Ethereum Weekly Forecast: ETH/USD bullish case to $500 delayed, not impossible

- Ethereum 2.0 is hard to implement than was expected from a technical perspective.

- Safex Platinum, is a new blockchain protocol that plans to steal the DeFi spotlight from Ethereum.

- Filecoin reports that Ethereum Improvement Proposal (EIP) is doing a good job in the trial.

- Ethereum price inclined to consolidate under $400 ahead of a potential breakout to $500.

Ethereum has spent the entire week trying to hold above $400. However, despite the efforts by the bulls, the second largest cryptocurrency has plunged to $370 twice this week. The first recovery massively lifted ETH/USD to $411. This significant price action was, however, short-lived mainly due to the lack of enough volume.

Increased selling activities occurred, forcing Ethereum not only below $$400 but back to $370. At the time of writing, Ether is still battling the resistance at $390 as discussed in the price prediction published on Friday.

Industry Overview: Can Ethereum sustain DeFi in the long term?

The decentralized finance (DeFi) ecosystem’s meteoric growth has in a way highlighted the limitations of Ethereum as its core protocol. Moreover, the mishaps experienced with the development of ETH 2.0 have only made matters worse. Industry participants, especially those involved directly with DeFi have started to worry that Ethereum will not support the ballistic growth of the ecosystem.

For instance, the network is clogged, leading to high gas fees and longer transaction processing time. The Ethereum 2.0 upgrade is supposed to be the answer to these challenges but the situation at the moment hints that the ride ahead will not be an easy one.

Safex Platinum plans to steal Ethereum’s DeFi limelight

Owing to the above challenges, DeFi participants are beginning to look for alternative for their projects in a bid to hedge against the struggling Ethereum network. One such project is Safex Platinum. Safex Platinum is a fork of the privacy oriented Monero and is working on revolutionizing lending, earning and spending cryptocurrency. If successful users will have access to instant, zero interest, pay-back-free private loans. Borrowed funds will be paid out in Safeth Cash, the protocols official currency and can either be traded on decentralized exchanges (DEX) or spent on the platforms official marketplace.

Snowfork develops DeFi Bridge between Ethereum and Polkadot

A new project is underway and seeks to bridge the gap between Ethereum and Polkadot to ensure that smart contract instructions are directly relayed between the two platforms. The firm building the bridge is referred to as Snowfork. The initial phase will allow the transfer of Ethereum (ETH) and the ERC-20 tokens to Polkadot blockchain. Intriguingly, the it’s a two way bridge, “anything you can do in one direction, you can do it in the other.”

Market Overview: Filecoin speeds up work on the restructure of ETH fee structure

One of the biggest challenges Ethereum network is facing at the moment is skyrocketing gas fees. The good news is that Filecoin network, is testing the Ethereum Improvement Proposal (EIP), a solution that has been proposed to be used in tackling the high transaction fees. Filecoin is a decentralized storage protocol still in its testnet phase. A tweet by Jerome Johnson which was highlighted by Vitalik Buterin on August 27 announced that the testing of EIP-1559 has been productive so far.

In case you missed it: recent writing on fee market reform (EIP 1559)

— vitalik.eth (@VitalikButerin) August 26, 2020

* My FAQ: https://t.co/E9JvIUkazS

* @MicahZoltu on safety: https://t.co/uNOEqSDNxV

* @bluepintail on fairness: https://t.co/bJYJSR1b0o

Oh and it seems to be working great on filecoin:https://t.co/sgWLPF1VXg

Ethereum 2.0 is much harder to implement – Vitalik Buterin admits

In a recent podcast with Peter McCormack, the co-founder of Ethereum, Vitalik Buterin admitted that working on the much-anticipated Ethereum 2.0 upgrade “is much harder than we expected to implement from a technical perspective.” He however, insisted that nothing nerve-shattering has been discovered that could make the upgrade impossible.

I definitely freely admit that Ethereum 2.0 is much harder than we expected to implement from a technical perspective. I definitely don’t think that we discovered any fundamental flaws that make it impossible, and I do think it will be finished. It’s just a matter of time, and it’s actually been progressing quite quickly lately.

Ethereum Technical Analysis: ETH/USD bullish case to $500

Ethereum failed to rally to $500 despite the magnificent price action in August. With just a few days to the end of the month, I wonder if Ethereum can pull up its socks for the ultimate approach to this level.

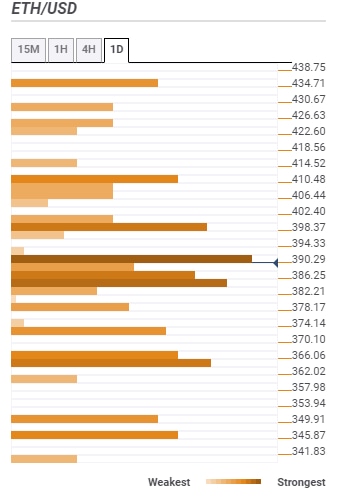

Meanwhile, Ether is trading at $388 after a shallow recovery from $370 (discussed earlier). The confluence detector tool highlights a couple of key resistances at $390 and $398. A break above the second hurdle at $398 is likely to boost ETH massively above $400. However, it is essential to realize that more seller congestion zones await the second-largest crypto including $410, $420 and $450.

According to the prevailing technical picture, Ethereum could remain in consolidation in the coming sessions (weekend included). Significant gains above $400 are projections of the coming week. It makes sense to keep an eye on the RSI (currently leveling at the midline) and the MACD (still diving towards the negative territory). What is apparent is that a break above $390 and $398 is bound to encourage more buyers to join the market, thereby relaunching Ethereum’s mission of hitting highs above $500.

ETH/USD daily chart

%20(92)-637342034619625214.png&w=1536&q=95)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren