Ethereum price prediction is uncertain as censorship declines bolstered by new relayers

- Ethereum censorship problems are on a downtrend, with only 66% of the blocks in the network being OFAC-compliant.

- Four non-censoring relayers, including Agnostic, Relayoor, Ultrasound and Aestus, make it into the network as validators.

- Ethereum price holds firmly to crucial triangle support to hold off declines below $1,000.

Ethereum’s (ETH) censorship concerns have, since the Merge, increased exponentially, with validators keen on complying with regulatory requirements. Validators verify transactions on proof-of-stake (PoS) networks like Ethereum, Cardano and Solana.

Crypto enthusiasts find it utterly disturbing, especially with blockchains claiming to be censorship-resistant, complying with asset control regulations. Ethereum has, in particular, been at the center of the discussion with Martin Koppelmann, the CEO of Gnosis Safe, reckoning that there is a reason for worry.

According to an insight that first appeared on Valid Points, a newsletter dedicated to dissecting the Evolution of Ethereum, censorship has declined over the last few months. The news comes as Ethereum core developers work around the clock to meet the deadline for the Shanghai Upgrade – hopefully before the end of the first quarter of 2023.

Ethereum’s censorship problems are on a downward trend, but what does this mean?

Over the last 24 hours, 66% of all the blocks coming into the Ethereum blockchain complied with the Office of Foreign Assets Control (OFAC) requirements. This means validators of these blocks did not process any transaction flagged by the United States Treasury.

The issue of censorship is not black and white – there are some grey areas. What some people call compliance, others refer to it as censorship. Overall, it impacts the Ethereum network, especially when transactions take too long to process.

On the bright side, the tide may finally turn with a steady decline in censored blocks. Blockchain data shared by mevwatch.info, a platform monitoring censorship on the Ethereum network, 79% of all the blocks on the PoS blockchain were OFAC compliant. Since then, this figure has declined but danced between 9 77% on November 28 and 64% on December 9.

So, who is behind the drop in OFAC-compliant blocks?

Over the last few months, validators have been outcrying to find new ways to furnish their blocks into the Ethereum blockchain. Their effort has seen the emergence of four new network relayers, providing an alternative to the usual Maximal Extractible Value (MEV)-Boost.

According to Coindesk, blocks relayed through the MEV-Boost have decreased by 7% since October 14 to 74%. The drop may be attributed to new non-censoring relayers coming into the business, including Agnostic, Relayoor, Ultrasound and Aestus.

— GnosisDAO (@GnosisDAO) November 30, 2022

We are proud to release two new relays as the Gnosis and @ultrasoundmoney communities.

Agnostic Relay Ultra Sound Relay

https://t.co/DDCKJwiUBQ

https://t.co/YCBQ6JxOvo

Details below pic.twitter.com/kHVHBh9MIS

The Agnostic relay is a brainchild of the team behind Gnosis Chain. The platform’s co-founder, Stefan George, believes this is the right step toward making Ethereum a “credibly neutral platform.”

The decline in censorship could have stemmed from validators becoming open to new relayers. About 20% to 25% of all processed blocks now come from non-censored relayers, which may continue to increase.

Ethereum price recovery still in jeopardy

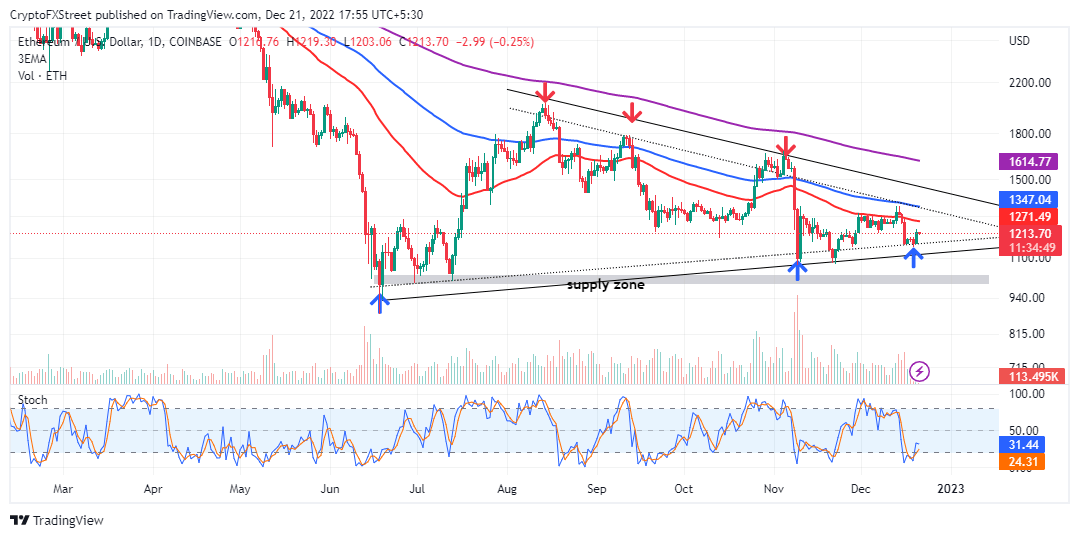

Ethereum price is trading at $1,210 following a bullish green candle from triangle support at $1,160. This rebound could have a reflex reaction to the oversold conditions due to last week’s sell-off, as observed with the Stochastic oscillator.

ETH/USD daily chart

However, that bullish momentum faded before Ethereum tagged a significant level like the 50-day Exponential Moving Average (EMA) (in red) and currently holding the ground at $1,271.

With the general crypto market conditions wobbling through various uncertainties, Ethereum price is unlikely to push out of the triangle pattern to the upside. Currently, the triangle support at $1,160 keeps bearish advances in check. However, if broken, ETH may drop below the next anchor at $1,100, ahead of another downstream move below the critical $1,000 level.

Read articles:

Ethereum Price Forecast 2023: The year of recovery towards $2,400

Polygon founder's Beacon accelerator to bolster Web3, bringing 1B users into the space

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren