Ethereum Price Forecast: Interpreting the current trading range

- Etheruem price rose by 4% following last week's 10% decline.

- ETH is 5% down on the month and trades below October’s trading range.

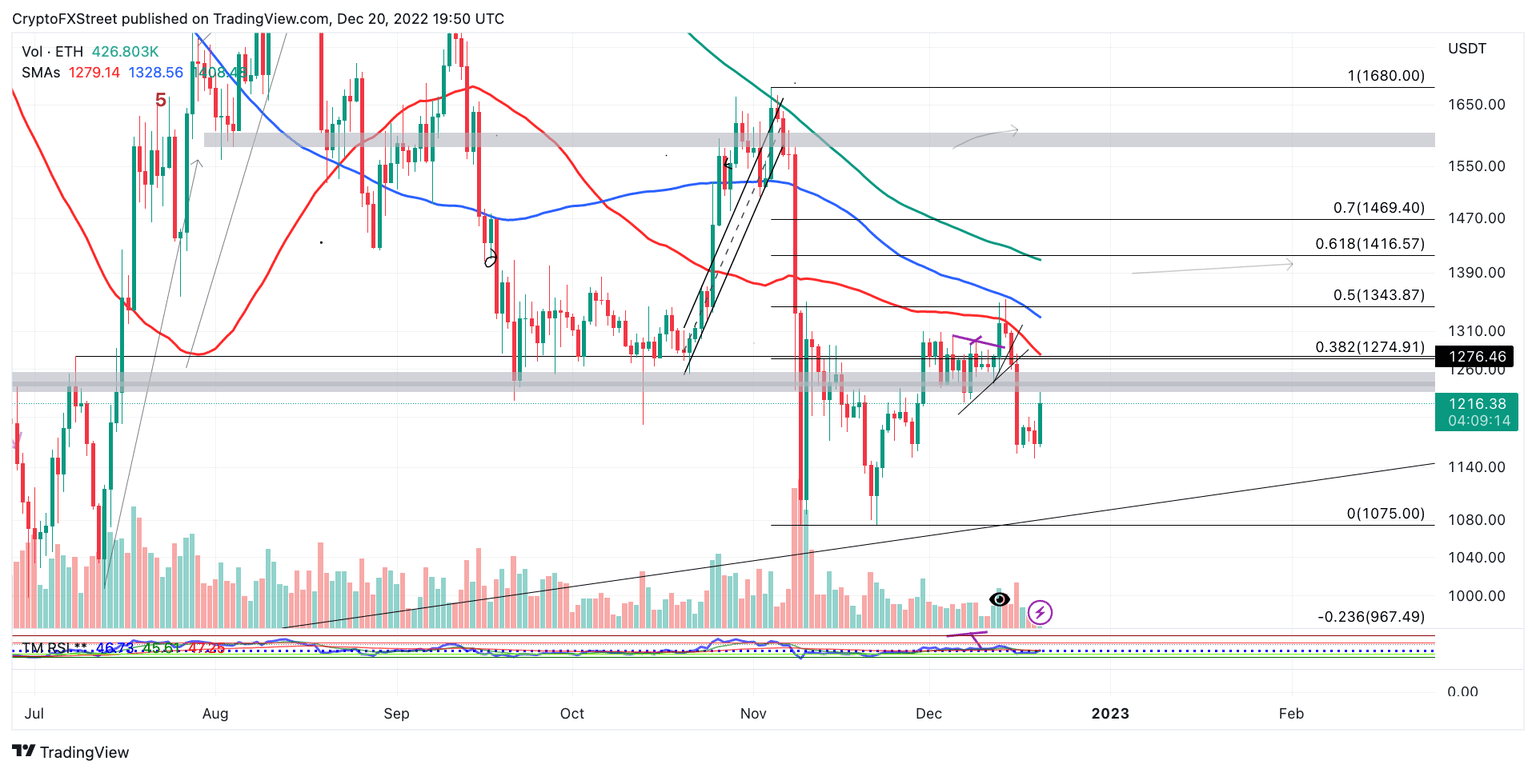

- A hurdle of the $1,250 zone is needed to justify aiming for $1400 and higher.

Ethereum price will be challenging to forecast as the bulls and bears spar over minute price fluctuations. Currently, the technicals lean bearish, but traders should be aware of the alternative scenario.

Ethereum price in indecision mode

Ethereum price is showing subtle signs of retaliation, but the bullish move needs time to decipher if there is potential for more gains. On December 16, the bears reconquered the shortterm narrative by producing a daily closing candlestick beneath the 8-day exponential and 21-day simple moving averages. Following the breach, the ETH price declined an additional 6% before bulls stepped in.

Ethereum price currently auctions at $1,212. The bulls prompted a 4% countertrend spike on December 20. The decentralized smart-contract token is now retesting the recently breached moving indicators, which has shorter time frame for traders hesitant to pull the trigger. Traders may also recall the low $1,200 barriers' significance as the zone supported ETH's October through November's 30% and 50% upswing moves.

Considering the scenario, a rejection from the barrier would wreak havoc on the Ethereum price as a classic breach and retest signal. The safest confirmation that the bears control the trend would be a breach of December 20's daily low at $1150.51. A second attempt at the low could induce a sweep of the lows event targeting the psychological $1000 price zone. The ETH price would decline by 13% if said price action were to occur.

ETH/USDT 1-Day

To play devil's advocate, Ethereum price is only down 5% on the month, and the countertrend surge shows bullish engulfing candle sticks on nearly all time frames. A piercing of the recently breached moving averages could send the ETH price back into October's trading range. The trading range high would be November's high at $1,680 and $1,40 being the halfway mark. ETH's ability to sustain support above the $1250 level would create the possibility to rally back into the midpoint of the range at $1400, resulting in a 15% increase from the current Ethereum price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.