Dogecoin Price Prediction: DOGE bulls fall short, putting new highs in jeopardy

- Dogecoin price is currently hovering under a critical resistance level at $0.423.

- A string of higher highs was followed by a potential lower high, suggesting a waning bullish momentum.

- Two consecutive lower highs with a lower low would confirm a shift in trend.

Dogecoin price is at a make-or-break point, where a decisive close below a certain level would ignite a shift in momentum from bullish to bearish.

Dogecoin price at crossroads

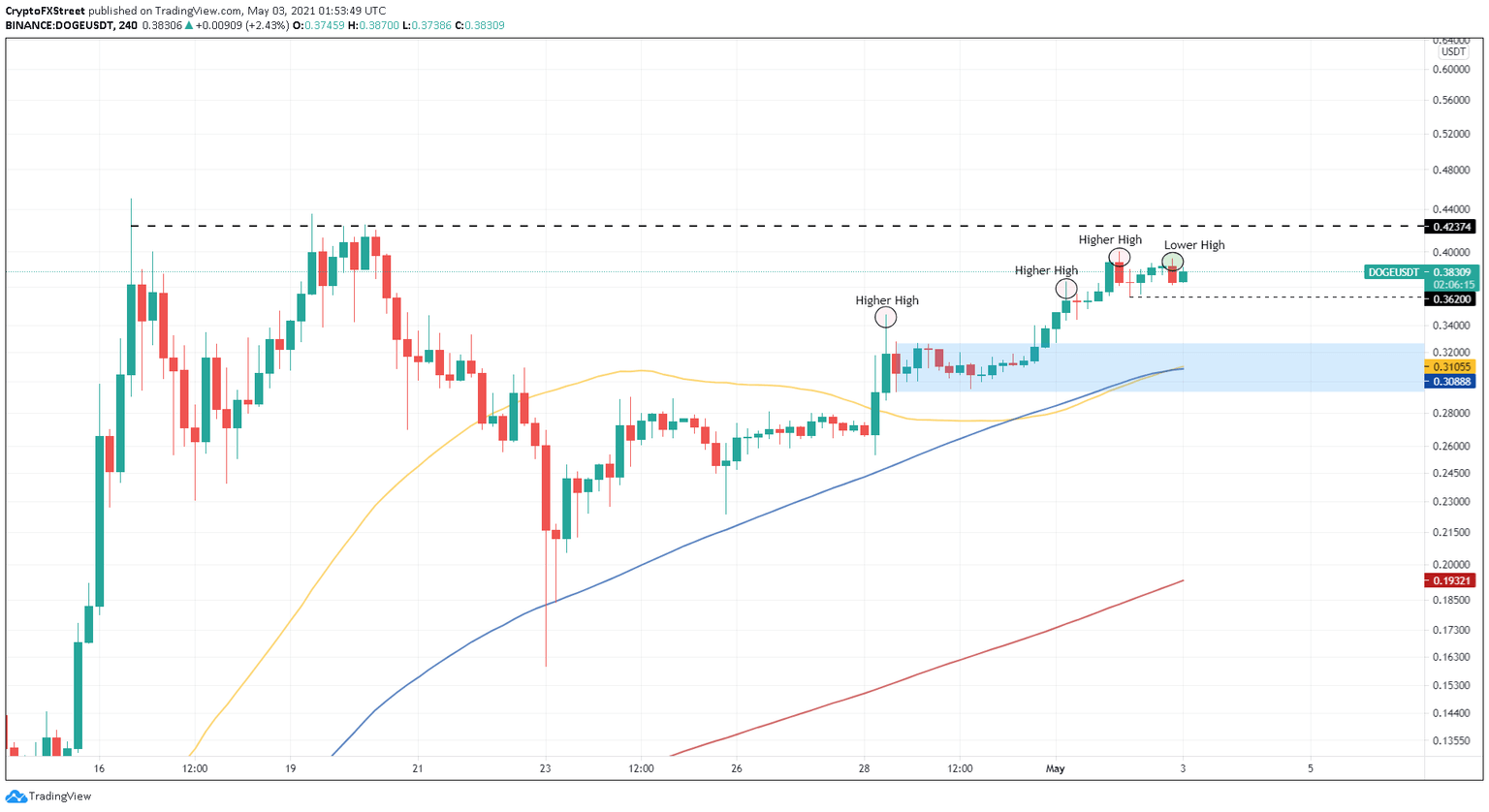

On the 4-hour chart, Dogecoin price shows a slew of higher highs and higher lows being formed since April 28. As this meme-themed cryptocurrency approaches a stiff resistance barrier at $0.423, the outcome seems to be shifting toward the bears due to the formation of a lower high.

While the recent swing high is not set in stone, a decisive close below $0.362 will confirm that a downtrend is nigh.

If the second swing point is also a lower high, it will seal DOGE’s fate and result in a sell-off to the demand zone that ranges from $0.293 to $0.327.

Interestingly, the 50 and 100 four-hour Simple Moving Averages (SMA) at $0.31 and $0.30 are present around the lower end of this area of support. Therefore, investors could expect Dogecoin price to give the upswing narrative another chance.

DOGE/USDT 4-hour chart

Market participants should note that the current 4-hour candlestick has not closed yet. Therefore, a close above the previous high at $0.399 could render the bearish thesis null and void.

Moreover, Dogecoin price is known for its celebrity-induced pumps. Hence, if something similar were to happen, DOGE could ignore these bearish signals and pump higher.

The first target for buyers would be $0.423, followed by the all-time high at $0.45. Beyond this, the meme coin could surge nearly 40% to hit a new all-time high at $0.63.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.