Bitcoin price sees flat performance as correlation with equities is on the rise

- Bitcoin price performance turned flat in the last two weeks as BTC entered a tight correlation with equities.

- BTC valuation model reveals Bitcoin price is unlikely to drop below $35,000 apart from short-term volatility.

- BTC funds recorded an inflow of $311.5 million from institutional investors.

Bitcoin price performance has flattened over the past two weeks after the BTC run up to $38,400 on November 24. The largest asset by market capitalization observed an increase in capital inflow from institutional investors last week, according to a CoinShares report.

Also read: Bitcoin price gains might be sustainable with declining stablecoin dominance

Daily Digest Market Movers: Bitcoin weekly fund inflow on the rise, valuation model sets lower boundary for BTC price

- Bitcoin price rally slowed after yielding consistent gains since October 16. BTC price wiped out its weekly gains but sustained above the $37,000 level.

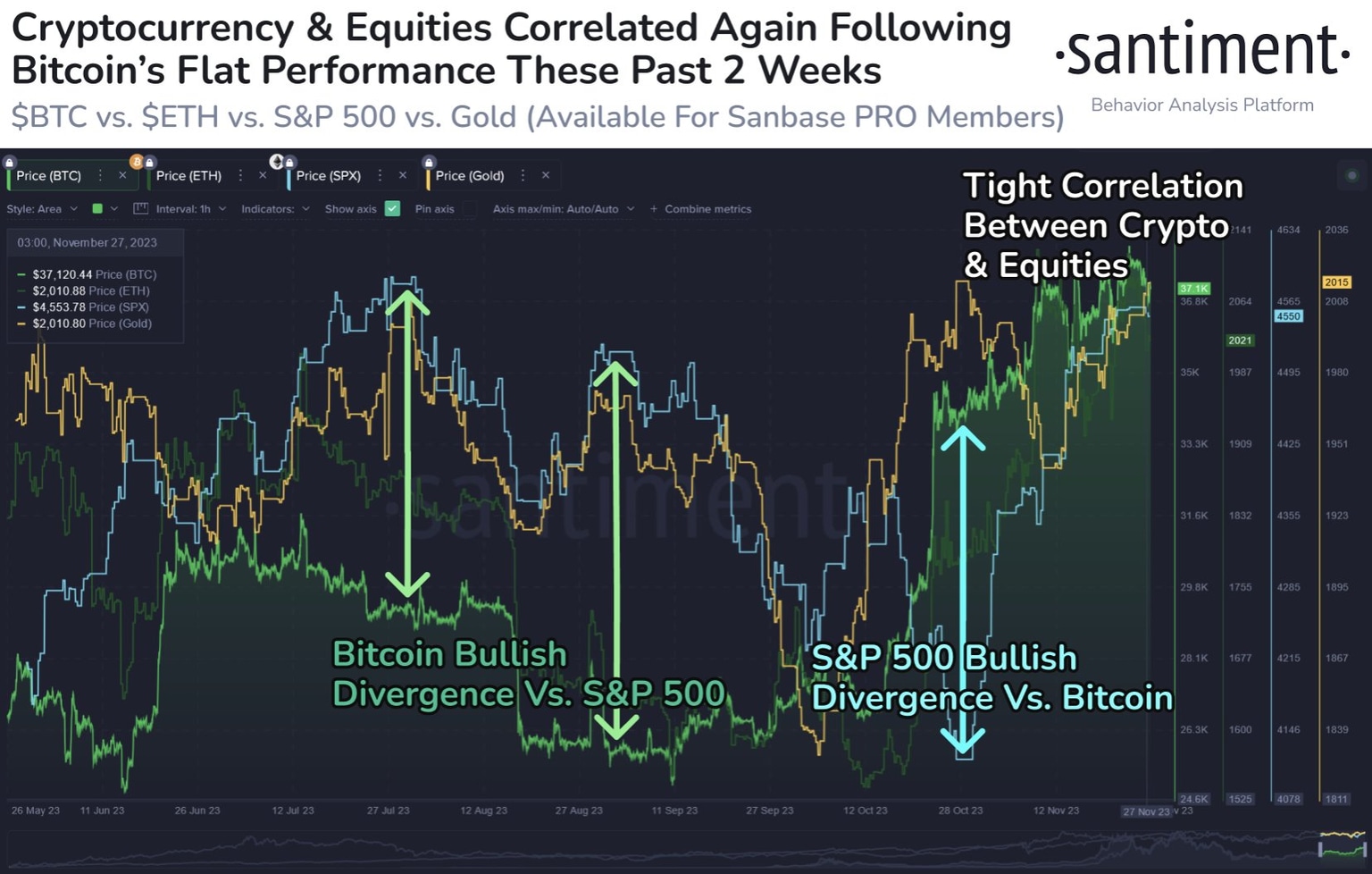

- Data from crypto intelligence tracker, Santiment, reveals a tight correlation between Bitcoin and equities after BTC price performance flattened. BTC correlation with S&P 500 is 0.43, up from a negative 0.76 on November 1.

BTC Pearson Correlation (30 days)

- The performance of equities rapidly caught up with Bitcoin in the last two weeks.nalysts at Santiment believe a BTC price rally without stocks following suit would be a strong sign that correlation between the sectors is breaking again. This is a key indicator to watch out for. Typically, a break in correlation is a sign of a rally in Bitcoin.

Cryptocurrency and equities correlation

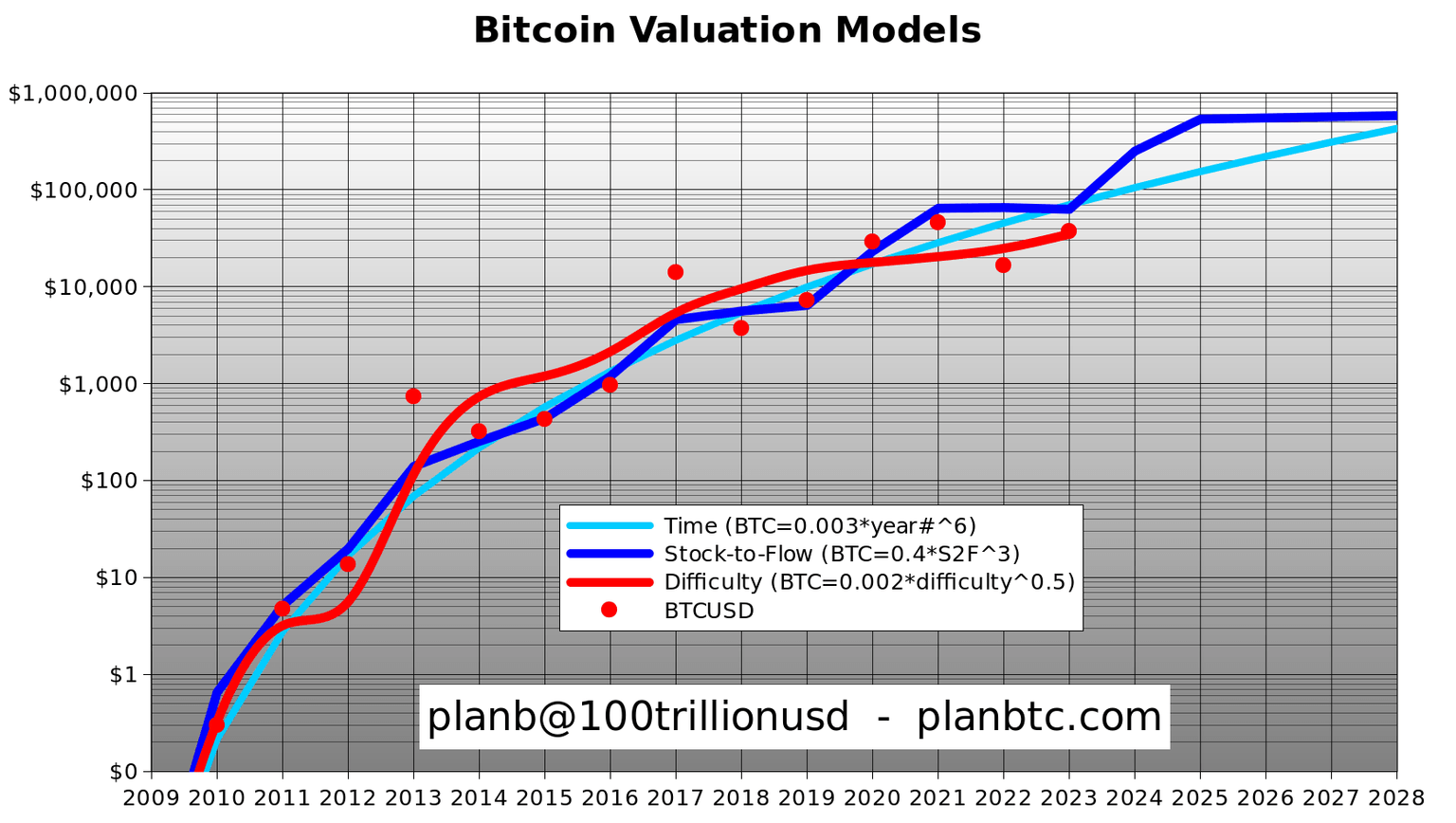

- A Bitcoin valuation model based on mining difficulty (hashrate) increased to $35,000 on November 27. According to PlanB, the pseudonymous analyst behind the Bitcoin Stock-to-Flow model (S2F model), believes that apart from possible black swans or short- term volatility, Bitcoin price is not likely to go below $35,000 in the longer term.

Bitcoin valuation models

- Institutional investors have poured $311.5 million in BTC funds in the past week, according to a latest CoinShares report. The year to date inflows to BTC funds has hit $1,550 million.

Crypto fund flows by asset

Technical Analysis: Bitcoin price rally hits pause

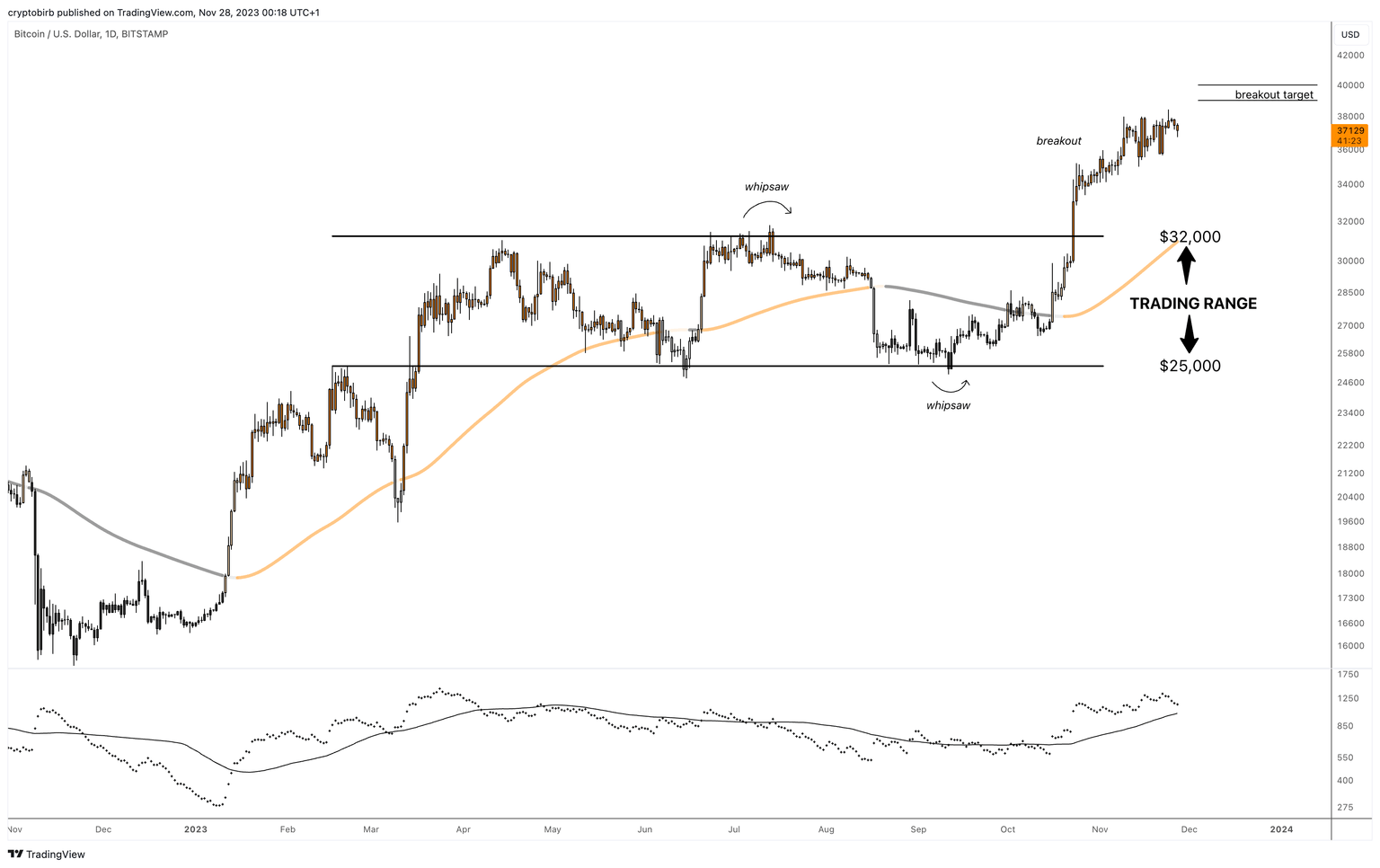

According to crypto analyst Adrian Zduńczyk, Bitcoin’s breakout target is the range between $39,000 and $40,000. The analyst has identified the range between $25,000 and $32,000, as the trading range for Bitcoin.

BTC/USD 1-day price chart

At the time of writing, Bitcoin price is above the $37,000 mark on Binance, the asset’s price remained largely unchanged in the past week.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.