Ethereum staking gets hot ahead of Shanghai upgrade, ETH turns deflationary again

- Ethereum staking activity increased closer to the Shanghai upgrade and subsequent staked-ETH unlock.

- Total value staked in ETH2.0 deposit contract hit a new all-time high of 16,042,407 tokens, in an upward swing.

- On-chain indicators like whale activity on the Ethereum network corroborate the growing interest among traders and the community.

Ethereum staking, which involves locking ETH tokens in a deposit contract and earning the opportunity of validating transactions and yielding the altcoin as a reward, has increased ahead of a major event for the altcoin: the Shanghai hard fork, which could happen in March 2023.

The Shanghai hard fork will involve a series of upgrades that are expected to improve the transaction speed, security and efficiency of the blockchain as well as lead to the unlocking of newly minted ETH from the beacon chain. The upgrade is the first of its kind since staking went live in November 2020.

Also read: Ethereum short traders could profit on one condition ahead of ETH Shanghai upgrade

Ethereum staking sees rise in popularity ahead of Shanghai upgrade

Ethereum staking has been viewed as a popular method to pull ETH tokens out of the circulating supply, reducing selling pressure across exchanges, with holders in turn benefiting from the yields and rewards from stakes held in the ETH2 deposit contract. When developers announced the unlock of staked ETH tokens following the Shanghai hard fork, experts suspected that staking would lose its popularity in the community.

However, staking activity witnessed an upswing instead, with Total Value Staked (TVS) in the deposit contract hitting a new all-time high of 16,042,047 ETH tokens, on January 15. The rise in TVS shows the ETH community is willing to pour more tokens into validators and yield rewards ahead of the unlock in 2023. The Shanghai upgrade bundled with its Ethereum Improvement Protocols marks a key milestone in Ethereum’s developmental journey and the ETH community is closely watching the event for predicting the future of ETH’s price trend in 2023.

A minimum of 35,000 ETH will be unlocked post the Shanghai hard fork, worth $55.07 million shortly after the upgrade. It remains to be seen how the unlock event will influence the largest altcoin network but increased supply is usually a negative for the price of any asset, which for ETH currently sits at $1541.

On-chain indicators signal rising interest from whales

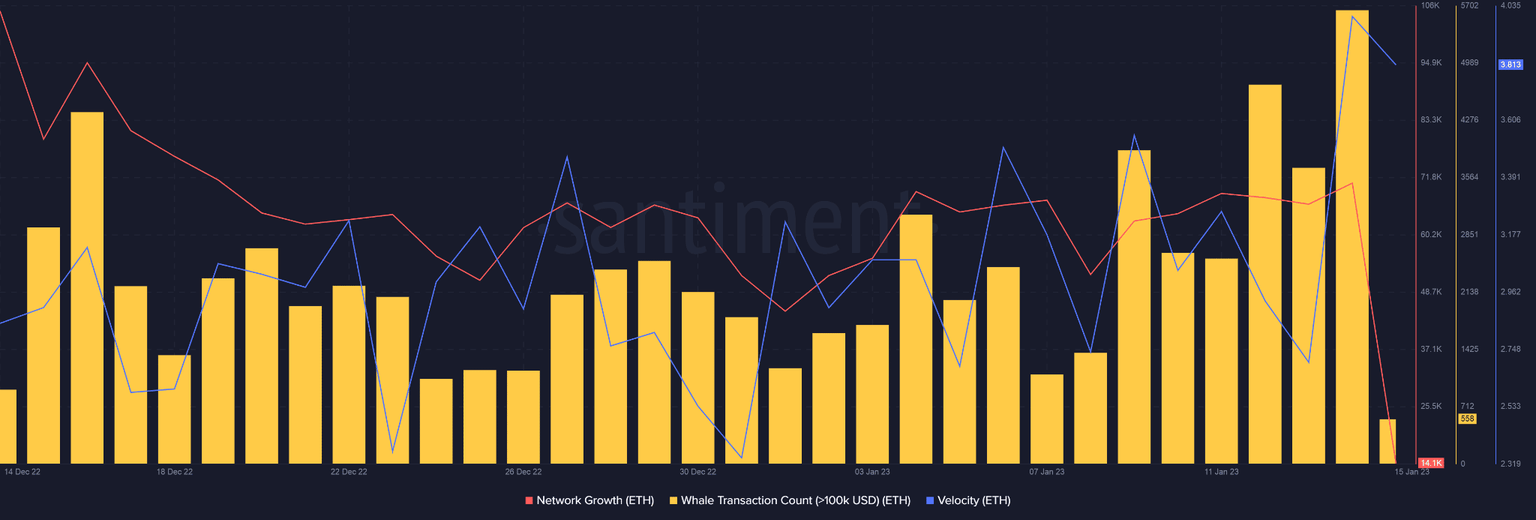

Large wallet investors and their activity is typically considered key to an asset’s price trend. A spike in large volume transfers could intensify selling pressure on the second-largest cryptocurrency in the ecosystem. Whales on the Ethereum network increased their activity; a sharp uptick was noted with a 30% month-on-month increase in large volume transactions on the ETH blockchain.

ETH Whale Transaction Count

As seen in the chart above, data from crypto aggregator Santiment reveals a massive increase in whale transactions, with activity on January 14, 2023 reaching above $100,000 for the first time in over a month. This trend could be balancing out the benefits to ETH price of increased staking, which reduces the supply of available ETH.

Ethereum turns deflationary overall

Despite the increase in whale activity possibly boding ill for ETH price, Ethereum’s overall fundamentals have strengthened during the tumultuous events of 2022. For example, one positive fundamental factor, according to the Ultrasound Money tracker, has been a fall in the net issuance of the altcoin, which has fallen into deflationary territory once again. This fuels ETH holders with hope that the supply will further decline, directly influencing the asset’s price. In 2023, when ETH supply is expected to decline at the rate of -1.09%.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.