Dogecoin price: DOGE climbs 20% overnight, whale transactions hit two month peak

- Dogecoin rose above $0.072 for the first time in 10 weeks alongside Ethereum’s breakout over the past two days.

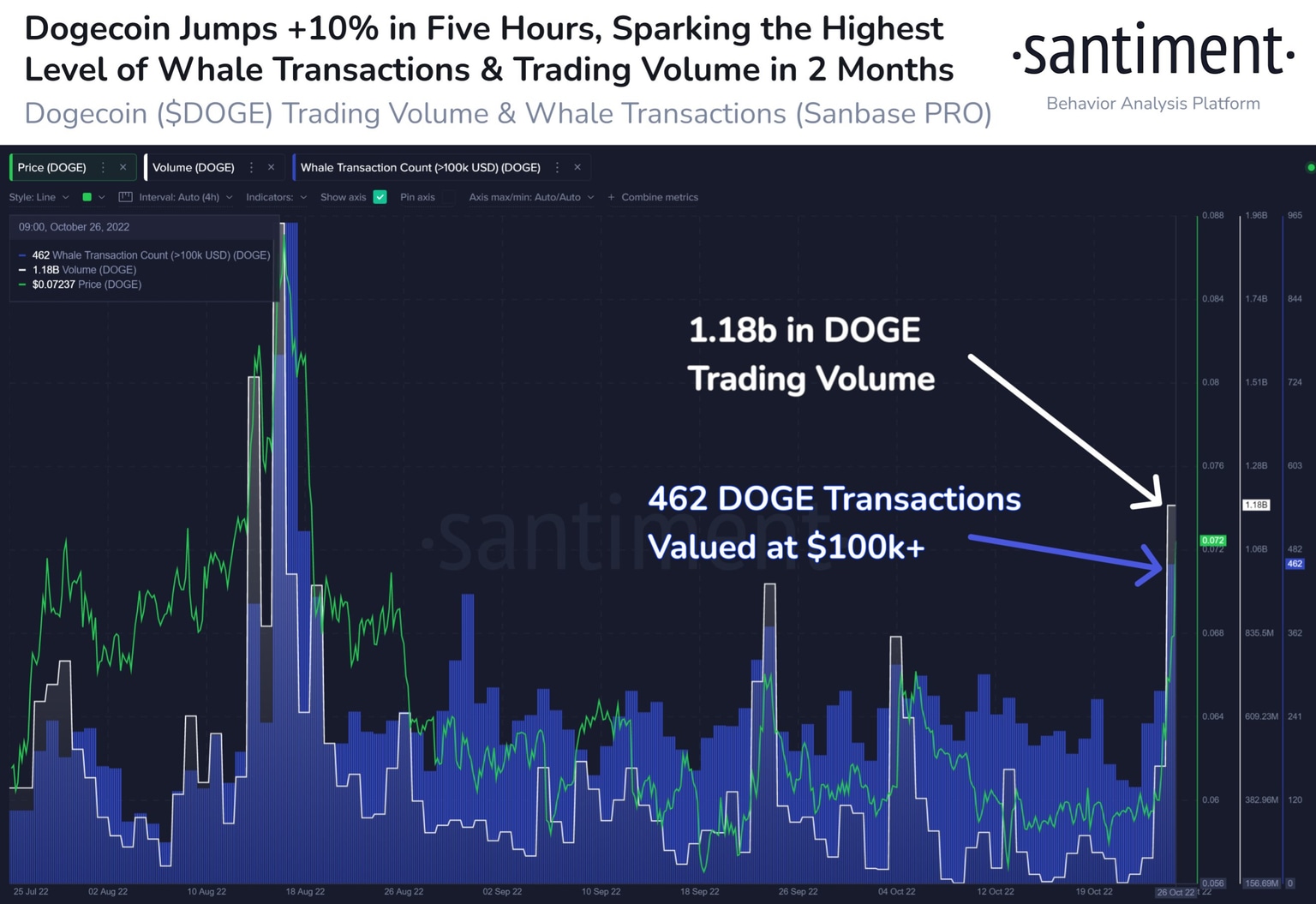

- Whale transactions and trading volume hit August levels, resulting in a spike in on-chain activity by large wallet investors in Dogecoin.

- Analysts predicted a 12.8% rally in Dogecoin price, setting a bullish target of $0.088.

Meme coin Dogecoin witnessed its price rally in the tail end of Ethereum’s massive breakout over the past two days. Both Dogecoin transactions and trade volume climbed to levels seen in August. The meme coin yielded double-digit gains for holders.

Also read: XRP Price: Addresses holding XRP cross 4.34 million, hit new milestone

Dogecoin and Shiba Inu yielded massive gains for holders

Cryptocurrencies staged a massive market recovery, with meme coins like Dogecoin and Shiba Inu staging double-digit price rallies. Following last week’s sell-off in meme coins, Dogecoin price broke out of its downtrend, completed its recovery and hit a new monthly high of $0.076.

DOGE has yielded holders upwards of 30% gains over the past week and 12% gains overnight. The tenth largest cryptocurrency has a market capitalization of $10.5 billion. Despite hitting a new monthly high, the asset continues to trade 89.5% below its all-time high of $0.73.

On-chain activity in Dogecoin hit a peak and trade volume climbed above $682 million on October 26. Dogecoin trade volume has climbed 178% from the previous day. DOGE’s price rally has reversed its weekly and monthly losses and the asset has posted nearly 30% gains month-on-month.

Dogecoin trade volume climbed

Dogechain, a newly-launched blockchain platform that lets users bridge over Dogecoin and use it for DeFi, NFTs, and more revealed plans for the future. The layer-2 scaling solution has no developers from the Dogecoin ecosystem. Dogechain’s announcement about staking on the platform fueled a bullish sentiment among DOGE holders. Users who lock up their DC (Dogechain) tokens in exchange for yet another token- veDC will be able to participate in governance and engage in third-party projects.

Users participating in Dogechain’s staking platform will lock their tokens for one month to four years. This would reduce the circulation of DC tokens and relieve the selling pressure on it. At the same time, this increases Dogecoin’s utility.

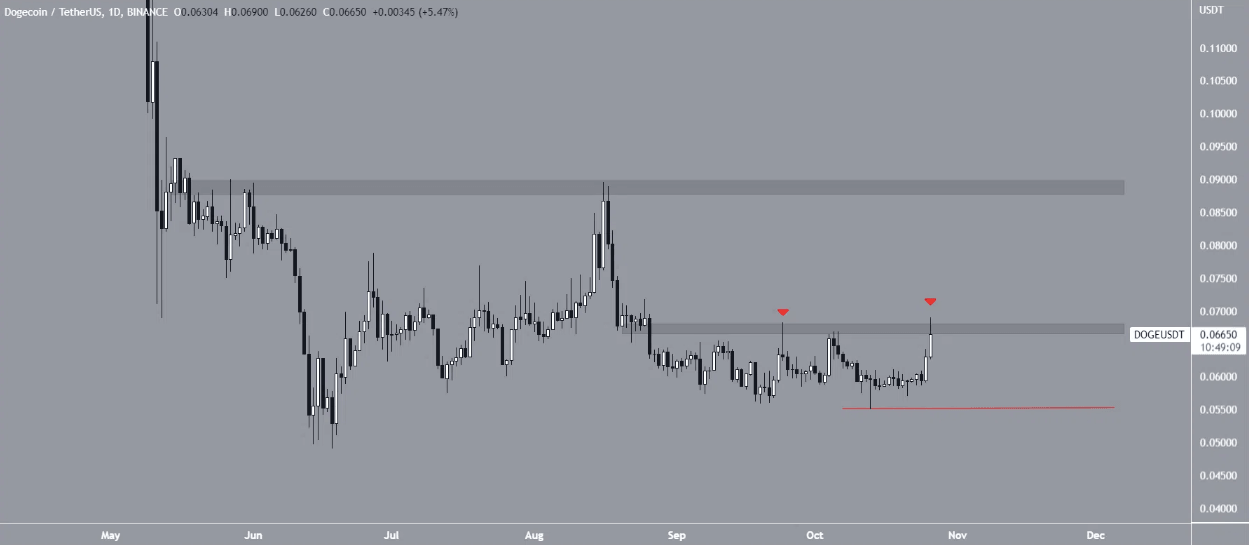

Analysts set a $0.088 target for Dogecoin price

Valdrin Tahiri, crypto analyst evaluated the Dogecoin price chart and in the process of breaking past the resistance at $0.66, DOGE broke out of its downtrend. The asset hit a new monthly high of $0.076 and analysts have set a bullish target of $0.088 for the meme coin. A drop below $0.055 would invalidate the bullish thesis.

DOGE-USDT price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.