Dogecoin set to remain consolidated as DOGE Whales turn into Long Term Holders

- Dogecoin has been stuck in a sideways momentum for almost three months now.

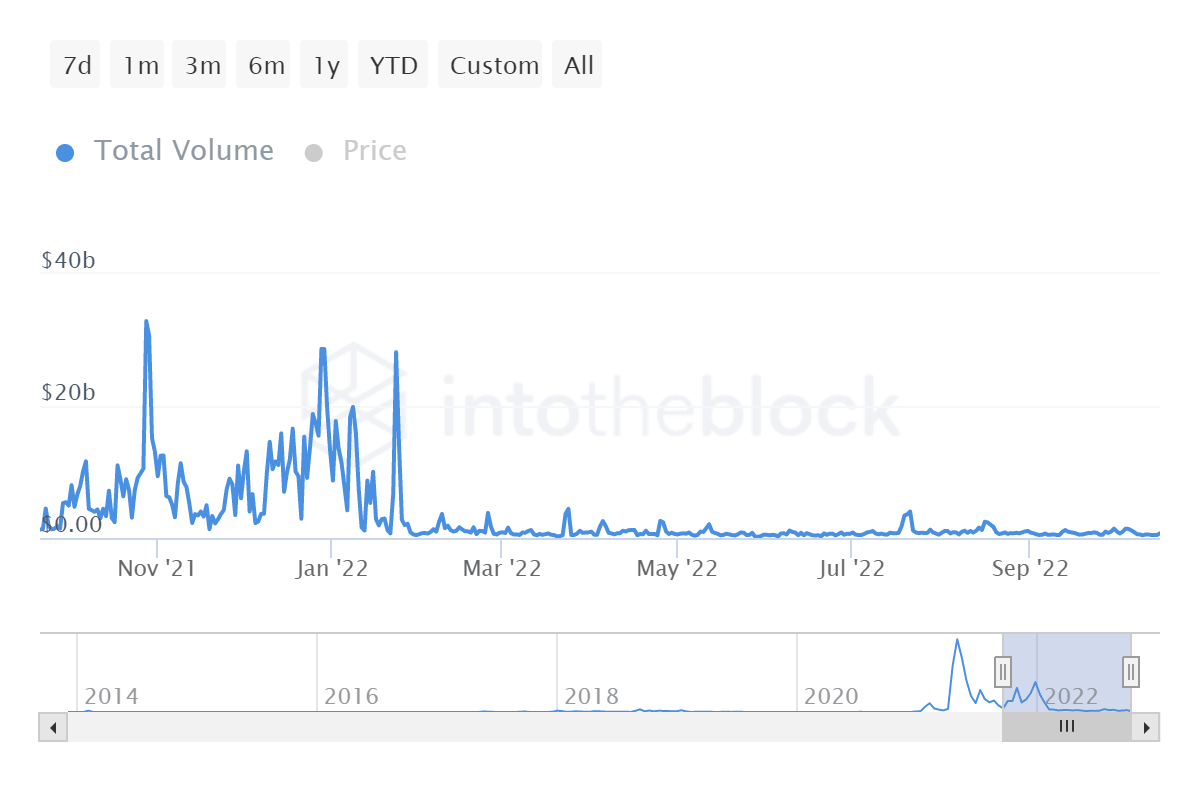

- DOGE whales’ transaction volume has reduced to less than $1 billion since January from an average of $10-$15 billion.

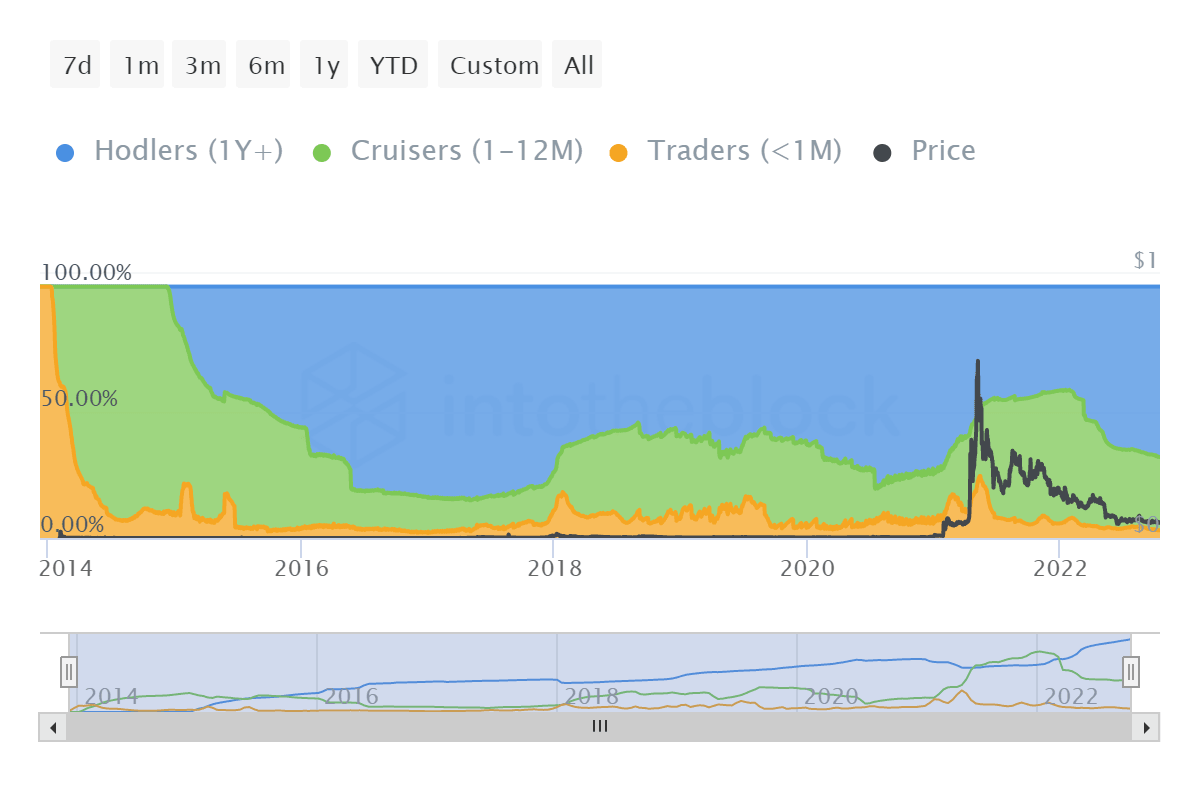

- Since January 2022, DOGE long-term holders’ concentration in the market has risen by over 26%.

Dogecoin is one of the most easily influenced cryptocurrencies in the market since it is dependent on social cues to push its price. But both Elon Musk and the broader market cues haven’t had a positive impact on the price. As a result, DOGE whales have decided to sit on their holdings for a little while longer than anticipated.

Dogecoin marches on

Dogecoin is marching on, however, to nowhere. Since mid-August this year, DOGE has been following a sideways momentum and is seemingly going to continue to do so. The Fibonacci retracement from its local top ($0.1729) to recent lows ($0.0491) established the 23.6% level at $0.0783.

This level was last tested in August, and the failure to flip it into support was followed by the fall in price that placed DOGE in consolidation. Trading at $0.0598, the meme coin king has minimal buying pressure, keeping it from retesting the 23.6% Fibonacci level.

As long as the Relative Strength Index (RSI) remains below the neutral line, selling pressure will dominate the market.

However, Dogecoin was once one of the most volatile assets in the market, the reason being its whale holders, who have been silent for a while.

Dogecoin whales make no splash

Whales play a significant role in an asset’s price movement, but particularly Dogecoin, these matter more since they dominate 48.88% of all supply. Thus the movement of 66.7 billion DOGE is in their hands.

This movement has been low since January when transaction volumes fell from $10-$15 billion to less than $1 billion on average. Co-incidentally in the same duration, the domination of HODLers grew.

Dogecoin whales’ transaction volume

Also known as the long-term holders, these HODLers’ presence has grown from 41% in January to 67.8% this month. This 26.8% growth could be the whales holding on to their assets since January.

Dogecoin HODLers

However, if they decide to be active again and move this DOGE around, the price could see an uptrend. If not, the bearishness of the market will get to it eventually and push the price toward its $0.0491 low.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.