Ethereum Price Prediction: ETH still in an uptrend but caution is justified

- Ethereum price is trading range-bound near $1,700, up 42% since January 1.

- The bulls could prompt a surge toward the mid-$1,800 liquidity zone.

- Invalidation of the bullish thesis would occur below $1,580.

Ethereum price has been consolidating within an overall uptrend, but there are signs of a potential trend reversal. Traders should exercise caution and implement effective risk management strategies before entering any trades on the ETH price.

Ethereum price is cooling down

Ethereum price is trading range-bound, giving traders time to consider which side of the market they want to join. The bulls have enjoyed six weeks of bragging rights as Ethereum is up 42% since January 1. However, the bears are showing credible evidence to believe a countertrend move is near.

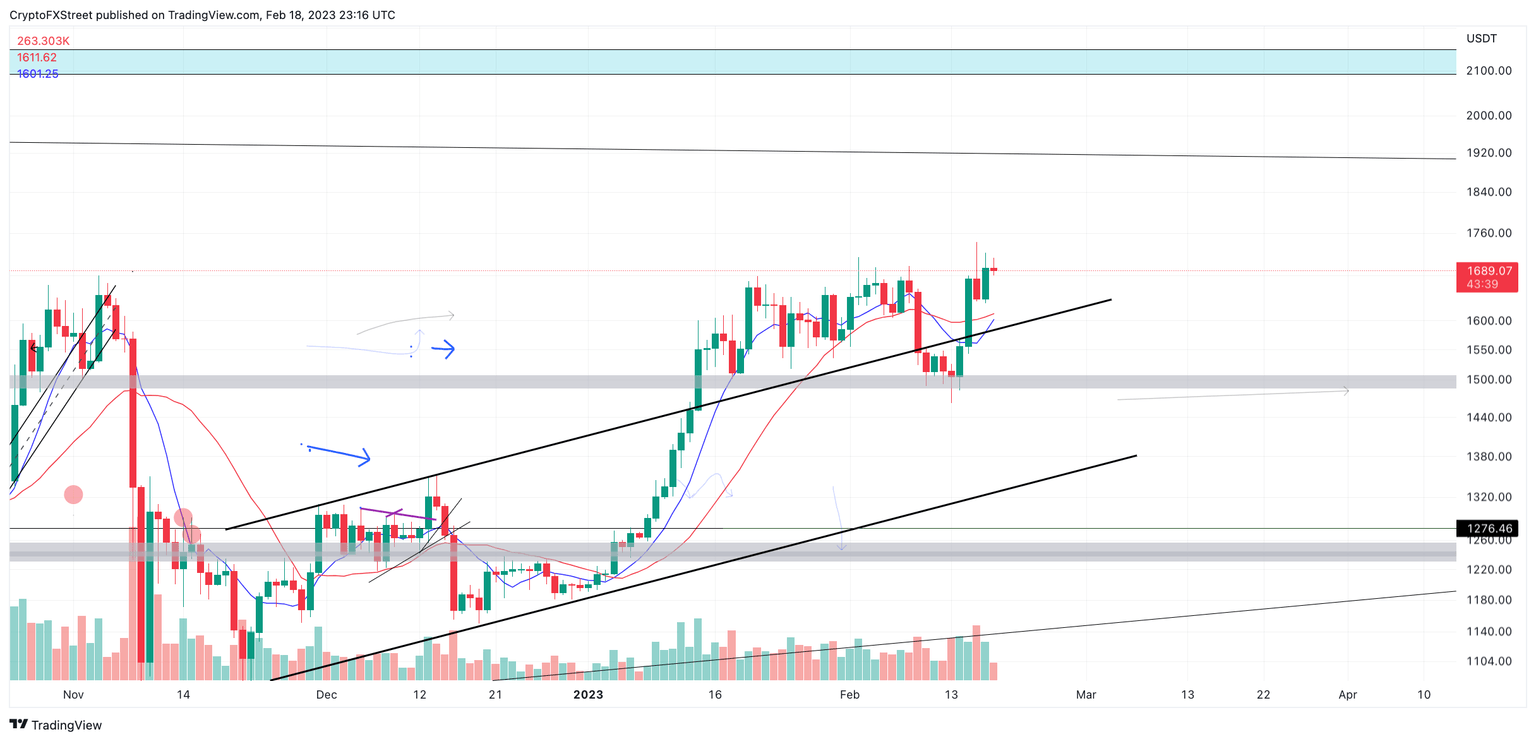

Ethereum price is currently trading at $1,684, as the bulls are experiencing resistance near the $1,700 zone. The Relative Strength Index (RSI) shows a bearish divergence with previous upswings near the $1,700 barrier and the mid-$1,600 zone’s highs that occurred earlier in the month. The RSI's divergence suggests the uptrend's underlying strength is waning,

Still, the uptrend remains intact as there is a compression of both the 8-day exponential moving average and 21-day simple moving averages. Compression usually occurs when an asset is subject to a volatile swing. In this case, since the ETH price is above the compressing indicators, the short-term bias for Ethereum is bullish.

Considering these factors, there is a fair chance that the mid-$1,800 liquidity zone may be tagged in the coming days. The bullish scenario creates the potential for a 10% increase from ETH’s current price.

ETH/USDT 2/18/22

However, the bullish thesis would be invalidated with a tag below the compressing indicators at $1,580. If the breach occurs, the ETH price could decrease towards the $1,265 support zone, resulting in 25% from Ethereum’s current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.