Ethereum aims for $720 ahead of ETH 2.0 launch

- ETH has jumped to a new 2020 high ahead of ETH 2.0

- The next bullish target is set on approach to $700.

ETH hit a new high of 2020 at $626 (data from Coinbase) as the market is expecting ETH 2.0 launch. The rollout is scheduled for today at 12 UTC and it will start a new era for the second-largest blockchain ecosystem in the world. The number of Ethereum nodes has skyrocketed ahead of the launch.

ETH is on fire ahead of ETH 2.0 launch

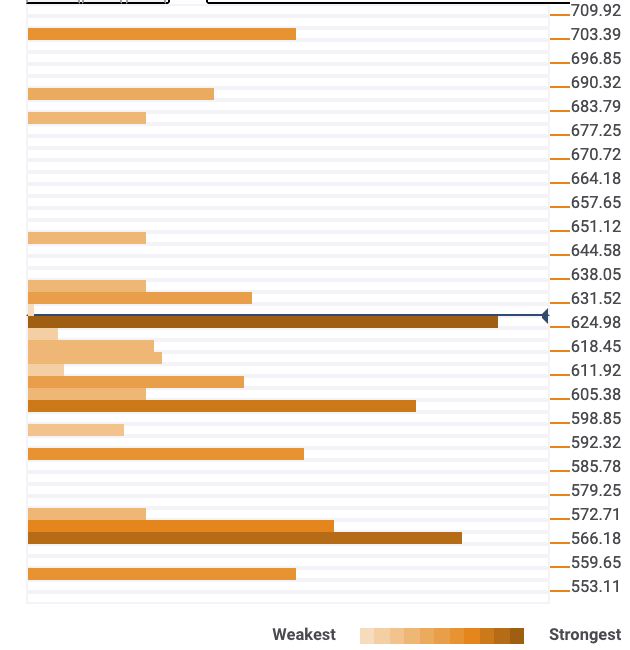

At the time of writing, ETH is changing hands at $628 with an upside trend gaining traction. The on-chain data provided by Intotheblock shows that the bulls will face little to no resistance until at least $710. The price may reach the new psychological barrier before the ETH.2 launch as the market is playing by "buy the rumor, sell the fact script."

On the downside, In/Out of the Money Around Price" (IOMAP) model shows that there is significant support around $550. About 535,000 addresses bought over 7.8 million ETH between $530 and $550, meaning that the selling pressure may slow down here.

The key technical levels to watch

According to the confluence detector, ETH is sitting on top of strong support created by a combination of November high and the short-term EMA. Once it is broken, the sell-off may be extended towards the psychological barrier of $600. This support is highlighted by Fibonacci 38.2% daily and 15-minutes Bollinger Band lower boundary.

The next barrier lies on the approach to $550 and is home to the Fibonacci 23.6% monthly and the 4-hour Bollinger Band middle boundary.

ETH/USD confluence chart

On the upside, a sustainable move above the local resistance created by the Pivot Point 1-day Resistance 1 at $630 can trigger further growth towards $700 guarded by the Pivot Point 1-month Resistance 1.

Author

Tanya Abrosimova

Independent Analyst

%2520Analytics%2520and%2520Charts-637424185616000319.png&w=1536&q=95)