Elrond Price Forecast: EGLD eyes 20% ascent, but buyers need to hold the line

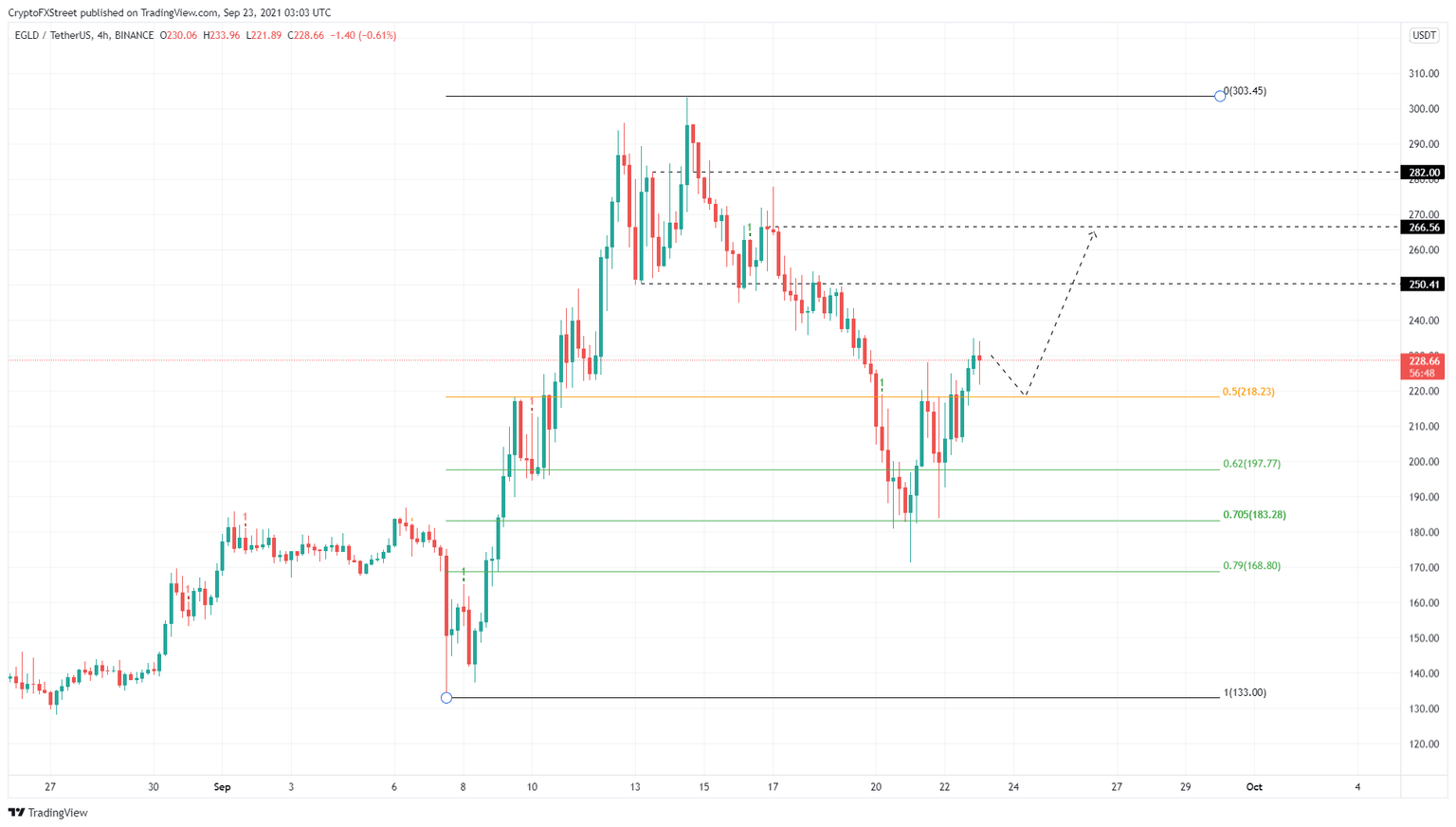

- Elrond price bottomed at $183.28 and rallied 27% so far.

- A pullback to the 50% Fibonacci retracement level at $218.23 is likely before a new uptrend originates.

- If EGLD fails to hold above $197.77, it will invalidate the bullish thesis.

Elrond price crashed violently after setting up a local top on September 14. The uptrend came to an end as EGLD crumbled uncontrollably for roughly a week. However, the bottom seems to be in, and the altcoin has kick-started a new bull rally.

Elrond price at make or break point

Elrond price dropped 43% after a 127% ascent. While the hemorrhaging appears to have stopped, EGLD rallied roughly 36% so far and is currently heading toward a resistance level at $250.41.

It is possible that the Elrond buyers might continue to push the altcoin higher. However, a retest of the 50% Fibonacci retracement level at $218.23 is likely.

If the buyers make a comeback here, EGLD price will continue the uptrend and make a run at the $250.41 ceiling.

In case of increased bullish momentum, investors can expect Elrond price to shatter $250.41 and take a jab at $266.56. This run-up constitutes a 20% ascent and might not be where the bulls decide to throw in the towel. In a highly optimistic scenario, Elrond price might try to retest the $282.20 hurdle, roughly a 30% advance from the $218.33 barrier.

EGLD/USDT 4-hour chart

While things seem to be going well for Elrond price, a breakdown of the 50% Fibonacci retracement level at $218.33 will indicate a weakness among buyers. If the selling pressure continues to rise from the investors booking profits, EGLD will encounter the $197.77 support floor.

A decisive 4-hour candlestick close below this platform will create a lower low and invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.