Dogecoin’s 4-month long consolidation set to drive investors away unless DOGE reclaims this level

- Since May 2022, short-term traders have been the only cohort to profit off Dogecoin, but they have even been at a loss lately.

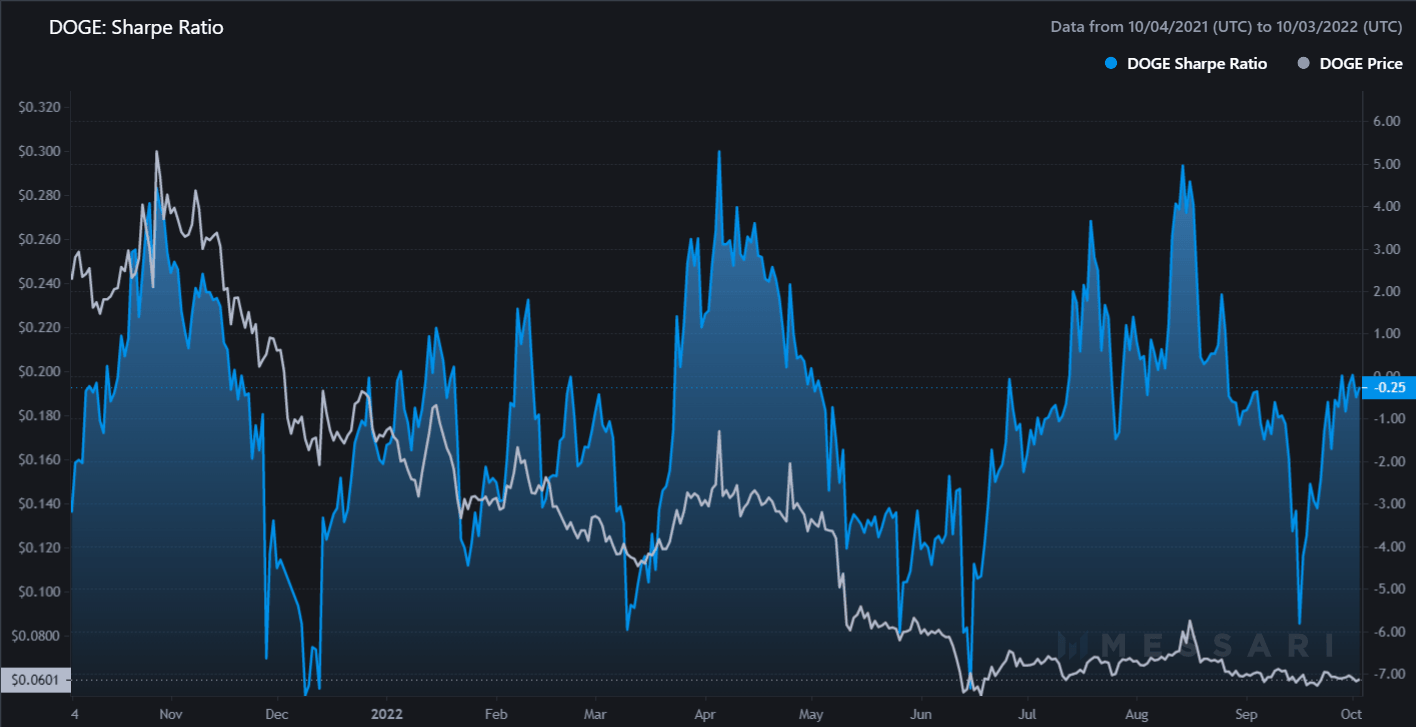

- Lack of volatility could create apprehension among newer investors as the risk-adjusted returns for DOGE is terrible.

- Dogecoin’s market value is suffering, and lack of growth could result in Polkadot flipping DOGE to replace it as the tenth biggest cryptocurrency.

Dogecoin is surprisingly still holding its charm despite having made no major development in months. However, the lack of improvement might create an environment of concern among investors who are joining the network in the fourth quarter.

Dogecoin investors looking for profits

November 2021 was the last time the crypto market noted actual bullishness, but in the case of some cryptocurrencies like Dogecoin, even November was not the best while. Having marked its all-time high in May 2021, DOGE has been in a constant downtrend, falling from $0.6903 to currently trading at $0.0604.

Over the last five months, the situation worsened as DOGE stopped moving completely. The sideways momentum has left only one set of investors in a good spot, the short-term traders. Scalping off of the intra-day fluctuations, these traders are the only ones making profits.

Although, in the last two weeks, their profits have been cut short as well since DOGE fell flat even on the 4-hour chart. Thus, in order to flip these investments into profit, DOGE is required to rise back to $0.0677.

This price point also marks the level where the 38.2% Fibonacci Retracement of the 0.0869 to 0.0570 decline lies. Reclaiming it naturally sets DOGE in upward momentum.

But if the same does not occur over the next few weeks, it can cause apprehensions in the minds of newer investors.

No returns, no value

The lack of volatility is becoming Dogecoin’s bane since the meme coin’s risk-adjusted returns are still at a negative right now. The Sharpe Ratio is currently at -0.25%, which is not the most alluring figure at the moment.

Dogecoin Sharpe Ratio

And with no improvement in returns, the market value of the asset is also stuck below the neutral line. These factors might keep potential investors from putting their money on Dogecoin.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%20%5B23.34.32%2C%2003%20Oct%2C%202022%5D-638004204230810770.png&w=1536&q=95)