Ethereum Price jumps 7% as Vitalik Buterin releases ETH 2.0 deposit contract

- Ethereum price spiked to $408 within hours of Vitalik’s ETH 2.0 announcement.

- The long-awaited Ethereum 2.0 update seems to be scheduled for December 1, 2020.

Although it wasn’t officially announced at first, the deposit contract of Eth 2.0 was released quietly. This is the first physical implementation of the upgrade and comes with a countdown set for December 1, 2020.

ETH2 deposit contract released:https://t.co/bDrtf9vRpJ

— vitalik.eth (@VitalikButerin) November 4, 2020

Vitalik Buterin, creator of Ethereum, did eventually post a tweet stating that the ETH2 deposit contract was released, but didn’t add anything else. This deposit contract is the key to the upcoming Proof of Stake consensus protocol.

Ethereum Price Prediction: Can Ethereum finally hit $500?

Ethereum price was trading inside a daily ascending triangle from which broke out on October 22 hitting $420. Days later, the digital asset re-tested the previous upper boundary of the pattern but couldn’t hold it as a support level.

ETH/USD daily chart

Bulls did manage to defend the lower boundary of the triangle pattern which coincided with the 50-SMA and the 100-SMA at $380 and Ethereum price is now $402 after a significant spike thanks to the announcement of ETH 2.0.

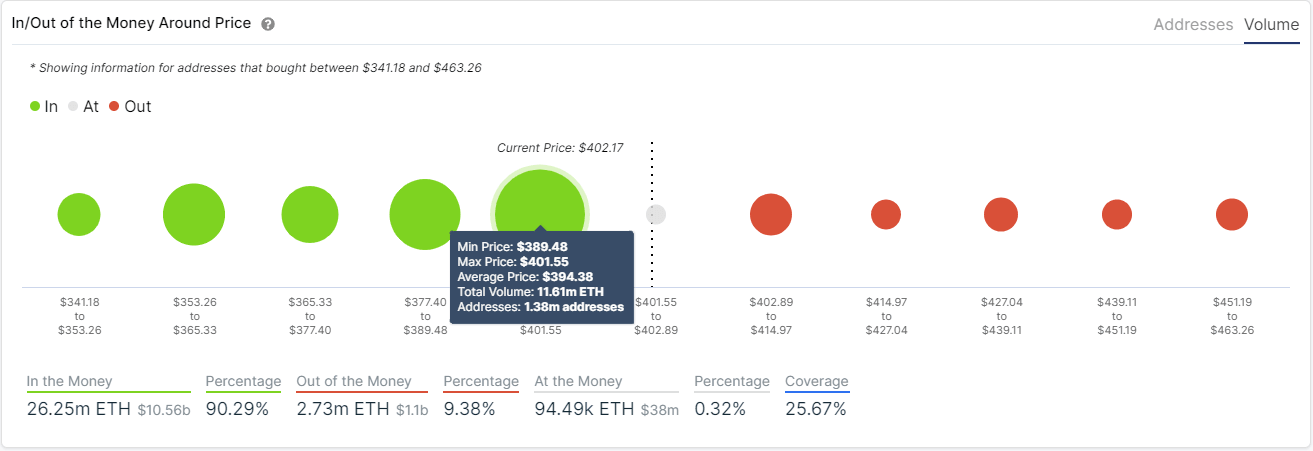

ETH IOMAP chart

The In/Out of the Money Around Price chart shows almost no opposition until $463 when compared to the colossal support area between $389 and $401, where 1.38 million addresses bought more than 11.6 million ETH, increasing buying pressure.

ETH/USD 1-hour chart

On the 1-hour chart, the RSI is overextended and the TD sequential indicator seems to be on the verge of presenting a sell signal after a massive 5% candlestick. Validation of the signal can drive the price of Ethereum down to the 200-SMA at $388.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.