Ethereum price could fool bulls into thinking it can go back to $1,400, as it will not

- Ethereum price action dropped over 3% this week in value as bears are trying to reach $1,243.

- ETH price action could be seen recovering partially as markets reassess the situation.

- Expect a fade just inched of $1,400 and see it drop back, hitting $1,243.

Ethereum price action is recovering from its small drop of 3% as it recovers from a volatile start of the week. The big issue was the cable and pound sterling that moved several figures in just two days on the back of rumors that the BoE would or would not extend its bond interventions to stabilize the UK bond market, At risk is the collapse of the UK bond market that holds billions in pension funds money at the risk of going up in thin air.

Sterling spillover put ETH under pressure

Ethereum price is getting headwinds from the UK bond market, and its main currency pairs EUR/GBP and cable (GBP/USD). Although the spillover is quite limited, the nervousness felled the most in some alt-currencies, while the bigger crypto names remained stable but still had to take a step back. Expect the massive liquidity to play an important role in this for the top 3 major cryptocurrencies.

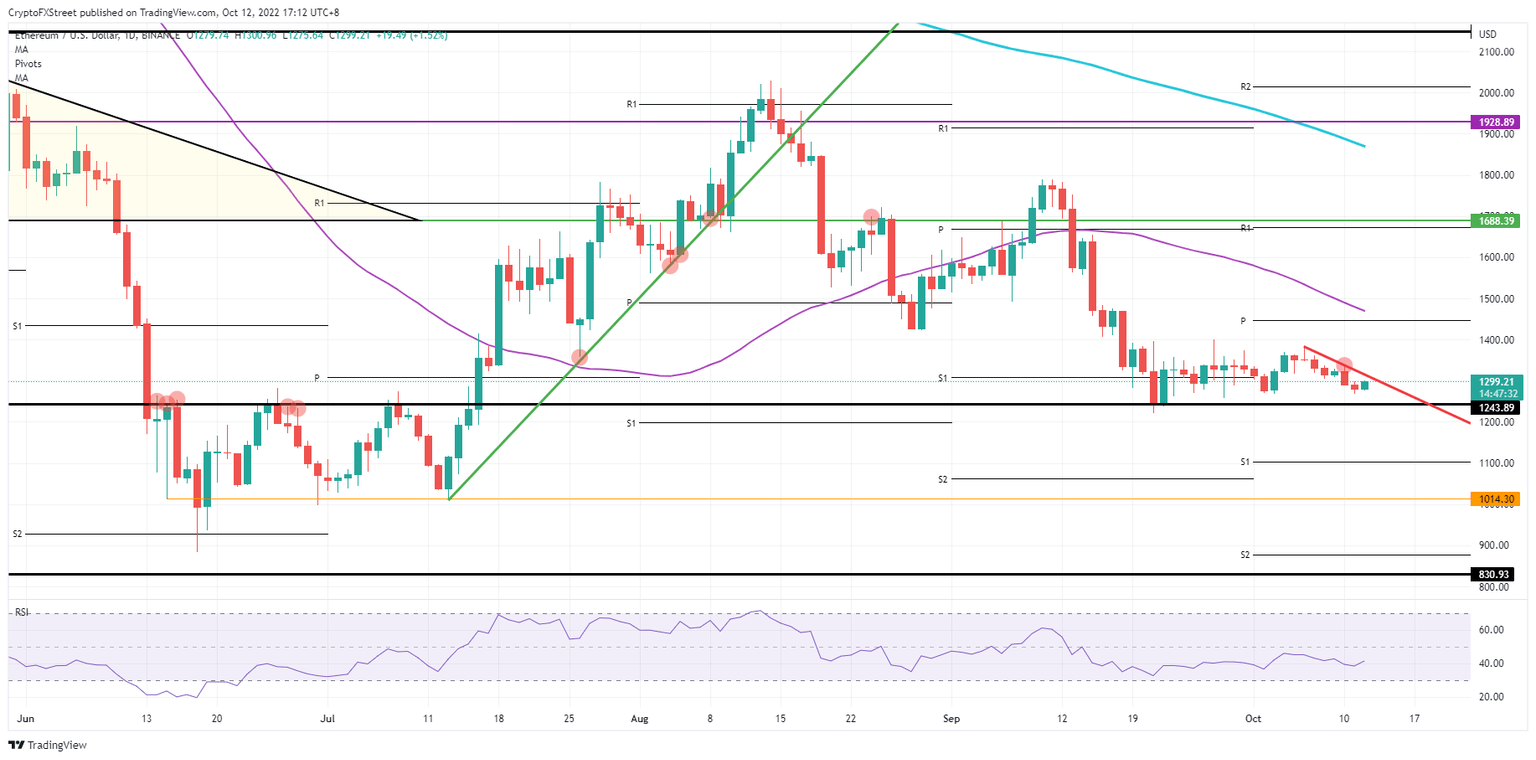

ETH price action might stage any recovery it wants. Still, it remains under bearish pressure from already a simple red descending trend line that is very much guiding price action since October 7. One could even say that a bearish triangle is formed with the base at that historic pivotal level of $1,243. Expect this a pop higher, rejection against the red descending trend line and a break below that base towards $1,100 in the coming weeks.

ETH/USD Daily chart

Looking for a bullish signal can be found when price action breaks above the red descending trend line. That could be a pure technical breakout with or without a catalyst event fueling it. Expect aspirations to grow to jump to $1,400. That would mean a 7.5% rally and could set the stage for $1,450 with the monthly pivot and the 55-day Simple Moving Average coming into play as caps.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.