Ethereum “Shanghai” hard fork set for March 2023, enabling users to withdraw their staked ether

- Ethereum developers confirmed EIP 4895, which will allow for staked ether’s withdrawal, will also be implemented simultaneously.

- Ethereum development team also discussed another hard fork in 2023, targeted to improve the network’s transaction handling capacity.

- Ethereum price reacted positively, rising by over 5.01% in the last 24 hours to climb to $1,279.

Ethereum is seemingly in a development streak ever since the network first experienced its biggest upgrade this year. The Merge, initiated the transition of the network from Proof of Work (PoW) to Proof of Stake (PoS), is set to be pushed further with “Shanghai”. This hard fork will bring a crucial upgrade to the network that has been missing for months now.

Ethereum to bring more than one hard fork in 2023

While, on the one hand, the crypto space still hasn’t completely moved on from the Merge, Ethereum developers, on the other, are moving towards the next big upgrade. As per discussions during the 151st Ethereum Core Developers Meeting on Thursday, “Shanghai” has received a tentative date.

“Shanghai” is the name of the next major Ethereum Improvement Proposal (EIP) - 4895, the hard fork which will continue the Merge’s journey. Set to arrive in March 2023, the “Shanghai” hard fork will enable the network to finally handle the staked ether’s (stETH) withdrawal. This option has been missing on the network despite close to 3.4 million stETH worth almost $4.48 billion being locked on Ethereum’s beacon chain.

Working in a structured manner allowed the upgrades to be simple and enabled the developers to ensure a successful transition to PoS. In line with the same, Ethereum is set to go through another hard fork sometime in the third quarter of 2023.

The EIP 4844 has been targeted at improving Ethereum’s capacity to handle more transactions. The developers would ascertain this through a new form of transaction known as “shard blob”.

This would allow for the data to be stored off-chain and also improve the capacity of rollups by up to 100x. The upgrade, known as EIP 4844, will introduce proto-danksharding and push the network further.

Ethereum price on a rise

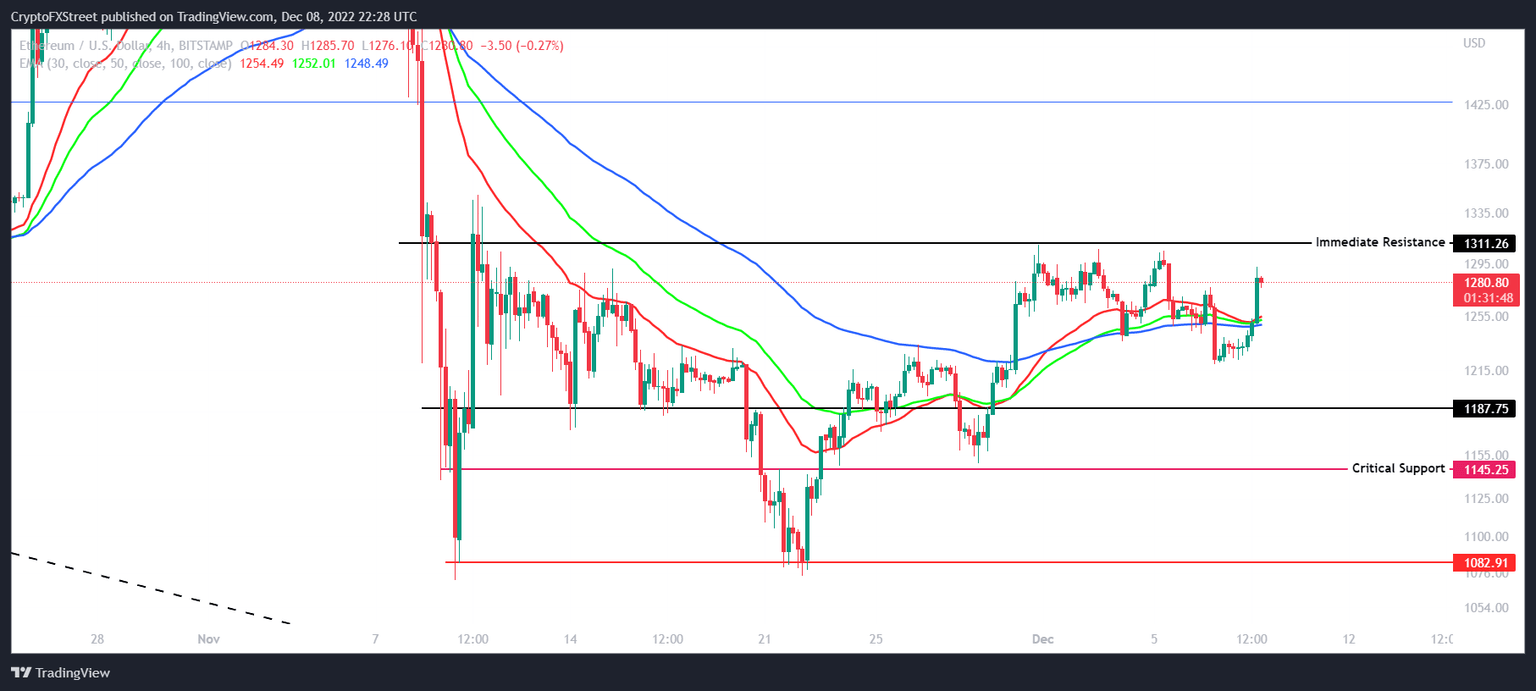

Ethereum price has registered a 5.01% increase in value over the last 24 hours, bringing the market price to $1,282. The second biggest cryptocurrency in the world inched closer to tagging its immediate resistance at $1,311.

If the upswing continues over the next 48 hours, the $1,311 would be flipped into a support floor, opening up the opportunity for a run-up to $1,426. Breaching this level would result in an 11.2% rally for the Ethereum price. The chances of an uptick are significantly stronger at the moment as ETH also has the support of the 30, 50 and 100-day Exponential Moving Averages (EMAs).

ETH/USD 4-hour chart

But if the bears take control and Ethereum price declines, a retest of the $1,187 support level could take place. Slipping below this level would take ETH to $1,145, and a daily candlestick close below the critical support would invalidate the bullish thesis. Consequently, the altcoin will end up tagging the monthly lows of $1,082.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.