EOS community votes to fire and cut off payments to Block.one

- The EOS community has come together to stop ongoing payments to Block.one.

- EOS members believe that Block.one has done little to support the blockchain network.

- Block.one will no longer receive 67 million EOS tokens in the next six to seven years.

The EOS community has decided to halt ongoing payments to the company behind the blockchain’s network, Block.one. Through a super-majority consensus, the community claims that the firm is no longer acting in the network’s best interests.

EOS begins a new era

Block.one released the software for the EOS blockchain in 2018, running on delegated proof-of-stake by the top 21 producers, voted in by token holders. However, these 21 block producers could be voted out of power by token holders despite having combined control over the network. Block.one was originally set to receive 100 million EOS, worth roughly $375 million over ten years, about 10% of its total supply in return for supporting the blockchain.

However, the EOS community has been disappointed by the firm’s commitment toward the blockchain, providing few use-cases for it, according to the EOS network Foundation (ENF).

La Rose, who formerly ran the EOS block producer, was appointed as the leader of the ENF and expressed his plans for the network in November. He stated that EOS had been let down by Block.one and the network needed another path to move forward.

The ENF had been in discussions with Block.one, with the aim of getting hold of the EOS network’s intellectual property. However, the ENF was dissatisfied with the result, therefore the network’s block producers came together to halt ongoing payments to Block.one.

Around 67 million EOS tokens that were set to be distributed over the next six to seven years to Block.one will be stopped, as EOS claimed that the firm is no longer acting in the blockchain’s best interest.

The ENF stated that the EOS network has taken its future into its own hands by voting to fire Block.one, beginning a new era for the blockchain.

EOS price at risk of 53% decline

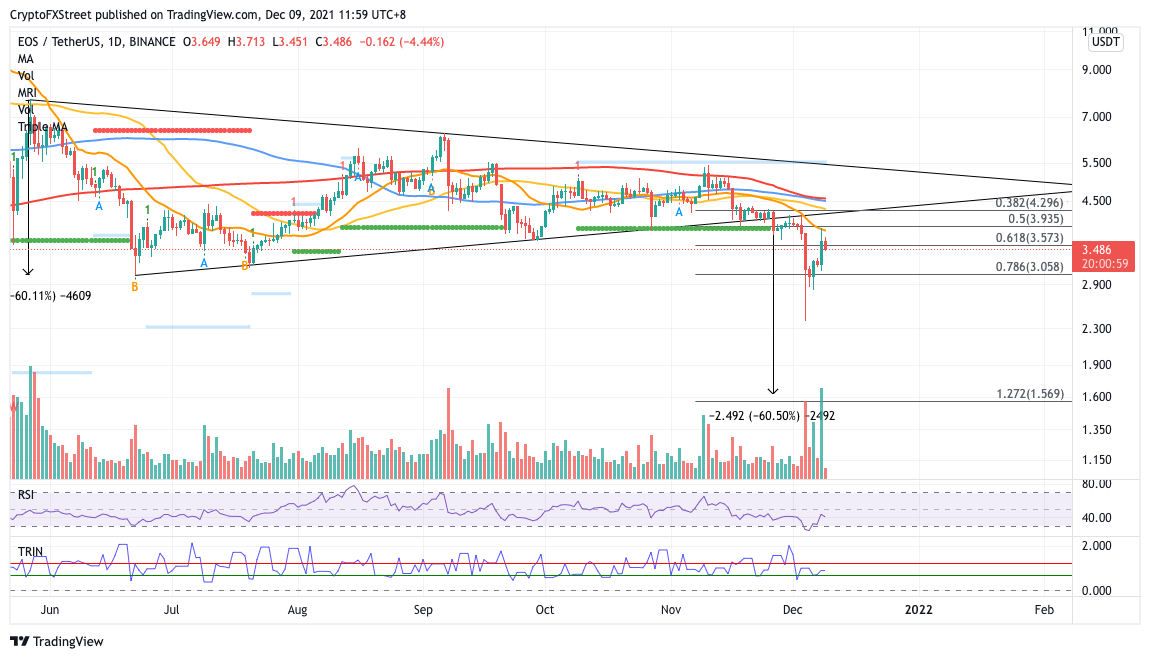

EOS price is on the edge of further losses as the token dropped below the symmetrical triangle’s lower boundary in late November on the daily chart. The prevailing chart pattern suggests a 60% decline from the downside trend line of the triangle toward $1.62.

The first line of defense for EOS is at the 78.6% Fibonacci retracement level at $3.05, then at the December 6 low at $2.81. An increase in selling pressure may see the token retest the December 4 low as support at $2.40 before reaching the bearish target.

EOS/USDT daily chart

If the bulls manage to reverse the period of underperformance, the first obstacle will appear at the 61.8% Fibonacci retracement level at $3.57, then at the 21-day Simple Moving Average (SMA) at $3.82. Bigger aspirations will target the 50% retracement level at $3.93.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.