Ethereum’s liquidity crisis will make ETH a safe haven asset

- Ethereum could position itself as a safe haven asset as the network moves toward the upcoming London upgrade.

- Ether supply has been steadily decreasing since mid-2020, causing a liquidity crisis for the second-largest cryptocurrency by market capitalization.

- ETH price could exceed current price predictions as it becomes a deflationary asset.

Bitcoin has emerged as a rival to gold and established itself as a safe haven asset. The “digital gold” has gained popularity as central banks started to print massive amounts of cash to cope with the economic impact of the pandemic. Unlike Bitcoin, Ethereum lacked the appeal of its value – until the London upgrade.

Ether anticipates London upgrade

With the multi-faceted capabilities that the Ethereum network provides, from smart contracts to non-fungible tokens, it comes as no surprise that the ETH has not had a central narrative to take hold that is similar to Bitcoin’s.

As Ethereum anticipates its London upgrade scheduled in July, a new narrative could emerge as EIP-1559 could mean ETH could become deflationary. The upcoming upgrade will change Ethereum’s monetary policy, which could bring new light into valuing the second-largest digital currency by market capitalization.

The London hard fork marks a significant milestone in the Ethereum Network on its way toward “Serenity,” or ETH 2.0. Although Ethereum 2.0 and its transition towards proof-of-stake will take some time, the network upgrades including EIP-1559 will occur during the London upgrade.

The Ethereum Improvement Proposal 1559 will introduce a fee burn model for each transaction, adding a deflationary element to Ether, and increase its appeal as a safe haven asset.

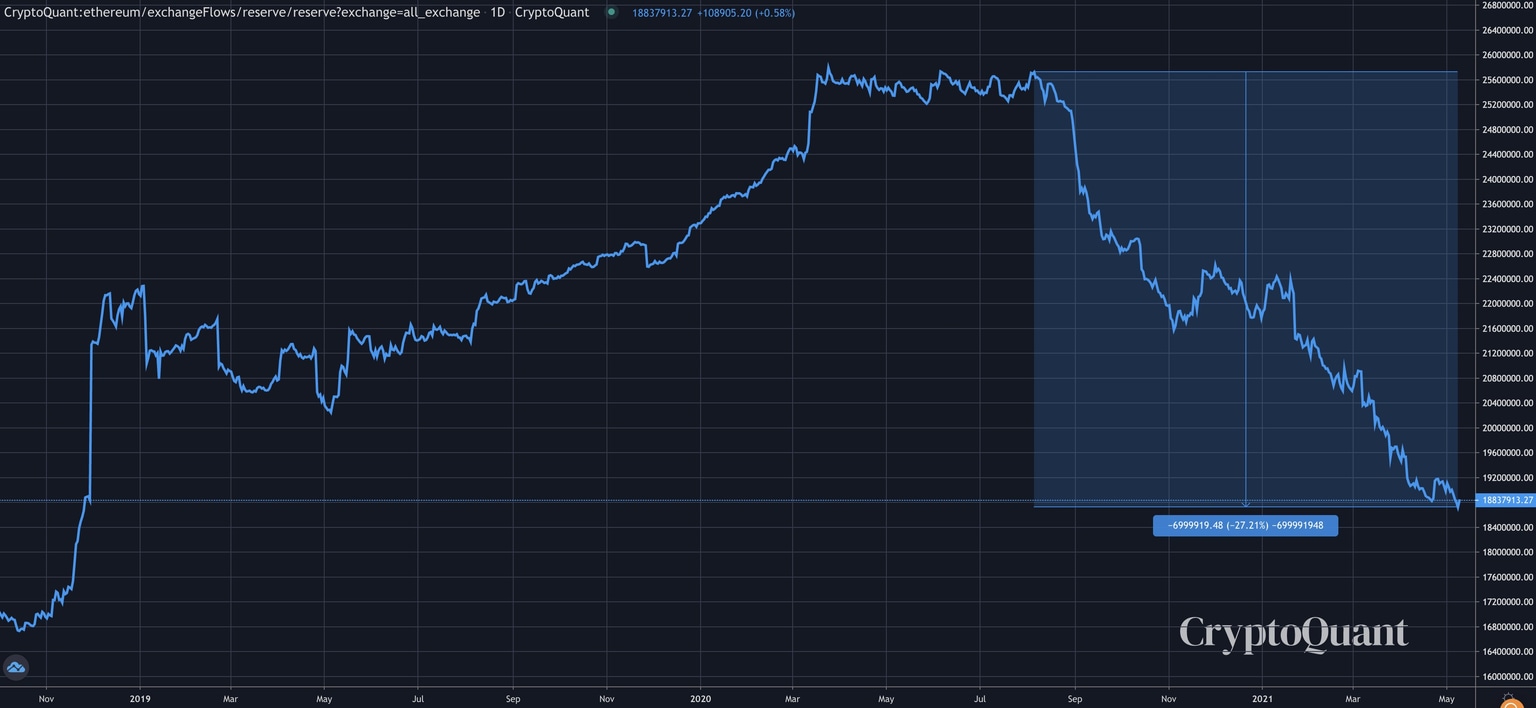

Ether liquidity has been steadily decreasing on exchanges over the past year, with over 27% less ETH seen compared with a year ago.

Ethereum supply on exchanges

The available ETH in the market is additionally becoming less liquid, with 4.5 million on Ethereum 2.0, 10.1 million in DeFi protocols and 3.2 million in Grayscale. With ETH a lot less liquid currently compared to the last bull cycle, the narrative that arises is that the low liquid supply could take Ether price to new highs beyond existing price predictions.

While Bitcoin has already taken off as a safe haven asset with a high premium, ETH could be on the same trajectory with the new deflationary outlook.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.