ETH price finally pushed through the $3,000 barrier and while further upside is warranted, analysts believe that retest of lower levels will happen first.

The cryptocurrency market continues to forge ahead on March 23 despite facing headwinds on multiple fronts. At the moment, global conflict, rising inflation and widespread economic uncertainty are taking a toll on financial markets and helping to highlight the need for a diversified investmen portfolio.

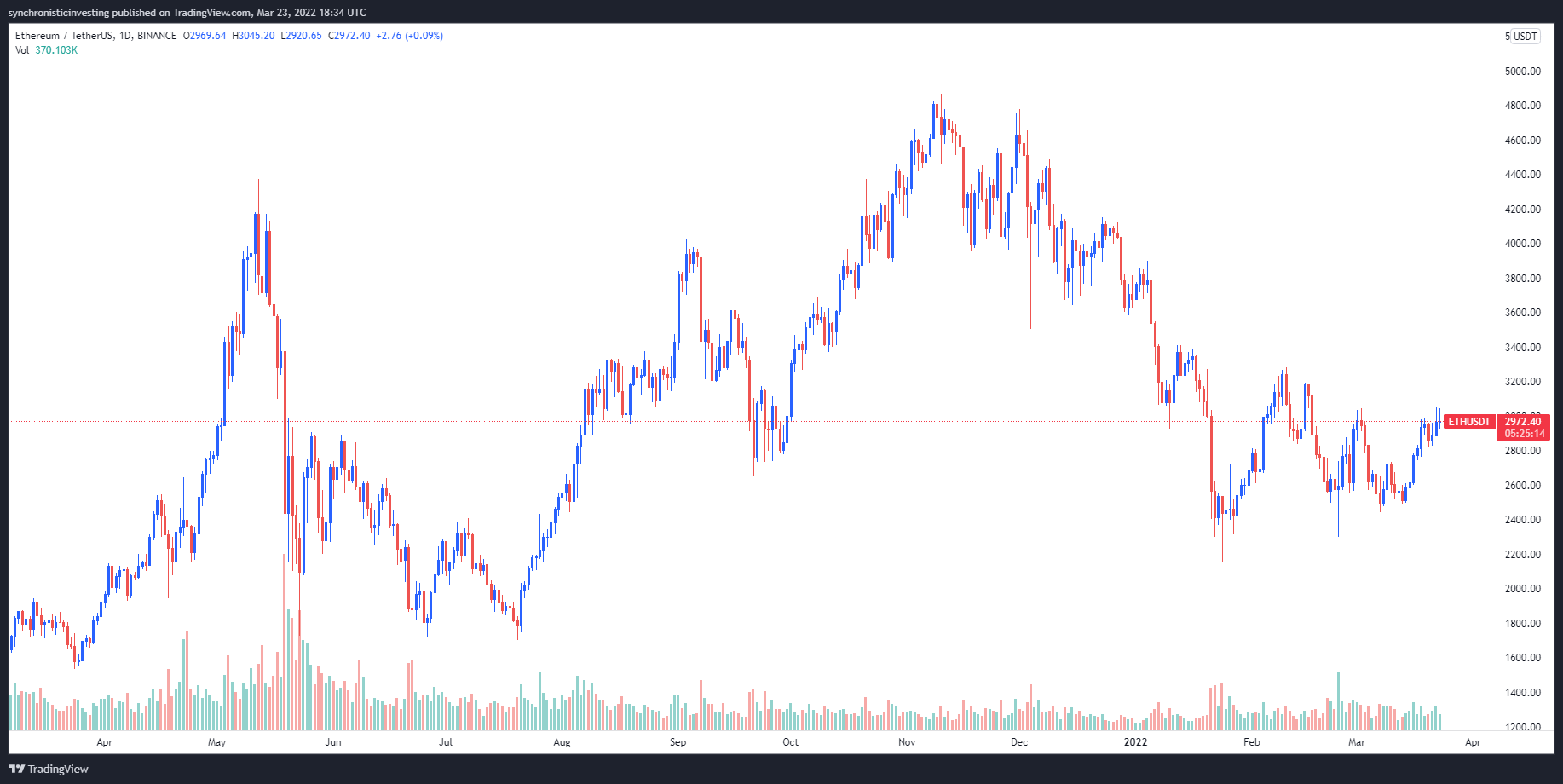

Altcoins have managed to gain some ground in recent days, led by Ethereum, the top smart contract platform, which managed to climb back to the major support and resistance zone at $3,000 where bulls are now battling for control.

ETH/USDT 1-day chart. Source: TradingView

Here’s a look at what several analysts in the market are saying about the path forward for Ether and whether or not further upside is expected in the short-term.

Upcoming test of $3,125

A general overview of the recent price action was provided by crypto analyst Michaël van de Poppe, who posted the following chart showing “Ethereum moving upward after holding crucial level.”

ETH/USD 2-hour chart. Source: Twitter

van de Poppe said,

Seems to me that we're going to test $3,125 next.

But not all traders were so quick to look for a higher price target, including pseudonymous Twitter user ‘Chartpunk’, who posted the following chart highlighting the ten-day uptrend for Ethereum and warned against jumping into an overheated market.

ETH/USD 4-hour chart. Source: Twitter

Chartpunk said,

Do not FOMO into the market. Should you want to join the trend, look for the retest of the entry zone on this chart.

Based on the area highlighted in the chart, Charpunk is looking for re-entry around $2,975.

Sentiment is neutral until $3,287

A more measured approach to the current price action was offered by crypto trader and pseudonymous Twitter user ‘Mad Max Crypto’, who posted the following chart indicating a “Neutral bias till it flips the $3,287 mark.”

ETH/USDT 1-day chart. Source: Twitter

This outlook was largely echoed by cryptocurrency advisor and pseudonymous Twitter user ‘Altcoin Sherpa’, who posted the following chart highlighting the series of higher lows and higher highs made by Ether.

ETH/USD 1-day chart. Source: Twitter

ETH/USD 1-day chart. Source: Twitter

Altcoin Sherpa said,

I think that you can make an argument for breaking market structure to the upside on lower time frame charts but I'm personally waiting for the higher levels. Regardless, ETH2.0 fundamentals are going to be strong coming soon.

A possible pullback to $2,600

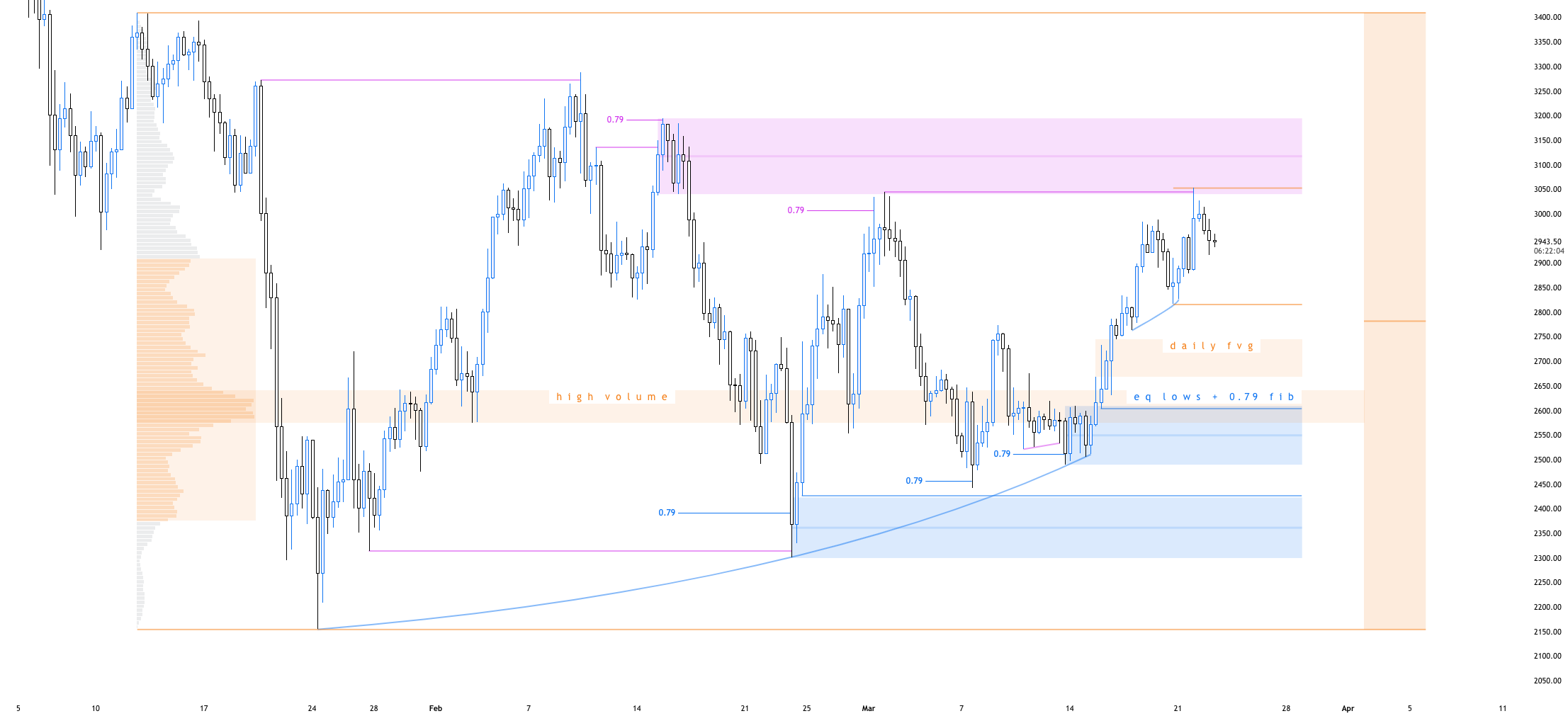

A final bit of analysis on the lower price levels to keep an eye on was touched on by crypto trader and pseudonymous Twitter user ‘Follis’, who posted the following chart suggesting the possibility of a pullback to $2,600.

ETH/USDT 8-hour chart. Source: Twitter

ETH/USDT 8-hour chart. Source: Twitter

Follis said,

Strong reaction from that sweep into supply, but most hourly time frames are bullish, and I expect more upside as long as we don't close below $2,800. $2,600 area is interesting if we get a pullback, the 0.79 fib has worked well within this macro range.

The overall cryptocurrency market cap now stands at $1.919 trillion and Bitcoin’s dominance rate is 41.7%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

CAKE price bottoms out as PancakeSwap announces $25 million burn

PancakeSwap’s price increased nearly 3% on Monday after the decentralized exchange platform on the Binance Smart Chain announced a token burn of more than 8.9 million CAKE tokens, collected from trading fees across Automated Market Makers Version 2 and 3 of the platform.

Ripple lawsuit to see SEC response on Monday, XRP nears 4.5 million mark in liquidity pools

Ripple closed above $0.52 on Sunday and resumed its climb on Monday, May 6. Sentiment among market participants is positive as traders await Securities and Exchange Commission response filing and XRP locked in Automated Market Maker liquidity pools crosses 4.31 million.

Crypto AI tokens post near double-digit gains amidst launches from NVIDIA, OpenAI and Amazon

AI-based cryptocurrencies have experienced nearly double-digit or higher gains on Monday, well above the price increases seen among the main crypto assets, likely fuelled by recent announcements of new developments from AI and tech giants in the US.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin’s consolidation crosses the two-month mark but shows no signs of a breakout or a directional move. Investors waiting with bated breath for a volatile move remain confused about whether to buy the dips or keep some cash reserves for a rainy day.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.