Ethereum price rally continues despite drop in mining profitability

- Miners on the Ethereum network witnessed a decline in profitability as the price of Ethereum slumped in the recent crypto bloodbath.

- Electricity consumption of some of the largest cryptocurrency networks dropped by as much as 50% as miners were forced to shut shop.

- Ethereum price witnessed a trend reversal and analysts predict a continuation of ETH uptrend.

Ethereum price rally continues despite the drop in mining profitability. With the decline in Ethereum mining profitability, electricity consumption dropped as nearly 50% of miners were forced to shut shop and stop their operation.

Miners dropped off the Ethereum network as profitability declined

The recent crypto bloodbath resulted in a spike in overhead costs for miners. Miners on the Ethereum network, faced hardships as Ethereum price plummeted in the recent crypto bloodbath. With a decline in electricity consumption, experts predicted that miners are pulling out of the two large cryptocurrency networks- Bitcoin and Ethereum.

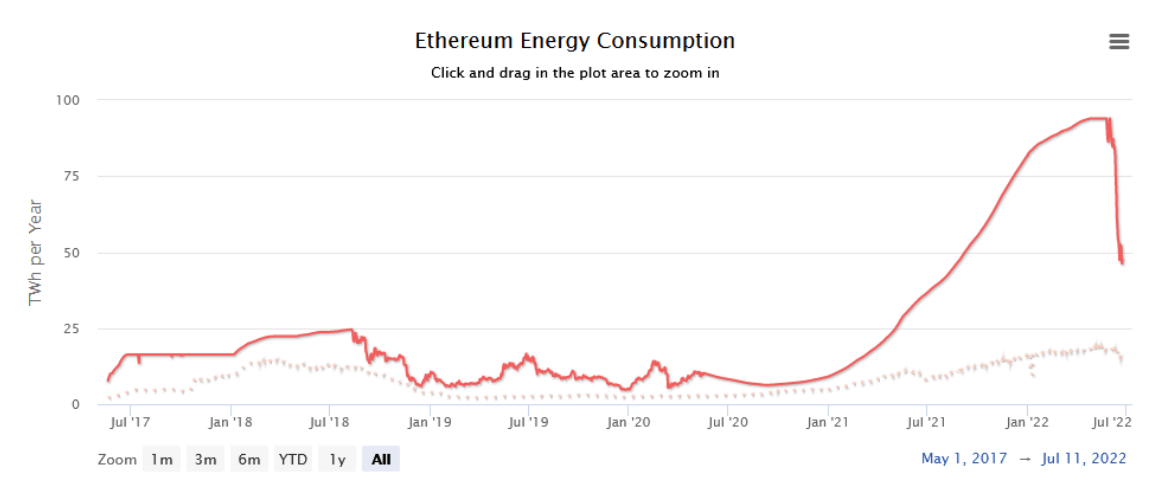

On May 23, electricity consumption on the Ethereum network was 93.98 TW/h and there was a steep decline soon after. The network’s electricity consumption has declined nearly 50%, to 47.43 TW/h in the past month.

Energy consumption on the Ethereum network

Ethereum price witnesses trend reversal, breaks out in a rally

Based on the daily Ethereum price chart, analysts at Inside Bitcoins noted that ETH recently crossed above the 21-day moving average and the next resistance is at $1,400. This could open doors for increase to $1,600 level and analysts have set bullish targets at $1,800, $2,000 and $2,200.

Analysts have predicted a climb towards the upper boundary of the channel, and predicted a continuation of Ethereum price uptrend.

ETH-USD price chart

FXStreet analysts have identified the upside target for Ethereum price in the current uptrend. For more information, watch this video.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.