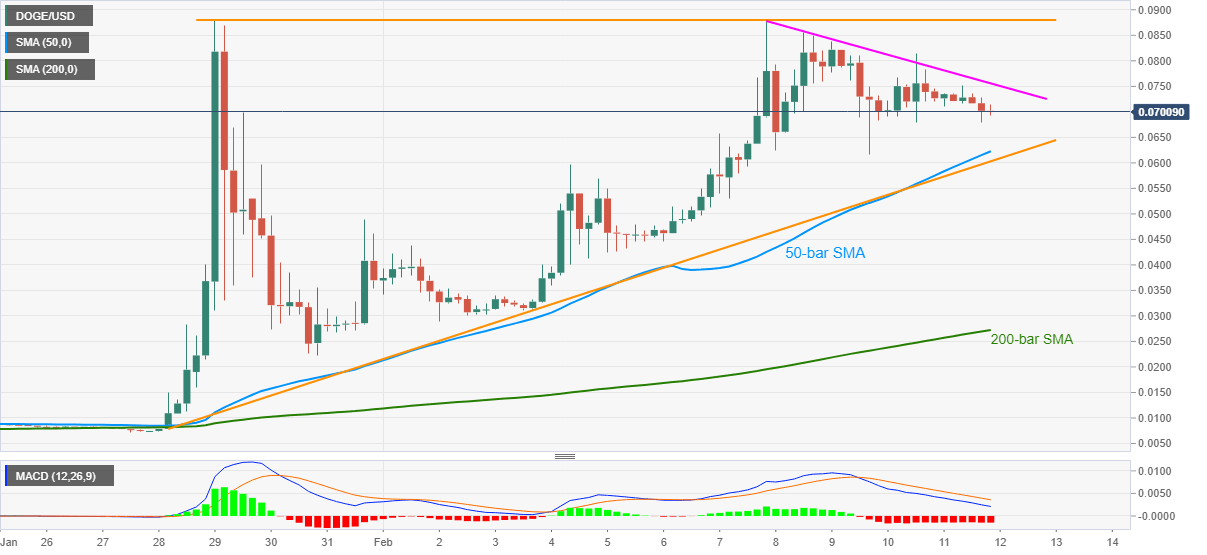

Dogecoin Price Forecast: DOGE bulls catch a breather between two crucial price levels

- DOGE consolidates recent gains while trying to keep 0.0700.

- 50-bar SMA pushes bulls toward breaking weekly resistance line.

- 200-bar SMA adds to the downside filter following ascending triangle confirmation.

DOGE/USD wavers around 0.0700 during its latest easy performance since late Thursday. In doing so, the digital asset follows a downward sloping trend line from Sunday amid bearish MACD.

However, successful trading beyond 50-bar SMA joins ‘higher low’ formation during the week to keep the ‘Meme Coin’ buyers hopeful inside a two-week-old ascending triangle formation.

That said, 50-bar SMA becomes the nearest key support, at 0.0620 now, ahead of the stated triangle’s support line, currently around 0.0600.

Though, a downside break of 0.0600 will confirm the bearish chart pattern that can recall the 0.0100 area on the screen. During the fall, a 200-bar SMA level of 0.0272 may help trigger the quote’s bounce.

Meanwhile, the one-week-old resistance line near 0.0755 guards the quote’s immediate upside ahead of the stated triangle’s upper trend line comprising the all-time high of 0.0880.

Should DOGE bulls manage to conquer the 0.0880 upside hurdle, bulls can unleash another set of wild moves, witnessed late in January, which will target the 0.1000 psychological magnet.

DOGE/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.