Ethereum price is bullish unless this happens

- Ethereum price remains in a bullish consolidation.

- ETH price has breached a new monthly high at $1630.

- Invalidation of the uptrend is a breach below $1270.

Ethereum price has bullish cues, but finding an entry will be the most challenging aspect for traders.

Ethereum price points higher with contingencies

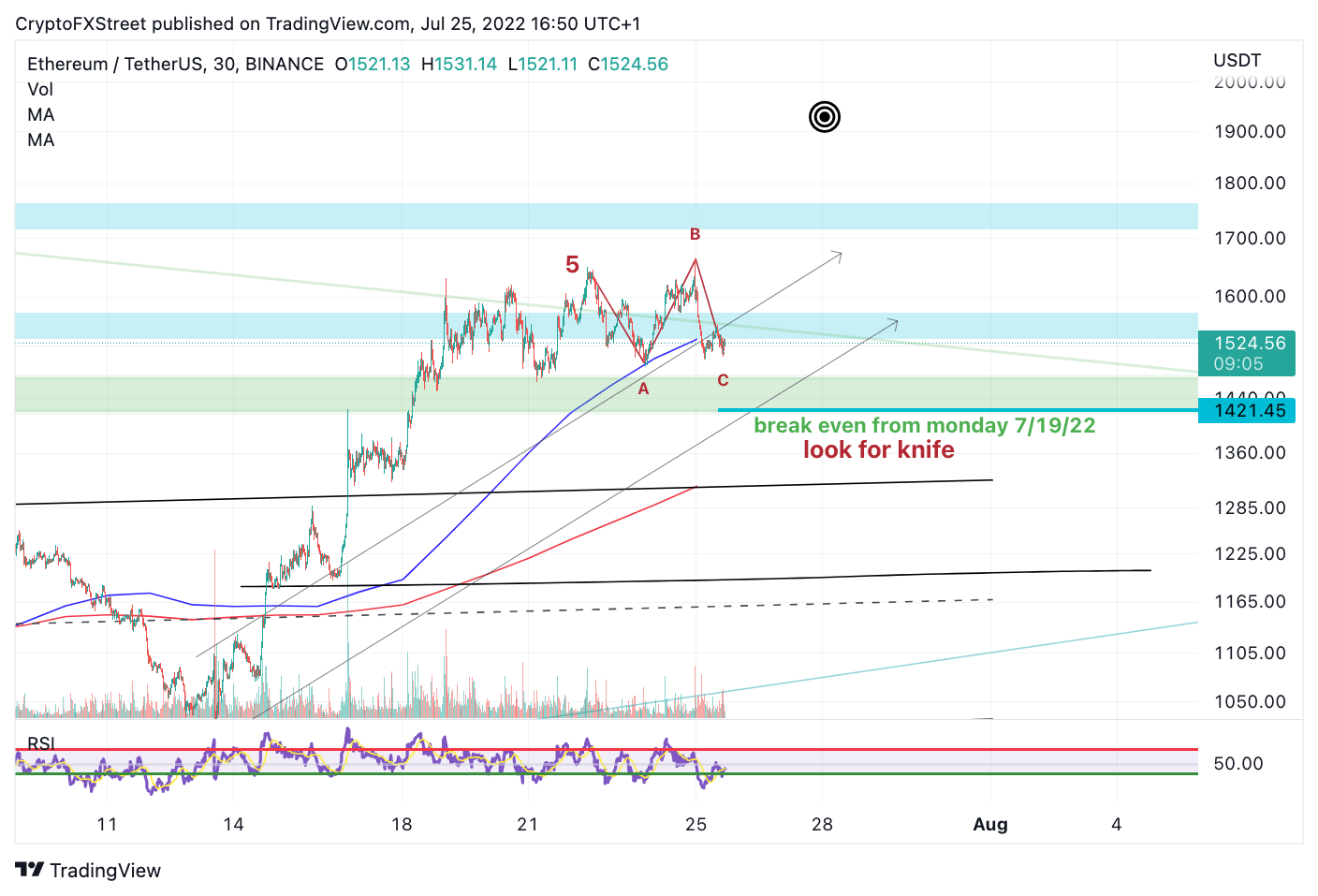

Ethereum price currently consolidates at around $1515. A bearish divergence was spotted on Friday, June 22, which prompted reasonable concern. Throughout the weekend, the decentralized smart contract token saw erratic behavior confined to a $1460-1640 zone. The back-and-forth action may have resolved to subtle bearish cues as the Ethereum price still hovers in the bullish territory on the Relative Strength Index on smaller time frames.

Conservative traders may want to consider waiting for an entry. A second attempt at the new monthly high at $1632 should be the catalyst of a bull run targeting $1860 and potentially $1900. Invalidation would be the most recent swing low before the imminent breach. This is a safer entry as the alternative scenario could bring a 16% decline targeting $1270.

ETH/USDT 30-Minute Chart

Ethereum price has not invalidated the bullish outlook targeting $1900, but there is still a fair amount of room for the ETH price to fall. $1270 is the line in the sand to determine an uptrend invalidation point. If $1270 were to get breached, an additional plummet towards $780 could result in a 47% decrease from the current Ethereum price.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.