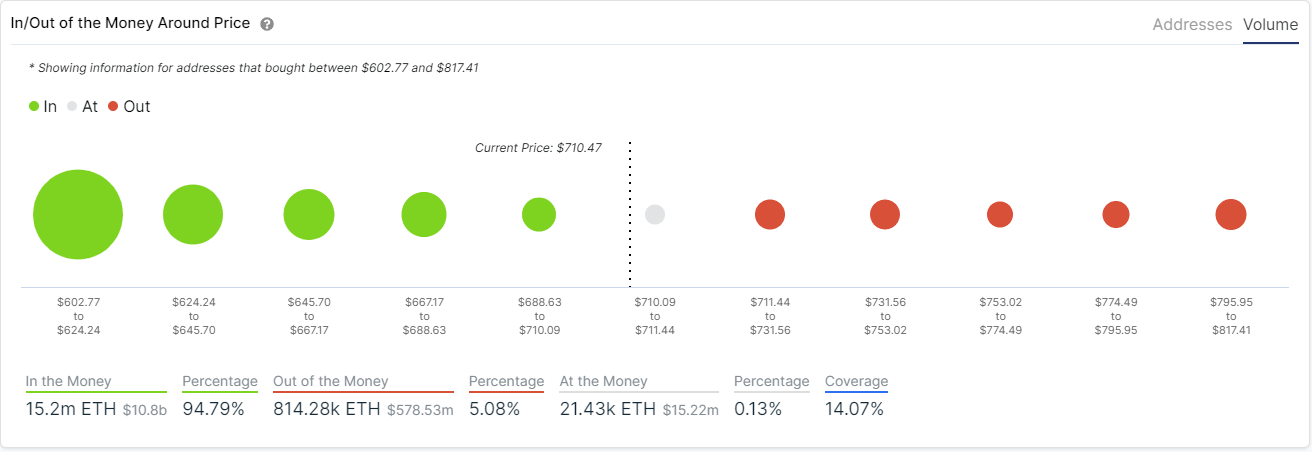

The In/Out of the Money Around Price (IOMAP) chart shows virtually no resistance above $700 with perhaps the most significant area between $795 and $817. There is, however, a significant amount of support located at around $600.

ETH IOMAP chart

While most signs indicate that Ethereum price is ready to climb even higher, the TD Sequential indicator is on the verge of presenting two sell signals on the 4-hour chart and the 12-hour charts.

Confirmation of both signals could potentially push Ethereum price below the psychological level at $700 and in the worst-case scenario down to the critical support area between $602 and $624.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637447749720545297.jpg&w=1536&q=95)

%2520%5B18.50.47%2C%252028%2520Dec%2C%25202020%5D-637447749784769343.png&w=1536&q=95)