Shiba Inu rallies on rising social volume as traders shift their focus to meme coins

- Bitcoin and altcoin prices shook gains from US CPI data and traders have shifted their focus to meme coins.

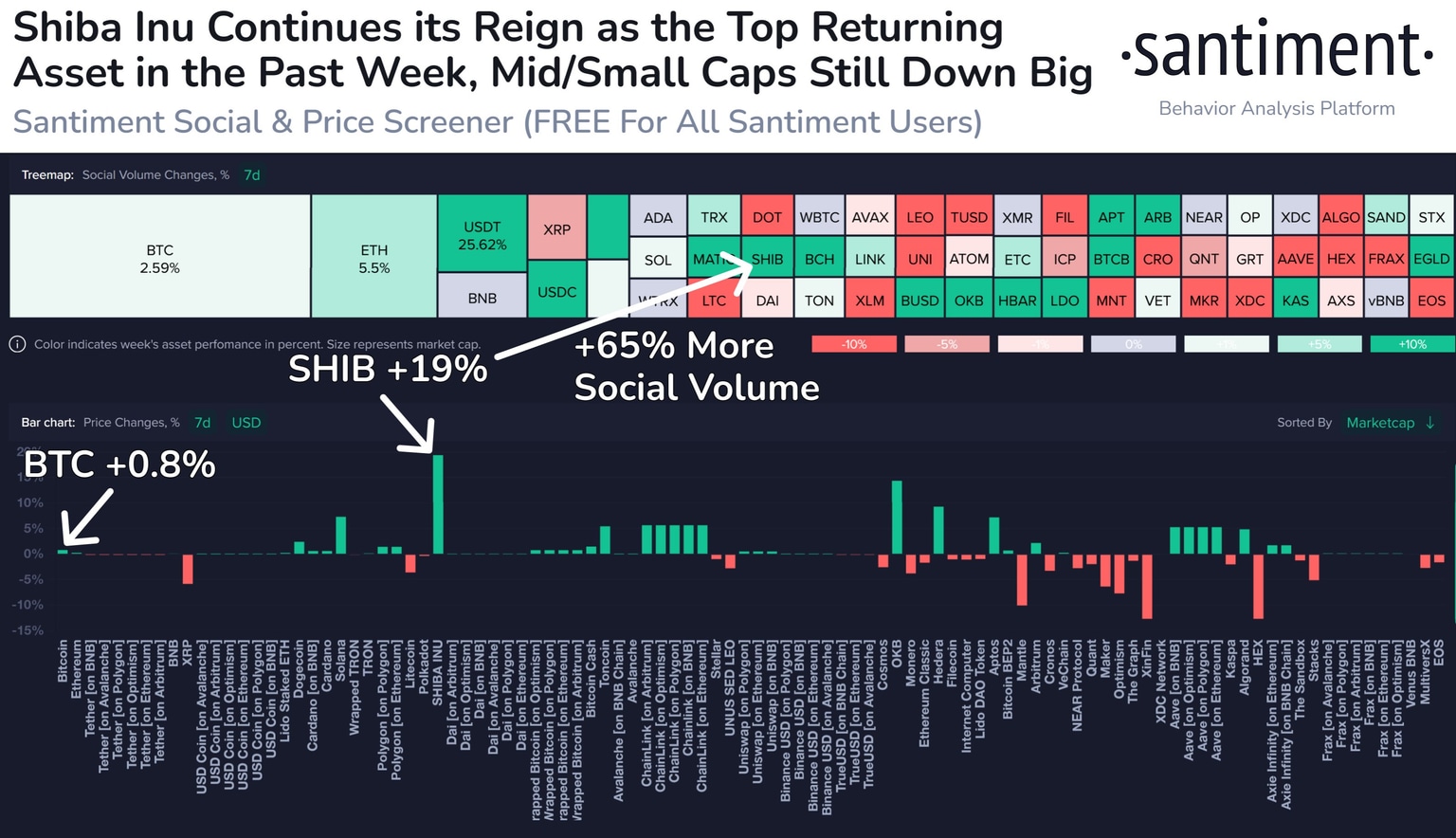

- Shiba Inu’s social volume increased 19% over the past week, pointing at increasing interest from market participants.

- SHIB price is up 15.3% since the start of the week, extending the meme coin’s upward trajectory since June.

Shiba Inu, one of the largest meme coins in the crypto ecosystem, garnered higher interest this week as traders shift their focus from large market capitalization assets like Bitcoin to altcoins, specifically meme coins, which appear to have potential for double-digit gains.

While mid and small market capitalization altcoins are still struggling to gain traction, Shiba Inu price has rallied, yielding more than 15% gains since Monday.

Shiba Inu on-chain metrics paint bullish picture for SHIB price

Shiba Inu’s three key on-chain metrics– the volume of daily active addresses, social dominance and social volume – suggest further upward momentum for SHIB price, according to data from crypto intelligence tracker Santiment.

The rising volume of addresses active in the SHIB network since August 7 fuels a thesis for a prolonged rally in the meme coin. Meanwhile, social dominance and volume are indicators that measure the relevance of the meme coin and the interest it generates among traders in the ecosystem. The two metrics have been in an uptrend since the beginning of the week.

Shiba Inu social volume spike, according to Santiment data

The social volume when compared to other altcoins and meme coins shows one of the largest spikes over a 7-day timeframe. Similarly, daily active addresses and social dominance climbed, as seen in the chart below.

Shiba Inu daily active addresses, social dominance and price

Shiba Inu price gains 15.3% this week

Shiba Inu price rallied from $0.00000876 on Monday to $0.00001011 at the time of writing. The meme coin’s price yielded double-digit gains for holders while traders remained indecisive this week, with key macroeconomic data releases such as US inflation data for July and the confirmation that the US Securities & Exchange Commission seeks to appeal the ruling on Ripple’s XRP token.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B13.22.32%2C%252011%2520Aug%2C%25202023%5D-638273391169226113.png&w=1536&q=95)