Ethereum price looks to retest $1,730 as the Merge edges closer

- Ethereum price saw a quick uptick in buying pressure resulting in a 9.8% upswing.

- A minor retracement to $1,500 seems likely before ETH targets $1,730.

- A daily candlestick close below $1,420 will invalidate the bullish thesis.

Ethereum price has witnessed a sudden influx of buying pressure after the recent sell-off. As a result, ETH has rallied quite a bit over the last 24 hours, an indication of the things to come.

Ethereum price straps in for a higher high

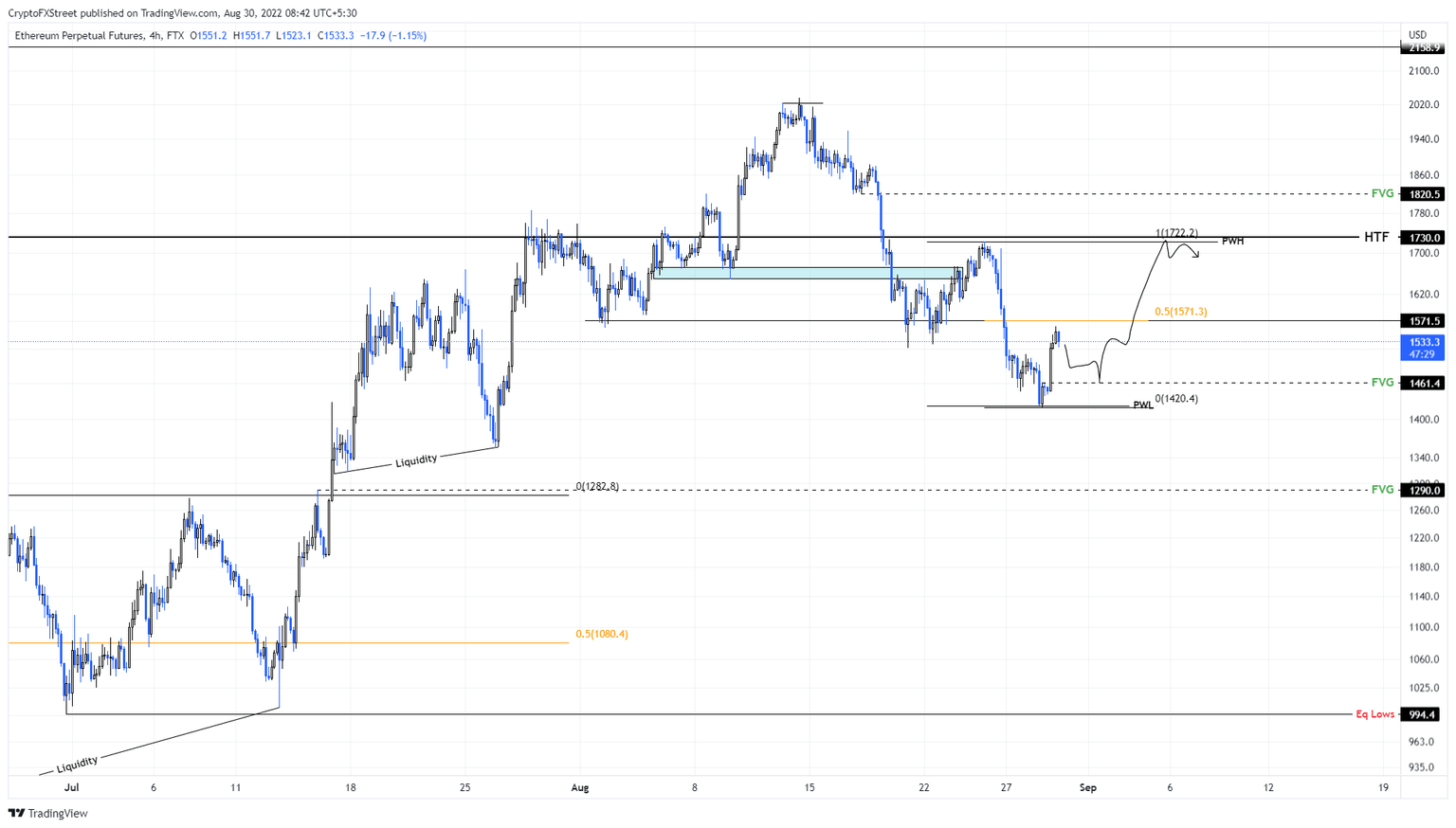

Ethereum price crashed 17% between August 25 and 29, falling from $1,722 to $1,420. The $1,420 swing low formed the bottom, causing the trend to shift. As a result, ETH rallied 9.8% in under 24 hours to set a swing high at $1,559.

While this uptick is impressive, investors should not FOMO but wait for a retracement to hop on the next leg. In this regard, the correction will likely bring Ethereum price to $1,500 or $1,485, which is the optimal zone for investors to get on the bullish bandwagon.

The resulting upswing will likely flip the midpoint of the recent crash at $1,571 and aim for the range high at $1,722. This move in Ethereum price would constitute a 16% gain and could potentially retest the $1,730 hurdle in the process.

ETH/USDT 4-hour chart

On the other hand, if Ethereum price fails to produce a higher low at $1,500 or $1,485 and continues to head lower, it will indicate a weak buying camp. In such a case, if Ethereum price produces a daily candlestick close below $1,420, it will create a lower low and invalidate the bullish thesis for ETH.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.