Ethereum tokens worth $3.1 billion moved on the blockchain as traders brace for incoming selling pressure

- Ethereum circulation exceeded 1.73 million tokens on Tuesday, hitting a three-month high in the on-chain metric.

- ETH worth $3.1 billion was moved across exchange wallets amidst rising selling pressure from the SEC’s lawsuit against Binance.

- Ethereum whales are likely moving ETH holdings to self-custody.

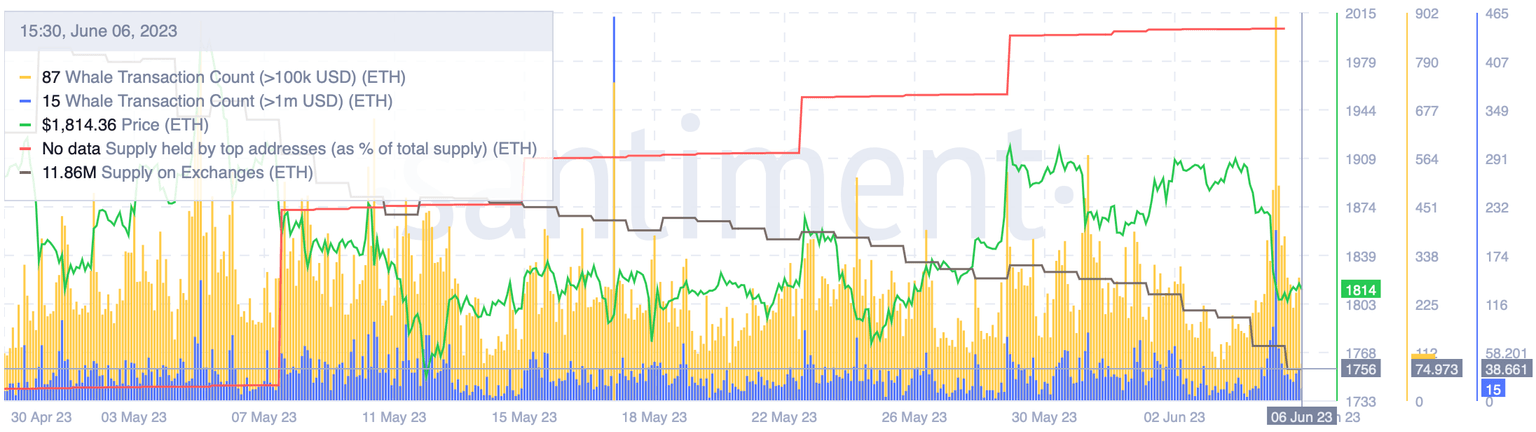

Ethereum circulation climbed to 1.73 million tokens on June 6, signaling a rising utility of the altcoin. A large volume of Ethereum’s supply has moved off exchanges, likely to self-custody wallets, alongside the Securities & Exchange Commission’s (SEC) crackdown on Binance.

Also read: Ethereum exchange supply hits multi-year lows, VanEck analysts predict a rally to $11,800

Ethereum tokens in circulation hit a three-month high

The volume of Ethereum tokens in circulation has climbed to a three-month high following the SEC’s crackdown on Binance. A rise in circulation of an asset is typically considered a bullish sign for the asset. However, in Ethereum’s case it remains to be seen how this on-chain metric influences ETH price performance.

In a recent YouTube video, analysts at Santiment evaluated Ethereum’s on-chain metrics to identify where the altcoin is headed next.

Moreover, $3.1 billion worth of Ether was moved across exchange wallets by large wallet investors and retail traders on the network. The altcoin’s supply on exchanges reduced from 11.95 million to 11.86 million overnight.

Ethereum supply on exchanges

Both circulation and supply on exchanges paint a bullish picture for Ethereum. The US financial regulator’s crackdown on the SEC has increased the selling pressure on assets within the crypto ecosystem.

However, Ethereum continues to tackle the same market with a dwindling supply on exchanges and rising circulation of ETH tokens. This is another metric that fuels a bullish thesis for the altcoin’s recovery, despite the SEC’s crackdown on crypto.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.