Dogecoin Price Forecast: DOGE’s future is defined by two crucial price levels

- Dogecoin price had a 1,100% pump on January 28 thanks to a Reddit group called WallStreetBets.

- Although the digital asset plummeted from $0.087 down to $0.03, it is still up 300%.

- DOGE is trading between two critical levels that will determine its future.

Dogecoin had one of the biggest cryptocurrency pumps in less than 48 hours jumping by 1,100% to a new all-time high of $0.087 reaching a total market capitalization of over $9 billion. Of course, this pump didn’t last long and the digital asset quickly dropped to a low of $0.022 but has recovered significantly.

Dogecoin price on the verge of another massive move

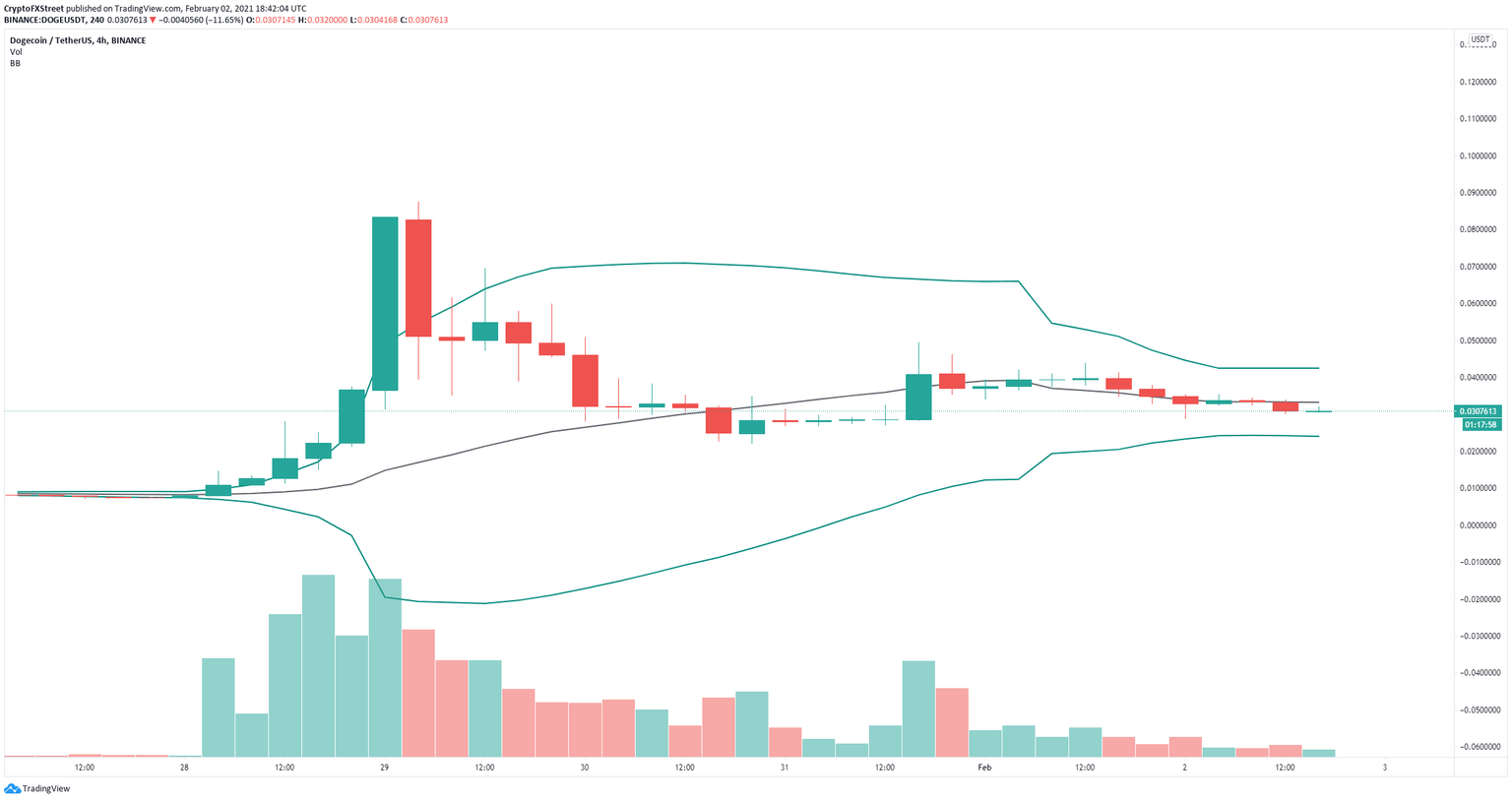

On the 4-hour chart, the Bollinger Bands have squeezed significantly and formed a range between $0.042 and $0.024. The trading volume of DOGE has also declined notably which indicates a major move is underway. A breakout above $0.042 would be a significantly bullish sign.

DOGE/USD 4-hour chart

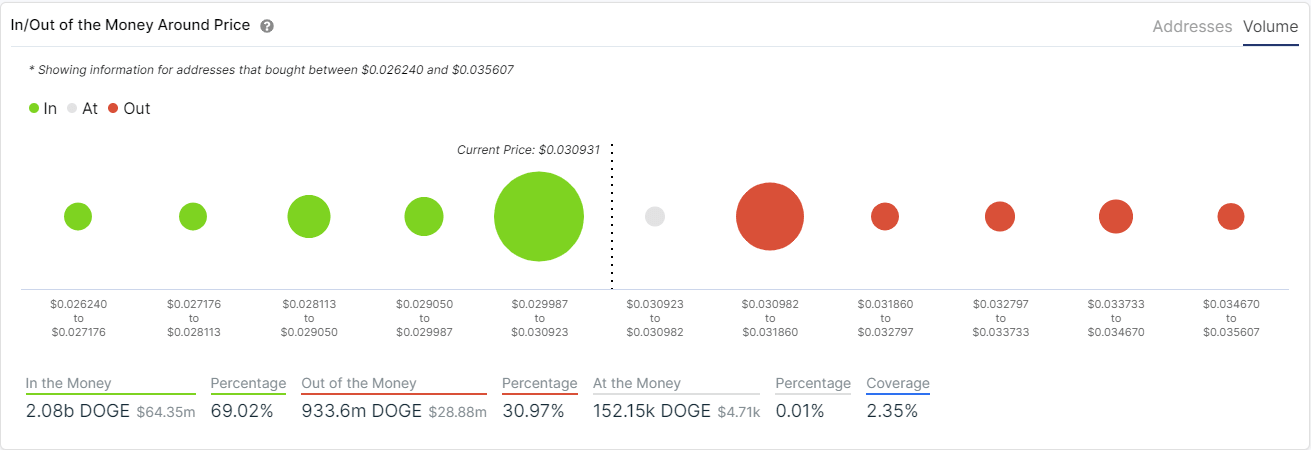

The In/Out of the Money Around Price shows only one significant resistance area between $0.031 and $0.032 with 808 million DOGE in volume. Crossing above this point can drive Dogecoin price towards $0.042.

DOGE IOMAP chart

On the other hand, there is a stronger support range between $0.03 and $0.031 with 1.74 billion DOGE of volume. Losing this crucial level can push DOGE towards the support level of $0.024.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.