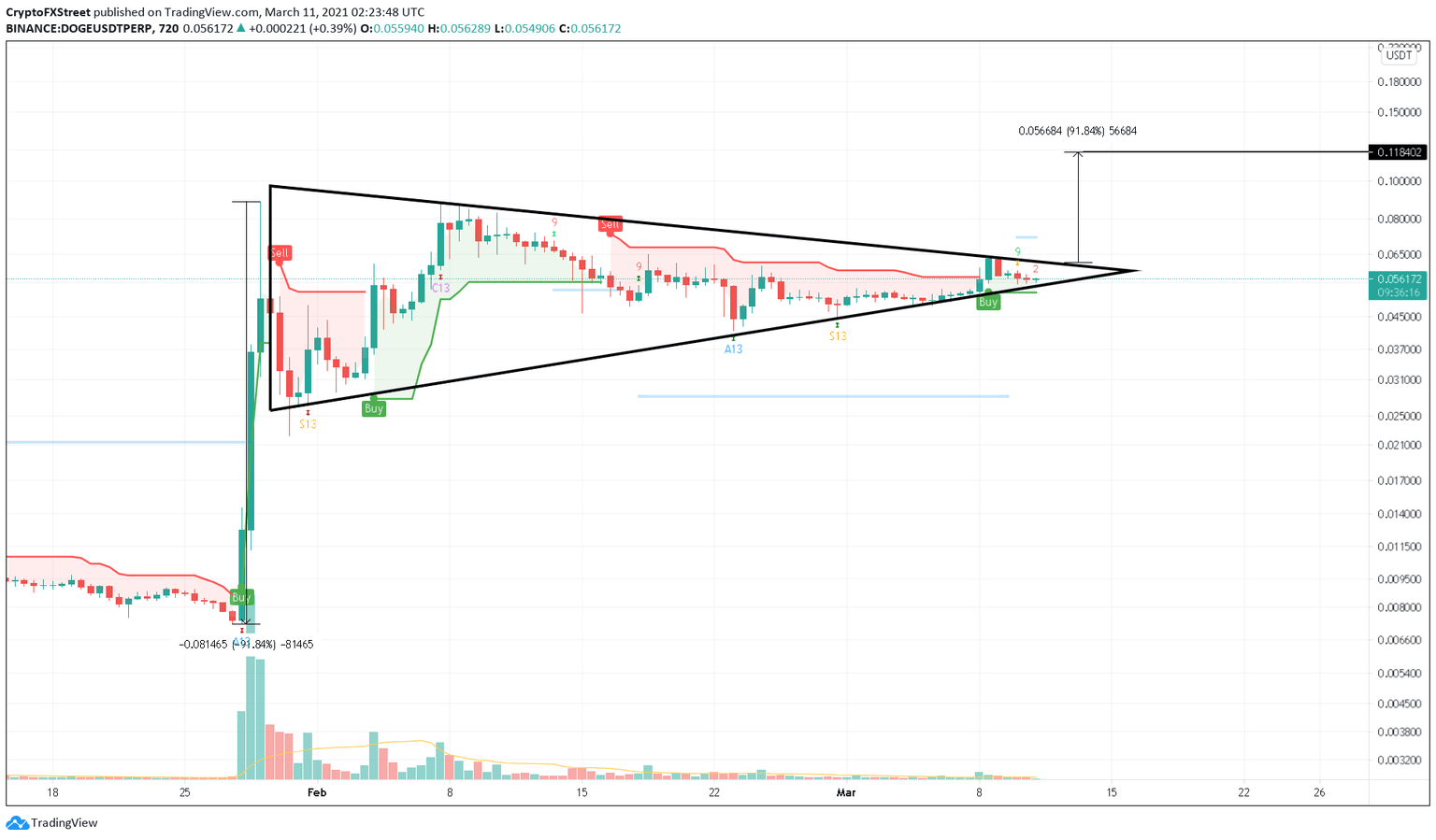

Dogecoin Price Prediction: DOGE on the verge of a 90% upswing

- Dogecoin price is at the end of consolidation in a bullish pennant pattern.

- A decisive close above the pennant at $0.061 suggests a 90% upswing.

- The Tom DeMark (TD) Sequential indicator's sell signal could potentially delay or even invalidate DOGE's bullish outlook.

Dogecoin price has moved towards the far-end of a consolidation phase, hinting at a volatile uptrend shortly.

Dogecoin price on the verge of a higher high

Dogecoin price has been forming a series of lower highs, and higher lows since its 1120% upswing ended on January 29. While the initial upswing can be considered a "flag pole," the consolidation that followed this is known as "pennant." So, DOGE has been forming a bullish pennant pattern since January 29.

This technical formation is a continuation pattern and projects a continuation of the previous price trend. Therefore, the setup hints at a 90% upswing, which is the flag pole's height, added to the breakout point at $0.061. This target places DOGE at $0.11.

Adding credence to this bullish scenario is the SuperTrend indicator that flashed a buy signal on March 8.

Regardless of the bullish outlook, investors need to note that the TD Sequential indicator has printed a sell signal in the form of a green nine candlestick on the 12-hour chart. This setup forecasts a one-to-four candlestick correction, so there could be a delay in an upswing for Dogecoin price.

DOGE/USDT 12-hour chart

Due to an unforeseen spike in selling pressure, if Dogecoin price slices through the pennant formation's lower trendline at $0.055, it would invalidate the bullish pennant formation. In such a case. DOGE could be expected to correct to $0.051 as it trends lower.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.