Elon Musk’s Tesla faces $440 million loss on its BTC holdings while whales continue to dump

- Bitcoin price plummets below $20,000 yet again, pushing automotive manufacturer Tesla towards a $440 million writedown on BTC holdings.

- Tesla accumulated $1.5 billion in Bitcoin in 2021, however the car manufacturer’s bet turned into a loss during the crypto bloodbath.

- Whales are depositing Bitcoin to exchanges rapidly, fueling an increase in selling pressure.

The electric car manufacturer faces a dire fate as its Bitcoin holdings further devalue amidst a market rout that is seeing whales readying to sell by rapidly pouring their Bitcoin onto crypto exchange platforms. Tesla is already facing a $440 million writedown of its Bitcoin holdings after the recent crypto market bloodbath, and could face even more.

Tesla prepares to record impairment on Bitcoin holdings

Bitcoin price has slipped below $20,000, hitting an 18-month low. This is bad news for Tesla which bought $1.5 billion of Bitcoin in 2021. The move has garnered a backlash from investors as the company is heading towards a writedown. Part of Tesla’s cash reserves were moved into cryptocurrency, however, the decision backfired as Bitcoin price crashed in the recent crypto bloodbath.

Tesla recorded the value of its Bitcoin holdings at $1.26 billion three months ago. The actual market value of Tesla’s holdings at the time was close to $2 billion, however, it could not register these gains on its investments, as they were unrealized (they had not yet been sold), in line with accounting practices.

With the recent slump in Bitcoin price (to the $19,000 level), on the final day of Tesla’s second financial quarter, however, the company’s holdings are now worth an estimated $820.8 million. Elon Musk’s Tesla is therefore likely to record an impairment on its Bitcoin holdings of around $440 million, 9% of the car company's annual profit in 2021.

When Tesla reports its quarterly results in July 2022, it is likely to make this announcement and take a writedown of $440 million on its big Bitcoin bet.

Bitcoin addresses underwater surpassed March 2020 record

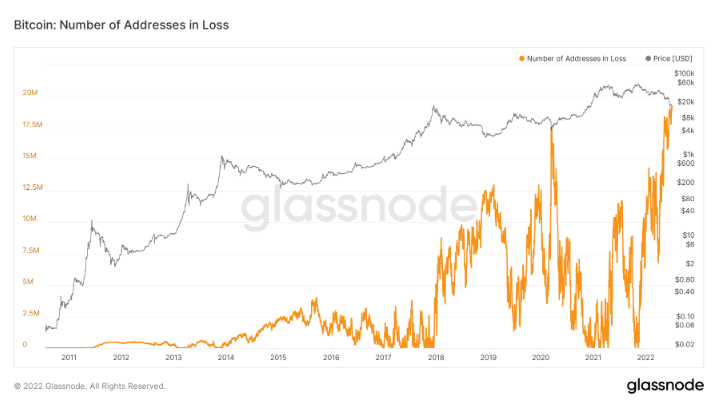

Based on data from crypto on-chain firm Glassnode, the weekly moving average number of unique Bitcoin addresses at a loss hit a peak of 18.8 million on July 3, 2022. Data revealed that the average Bitcoin holder was hit by the worst monthly loss since 2011 in the current bloodbath.

Bitcoin: Number of Addresses in Loss

Analysts at CryptoQuant reveal that the Whale Ratio metric, an indicator that reveals the selling behavior of large wallet investors, points towards a Bitcoin price bottom soon. Whale Ratio metric is calculated by dividing bitcoin’s top 10 inflows to exchanges by all the inflows in a single day. High values of the metric indicate price fluctuations.

The analyst noted that whales are rapidly depositing their Bitcoin holdings to cryptocurrency exchanges and realizing massive losses. Bitcoin price is therefore likely to find a bottom soon and for the next bullish cycle to then begin.

Analysts predict Bitcoin price could bleed further

Analysts at FXStreet evaluated the Bitcoin price chart and revealed that the asset wants to plummet below $18,817, its seven-day low. For more information and key price points to watch out for, check this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.