Ethereum’s low volatility and bullish on-chain metrics hint at potential ETH price rally

- Ethereum volatility has declined to a record low level.

- Ethereum’s on-chain metrics have flipped bullish, signaling an upcoming price rally.

- ETH price holds above the $1,800 level after wiping out US CPI gains.

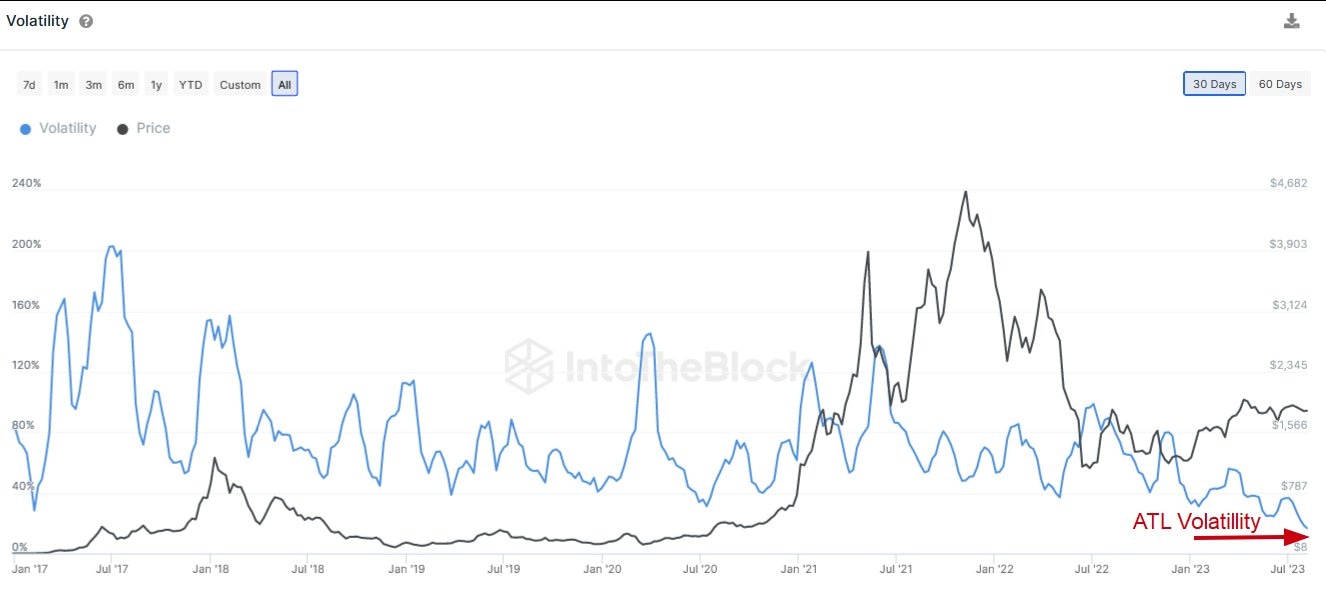

Some of Ethereum’s on-chain metrics have flipped bullish recently, at a moment when the volatility of the altcoin’s price has hit a record low, according to data from IntoTheBlock. This combination of factors is likely to lead to an upward rally in the short term, as periods of low volatility, which usually don’t last longer than a month, are typically followed by a price spike in either direction..

Ethereum volatility hits record low alongside bullish on-chain metrics

Based on data from crypto intelligence tracker IntoTheBlock, Ethereum’s price volatility has declined to a record low. Typically, periods of decreasing volatility lead to higher adoption of the asset among holders. Still, the levels seen at the time of writing are extraordinarily low.

Ethereum volatility as seen on IntoTheBlock

The MVRV ratio, or Market Value to Realized Value, is an on-chain metric obtained by dividing the asset's market capitalization by its realized capitalization.

The higher the MVRV ratio, the more people will be willing to sell as the potential profits increase. The value of MVRV gives an idea of how much overvalued or undervalued an asset is. For Ethereum, the current value of Ethereum’s MVRV ratio indicates that ETH is undervalued as of August 11, according to data from Santiment

MVRV ratio for Ethereum as seen on Santiment

There are additional metrics which signal an upcoming price rally. The supply of Ethereum held on exchanges has steadily declined since May, and the supply of the altcoin held by whales – or large wallet investors – has risen in the same period.

These metrics are likely to act as bullish catalysts for Ethereum price since a low supply of tokens deposited into exchanges can be seen as a sign of increasing buying pressure and whale accumulation hints at potential increase in prices.

In mid-July 2023, there was a surge in Ethereum whale accumulation, for the first time since the Shapella upgrade. Whales scooped up Ether at discounted prices, anticipating a rally in the altcoin in the coming months.

Supply held by top addresses and supply on exchanges vs price

Ethereum price has sustained above the $1,800 level after US CPI and PPI data releases for July. At the time of writing, ETH is trading at $1,848.51.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B16.08.16%2C%252011%2520Aug%2C%25202023%5D-638273599966683146.png&w=1536&q=95)

%2520%5B16.09.12%2C%252011%2520Aug%2C%25202023%5D-638273601279782460.png&w=1536&q=95)