Dogecoin Price Prediction: DOGE at make-or-break point after new all-time highs

- Dogecoin price remains indecisive after setting up record highs on May 4 at $0.611.

- The MRI has flashed a reversal signal, indicating that DOGE might retrace.

- A spike in bullish momentum due to FOMO among buyers could result in a new all-time high at $0.561.

Dogecoin price is at a crossroads as a technical indicator hints at a reversal, but bulls seem to be opposing that idea and want to rally.

Dogecoin price shows potential to surge higher

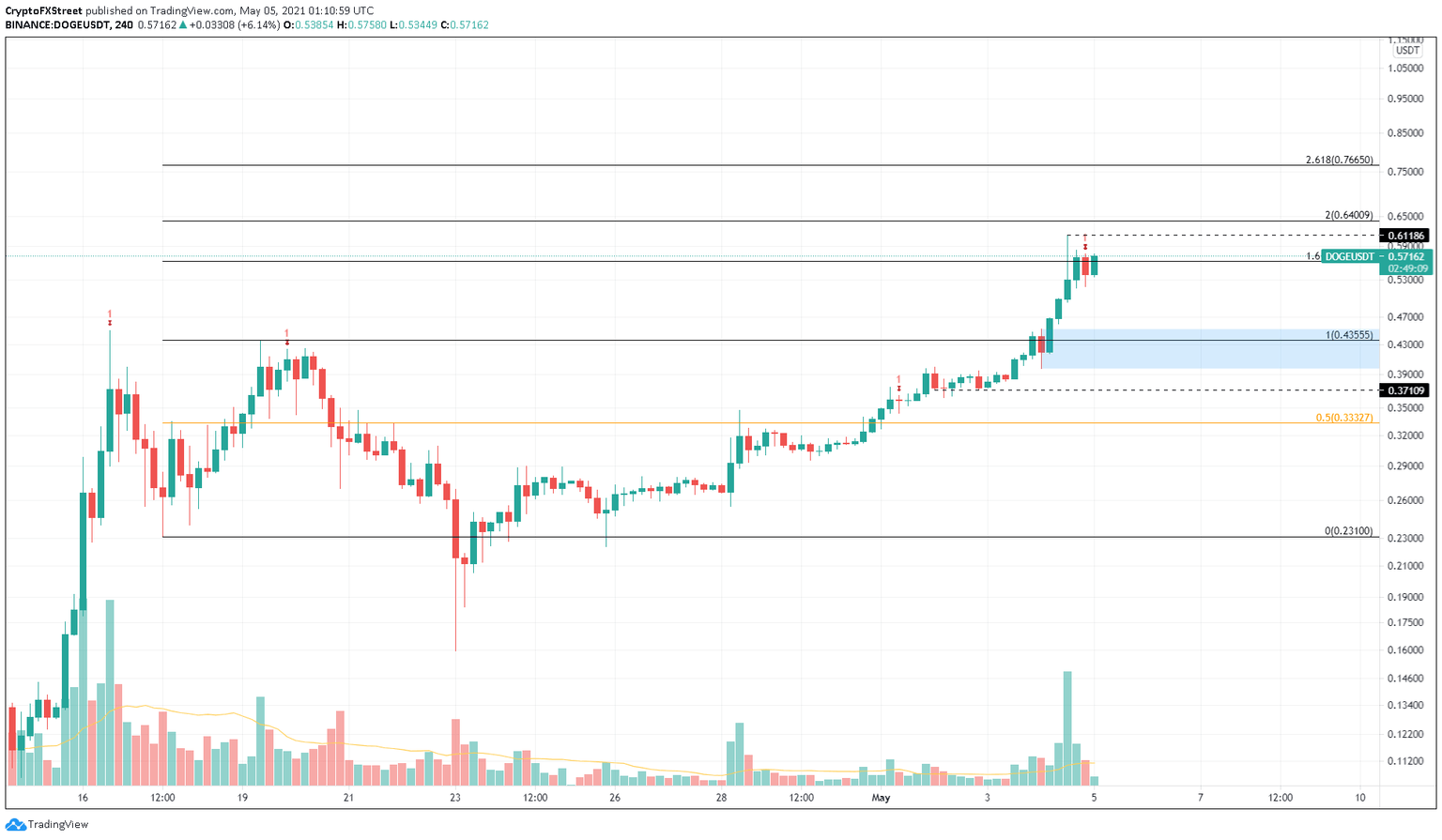

Dogecoin price is trading at $0.571 on the 4-hour chart after erecting a new all-time high at $0.611. The Momentum Reversal Indicator (MRI) has flashed a sell signal in the form of a red ‘one’ candlestick, indicating that the cycle has topped.

Interestingly, this move comes as DOGE hit a blockade at the 161.8% Fibonacci extension level at $0.561. The MRI’s current setup forecasts a one-to-four candlestick correction. Hence, from a technical point of view, Dogecoin price could retrace.

Despite this bearish signal, DOGE has dropped only 4% and reveals that the buyers are propping up Dogecoin price, which could result in reentry into the price discovery phase.

If such a move were to occur, the meme-themed cryptocurrency might shatter its all-time high and test the 200% Fibonacci extension level at $0.64. Under special circumstances, if the buying pressure persists, Dogecoin price could surge 19% to tag $0.766, coinciding with the 261.8% Fibonacci extension level.

However, failing to slice through $0.611 could cause the meme coin to drop 22% to retest the demand zone, extending from $0.397 to $0.451.

DOGE/USDT 4-hour chart

While a 22% downswing seems extreme, it will allow the buyers to recuperate and prepare for the next run-up. However, a breakdown of the support barrier at $0.371 will indicate that the sellers are overwhelming the buyers and will invalidate the bullish thesis.

In such a case, Dogecoin price will retrace to the 50% Fibonacci retracement level at $0.333

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.