Elon Musk resumes legal fight against Open AI and Sam Altman as AI tokens trend

- Elon Musk takes on Open AI and Sam Altman in a new lawsuit, calling out the executive for allegedly defrauding him into investing in the firm.

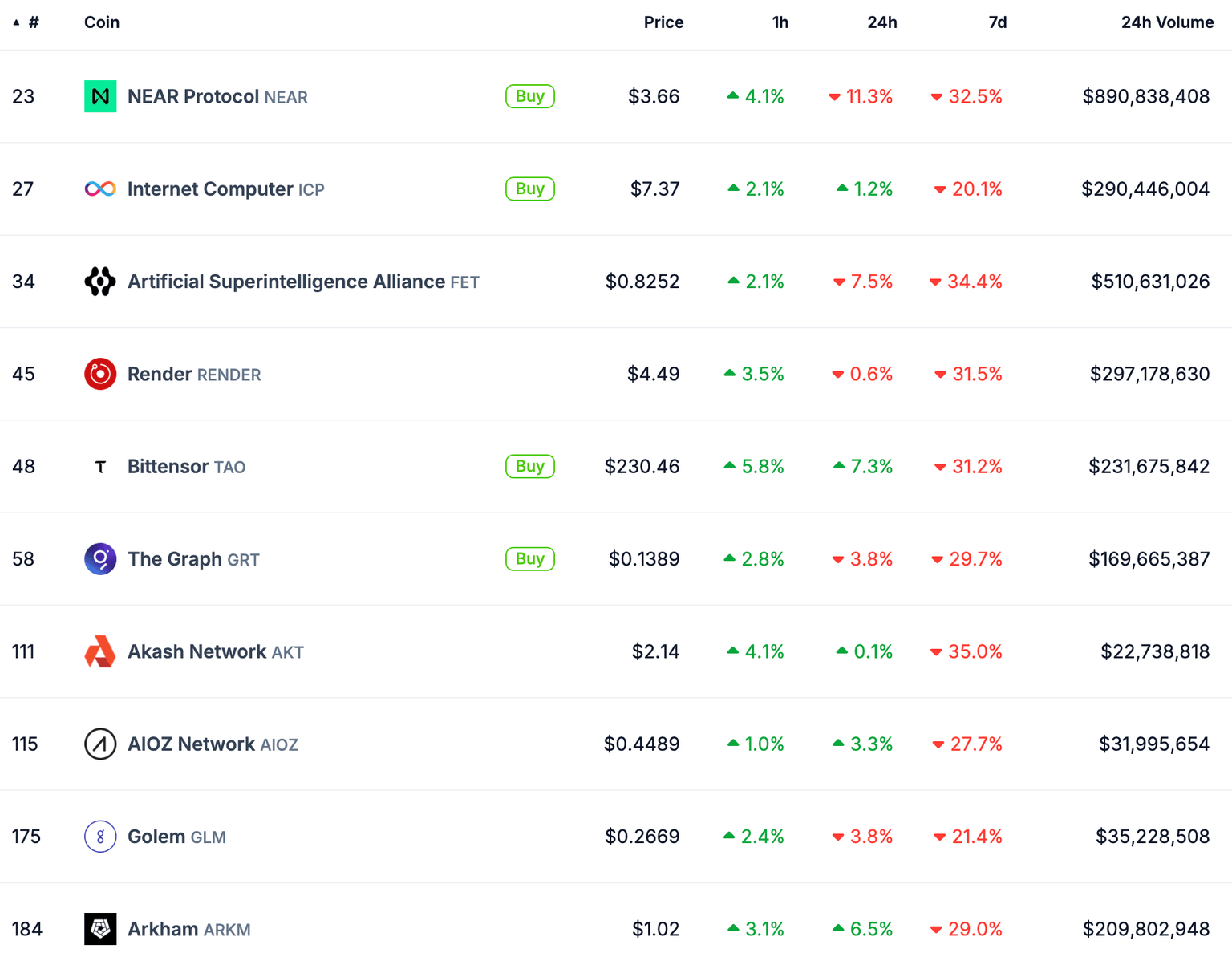

- AI tokens rallied on Monday despite market-wide bloodbath, top 10 AI tokens post between 2% and 6% gains.

- Bittensor, AIOZ Network and Arkham rally up to 7% in the past 24 hours, per CoinGecko data.

Elon Musk takes Sam Altman and Open AI to court over getting him to invest in the artificial intelligence (AI) firm “fraudulently.” Monday's filing shows that the $44 million investment was based on the premise that the firm will remain a “nonprofit” focused on development of AI.

Musk has sued the AI firm and its CEO previously. Musk dropped his previous lawsuit that alleged the creators of ChatGPT have breached their initial mission to develop AI for the “benefit of humanity.”

Musk withdrew his lawsuit in June without proper explanation.

AI tokens rallied despite the recent bloodbath in crypto, gaining relevance among traders, even as market participants shed their “risk asset” holdings.

Musk’s lawsuit against OpenAI and Sam Altman

In the Monday filing, Musk claims that OpenAI executive Altman planned to convert the firm to a “for-profit” after the research churned out valuable technology. Musk says the plan changed and the executives “improperly profited” from their deals with Microsoft and other entities.

Musk accuses the executives of fraud, breach of contract, unfair competition and false advertising, among other allegations. Musk’s lawsuit holds several Open-AI related entities responsible for turning the firm into a “for profit” and defrauding him.

AI tokens gain despite crypto bloodbath

AI tokens, specifically the top 10 in the category ranked by market capitalization, started their recovery on Monday. Even as Bitcoin and other cryptocurrencies slipped under key support and over $1.06 billion was flushed out of the market in liquidations during a 24-hour time frame. AI tokens sustained their recent gains, specifically Internet Computer (ICP), Bittensor (TAO), Akash Network (AKT), AIOZ Network (AIOZ) and Arkham (ARKM). CoinGecko data shows these assets held onto their gains from the past 24 hours and recovered despite the market-wide correction.

AI token price from CoinGecko

Despite the controversies in the AI sector, the 24-hour trade volume exceeds $3.14 billion.

The AI firm recently released advanced voice mode in ChatGPT, adding to the utility of the Large Language Model (LLM), the major development in the sector.

Sam Altman’s Worldcoin (WLD) loses nearly 3% on Monday, trading at $1.598 at the time of writing.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.