Dogecoin price: Why DOGE price nearly doubled in thirty days, what next?

- Dogecoin whale profit-taking climbs, 400 million DOGE tokens moved to Binance, the largest cryptocurrency exchange by volume.

- Self-proclaimed Dogefather and Tesla’s billionaire CEO Elon Musk completed his takeover of Twitter, fueling the Dogecoin price rally.

- Analysts believe Dogecoin price has strong support at between the $0.0772 and the $0.0792 level where more than 5.89 billion DOGE was acquired.

Elon Musk, a business magnate and the billionaire CEO of Tesla added another giant to his list of acquisitions. Musk’s Twitter acquisition acted as a bullish trigger for Dogecoin price since the self-proclaimed Dogefather has voiced his support for DOGE several times on social media.

Analysts believe Dogecoin’s trend reversal is a sustainable one and the meme coin is likely to continue its climb after finding strong support between the $0.0772 and $0.0792 level.

Also read: Dogecoin price: DOGE climbs 20% overnight, whale transactions hit two month peak

These factors triggered Dogecoin’s massive price rally

Dogecoin price yielded nearly 50% gains over the past thirty days. While there are several factors that contributed to the massive rally, three of them stood out. Accumulation of Dogecoin by large wallet investors, Elon Musk’s (Dogefather) takeover of Twitter and Dogechain’s announcement of its future roadmap were the key factors that influenced the meme coin’s price rally.

According to a Reuters report, Elon Musk recently completed his multibillion-dollar ($44 billion) acquisition of social media giant Twitter. The news of Musk’s Twitter acquisition sent Dogecoin price soaring, from its low of $0.04729 to $0.0877. DOGE price yielded a double-digit gains overnight. Previously, Musk has issued statements arguing that payments on Twitter should be digitized and voiced his support for Dogecoin, the tenth largest cryptocurrency by market capitalization.

the bird is freed

— Elon Musk (@elonmusk) October 28, 2022

Whales scooped up large volumes of Dogecoin ahead of the massive price rally and started profit-taking after crossing the $0.0792 level. Large wallet investors have transferred 400 million DOGE tokens to Binance, in a move to take profits as the meme coin’s price hit a monthly high of $0.087.

Dogecoin Whale Alert, a Twitter account that tracks movement of DOGE whales shared the details of the transaction in a recent tweet:

— Ðogecoin Whale Alert (@DogeWhaleAlert) October 28, 2022

286,953,266 $DOGE ($22,140,740 USD) was transferred from a #Top20 wallet to a #Binance wallet.

Fee: 2.41 ($0.19 USD)

Tx: https://t.co/sJzxNZHZLi#DogecoinWhaleAlert #WhaleAlert #Dogecoin #CryptoNews

Dogechain, a layer-2 scaling solution for Dogecoin announced its future roadmap, fueling Dogecoin’s rise to power as the tenth largest cryptocurrency by market capitalization. Dogechain started the voting process on its coin burn and this fueled a bullish sentiment among DOGE holders.

The Great Burn of 2022 Vote is now LIVE

— Dogechain (Giving away a Tesla) (@DogechainFamily) October 23, 2022

Do you want the Dogechain foundation to burn 80% of the total supply and reduce the vesting period of Early Shibes airdrop from 48 to 6 months? YES/NO ✅ ❌

Full proposal overview and vote:

https://t.co/fruuRUq6ni pic.twitter.com/joksIDMWGk

Why analysts believe Dogecoin price rally is guarded

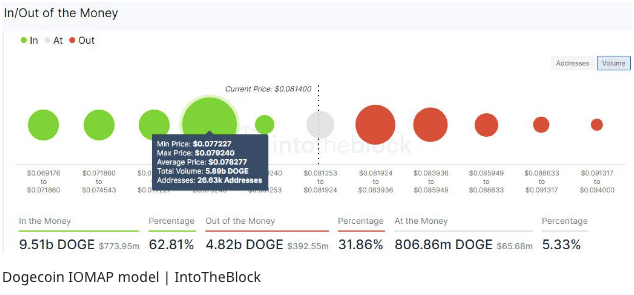

Analysts believe Dogecoin’s recent bullish trend reversal is guarded by support between the $0.0772 and $0.0792 level. According to data from IntoTheBlock, this is the price level at which approximately 27,000 addresses scooped up 5.89 billion DOGE tokens.

5.89 billion DOGE acquired between $0.0772 and $0.0792

Dogecoin price could experience selling-pressure from increased whale profit-taking. Holders within the range of $0.0772 and $0.0792 would fight to defend their gains and support DOGE’s upward climb. Whether holders can help sustain Dogecoin above the $0.0792 level remains to be seen.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.