Dogecoin Price Prediction: DOGE remains on track to hit new all-time highs at $1

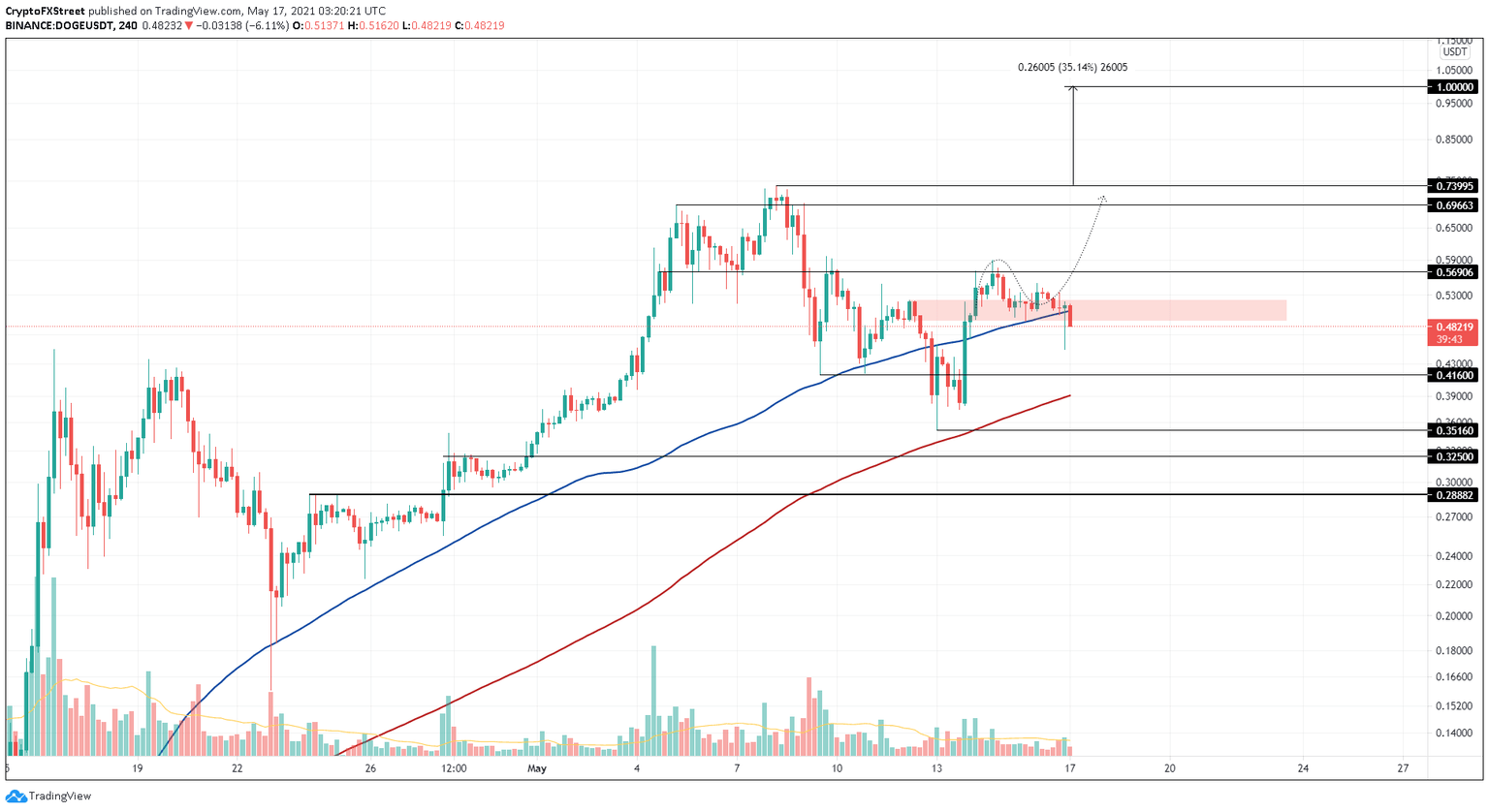

- Dogecoin price shows resilience as it treads the demand zone extending from $0.489 to $0.522.

- The 100 four-hour SMA at $0.504 coincides with this range and adds credence to a potential bounce from this level.

- Clearing the $0.569 resistance barrier will allow DOGE to skyrocket 75% to $1.

Dogecoin price is hovering around a confluence of support levels that promise an upswing to record levels. A breakdown of the immediate resistance level will confirm the start of this bullish trajectory.

Dogecoin price remains bullish

Dogecoin price is currently hovering inside the demand barrier that stretches from $0.489 to $0.522. Interestingly, this zone harbors the 100 four-hour Simple Moving Average (SMA) at $0.504. Hence, a quick bounce from this confluence seems likely.

If this short-term spike pushes Dogecoin price above $0.569, it would confirm the start of an uptrend. Under these conditions, investors can expect DOGE to surge 23% to tag the first resistance level at $0.696. Following the breach of this ceiling, $0.739 is the next area of interest, the present all-time high.

Clearing this swing high will open up Dogecoin price to surge to $1. All in all, this trajectory would be a 75% bull rally from $0.569.

Although unlikely, a breakdown of the demand zone’s lower boundary at $0.489 will lead to a 15% downswing to the support level at $0.416. This move will not invalidate the optimistic outlook explained above. If this bearish descent continues, market participants can expect a quick reversal as Dogecoin price tags the 200 four-hour SMA at $0.390.

DOGE/USDT 4-hour chart

The uptrend outlook detailed above isn’t set in stone and is subject to change if the market conditions worsen. Therefore, a sudden spike in selling pressure that slices through the 200 four-hour SMA and produces a decisive 4-hour candlestick close below $0.325 will invalidate the bullish thesis.

Under these circumstances, Dogecoin price will likely slide 10% to tag $0.288.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.