Dogecoin price in quest of a buying stampede, as DOGE suffers without the spirit of FOMO

- Dogecoin price drifts upwards within an ascending parallel channel, but no hint of a resumption of the rally.

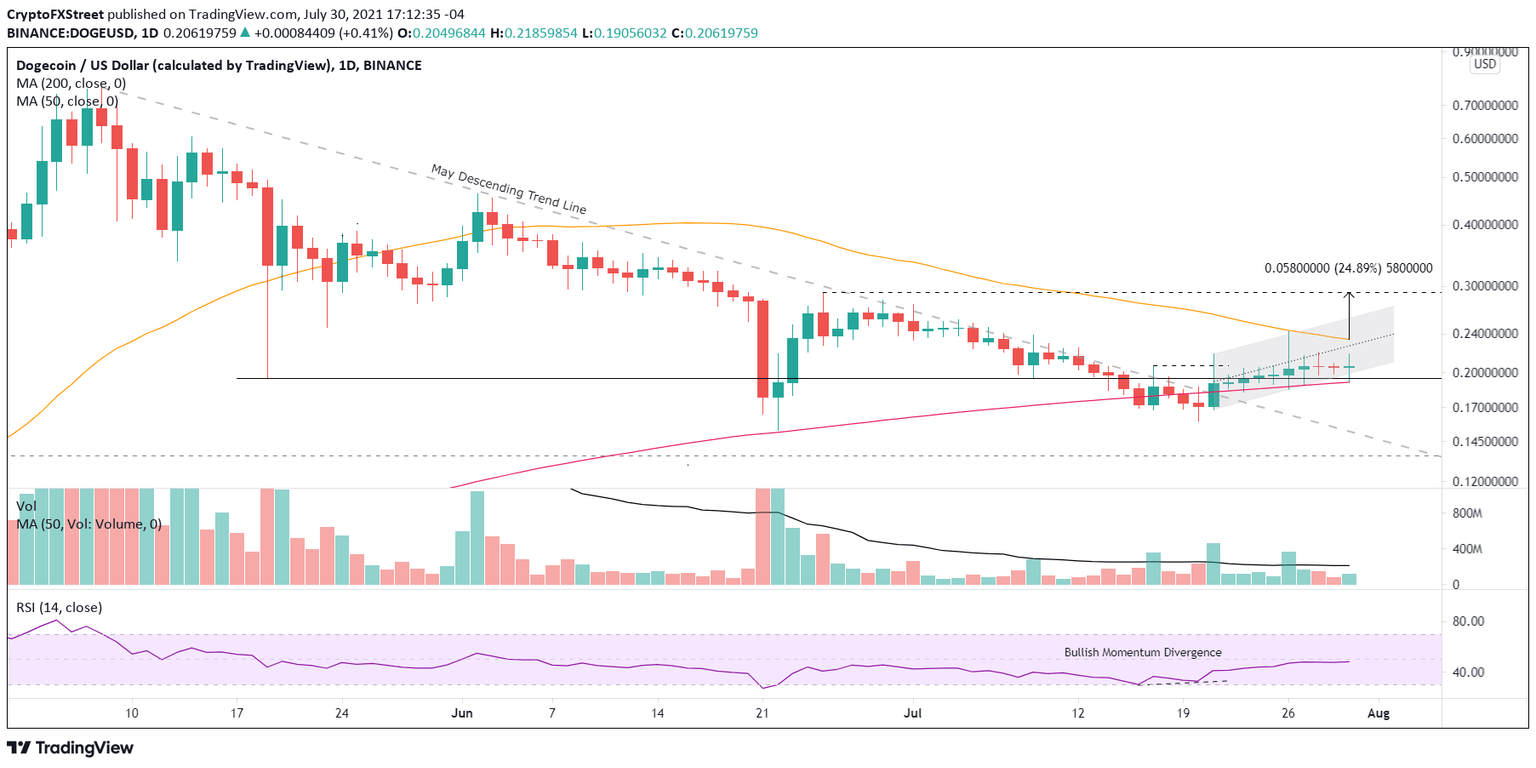

- May 19 low of $0.195 combines with the 200-day simple moving average (SMA) to transmit support.

- DOGE fails to tally the significant gains captured by other coins, as a nine-day gain only strikes 20%.

Dogecoin price has stumbled after the energetic charge of 11% on July 21, registering just a 7% gain over the last nine days. Many of the days have concluded with doji candlestick patterns, signifying a balance between buyers and sellers and overall uncertainty within the ranks of DOGE investors. Until the altcoin can register a daily close above the declining 50-day SMA, it is better to let Dogecoin price sway in the boundaries of the ascending parallel channel pattern.

Dogecoin price not getting a quality jump from the pump

A recent FXStreet article on July 26 pointed out that the social media ravings of Elon Musk about DOGE have failed to ignite a powerful and sustainable rally in Dogecoin price. It is unfamiliar territory for the meme token and diehard DOGE investors. Earlier this year, the rantings of Musk and other high-profile personalities would drive the cryptocurrency notably higher and secure the lead story on the news roll.

Without the prospect of social media-driven FOMO, it is profitable to consider the price structure being plotted by Dogecoin price. The rise from the July 20 low, excluding July 21, has taken on a corrective personality, suggesting it is a pause in the larger correction that began at the beginning of May.

To turn the probabilities in favor of an extended rally, Dogecoin price needs to close above the 50-day SMA at $0.233. If successful, DOGE may be motivated to test the June 25 high of $0.291, logging a 25% gain. The declining 50-day SMA will partially restrict a continuation of the rally as it pulls down on price.

DOGE/USD daily chart

Fortunately for Dogecoin price, three support levels are present that may arrest any selling pressure before it gets started. One level is the lower line of the ascending parallel channel tested today, followed by the May 19 low of $0.195, tested today, and finally the 200-day SMA at $0.191.

Even a daily close below the 200-day SMA does not guarantee a rapid descent as the July 20 low of $0.159 and the June 22 low of $0.152 create formidable support for Dogecoin price. A decline from the 200-day SMA to the June 22 low would yield a 20% loss. Interestingly, the June 22 low aligns with the May descending trend line, reinforcing the support value.

With many of the altcoins and Bitcoin at or near considerable resistance, the probability of short-term weakness in the cryptocurrency complex is tilted higher, leaving Dogecoin price with no tailwind to help press DOGE through the trigger price.

If this is a new chapter in the DOGE story, it is not interesting for market operators. In reality, Dogecoin price is learning the harsh realities of an environment that ignores the social media antics of the famous and cannot engineer the FOMO that underpinned the dramatic advance earlier in the year. As long as the 200-day SMA holds, the altcoin will likely continue the quest for a buying stampede.

Here, FXStreet's analysts evaluate where DOGE could be heading next as it looks ready to jump.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.